Question 6 10 points The following information is from refor

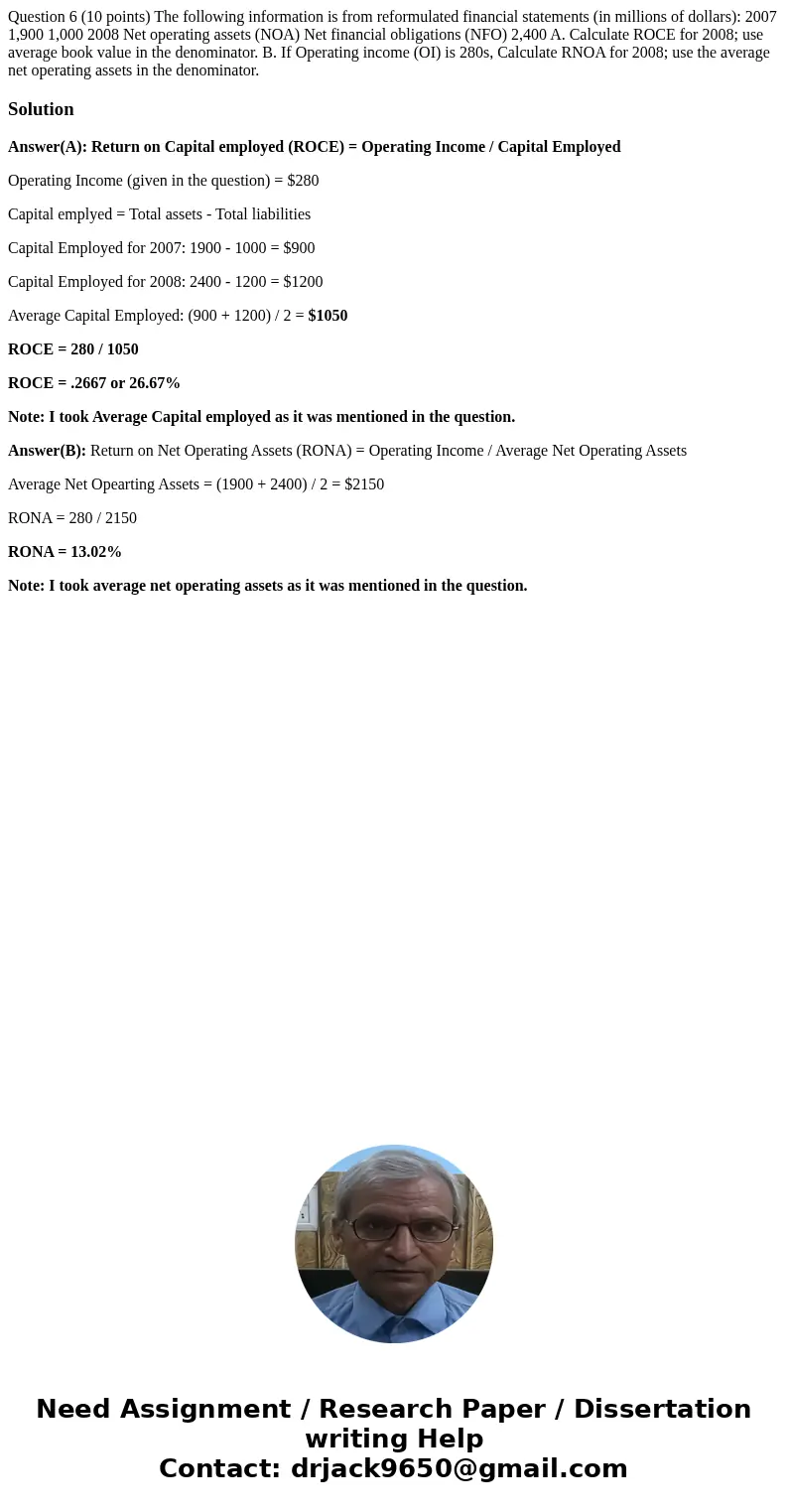

Question 6 (10 points) The following information is from reformulated financial statements (in millions of dollars): 2007 1,900 1,000 2008 Net operating assets (NOA) Net financial obligations (NFO) 2,400 A. Calculate ROCE for 2008; use average book value in the denominator. B. If Operating income (OI) is 280s, Calculate RNOA for 2008; use the average net operating assets in the denominator.

Solution

Answer(A): Return on Capital employed (ROCE) = Operating Income / Capital Employed

Operating Income (given in the question) = $280

Capital emplyed = Total assets - Total liabilities

Capital Employed for 2007: 1900 - 1000 = $900

Capital Employed for 2008: 2400 - 1200 = $1200

Average Capital Employed: (900 + 1200) / 2 = $1050

ROCE = 280 / 1050

ROCE = .2667 or 26.67%

Note: I took Average Capital employed as it was mentioned in the question.

Answer(B): Return on Net Operating Assets (RONA) = Operating Income / Average Net Operating Assets

Average Net Opearting Assets = (1900 + 2400) / 2 = $2150

RONA = 280 / 2150

RONA = 13.02%

Note: I took average net operating assets as it was mentioned in the question.

Homework Sourse

Homework Sourse