Problem 328 LO 1 Compute 2017 taxable income in each of the

Problem 3-28 (LO. 1)

Compute 2017 taxable income in each of the following independent situations. The personal exemption amount for 2017 is $4,050. Click here to access the standard deduction table to use if required.

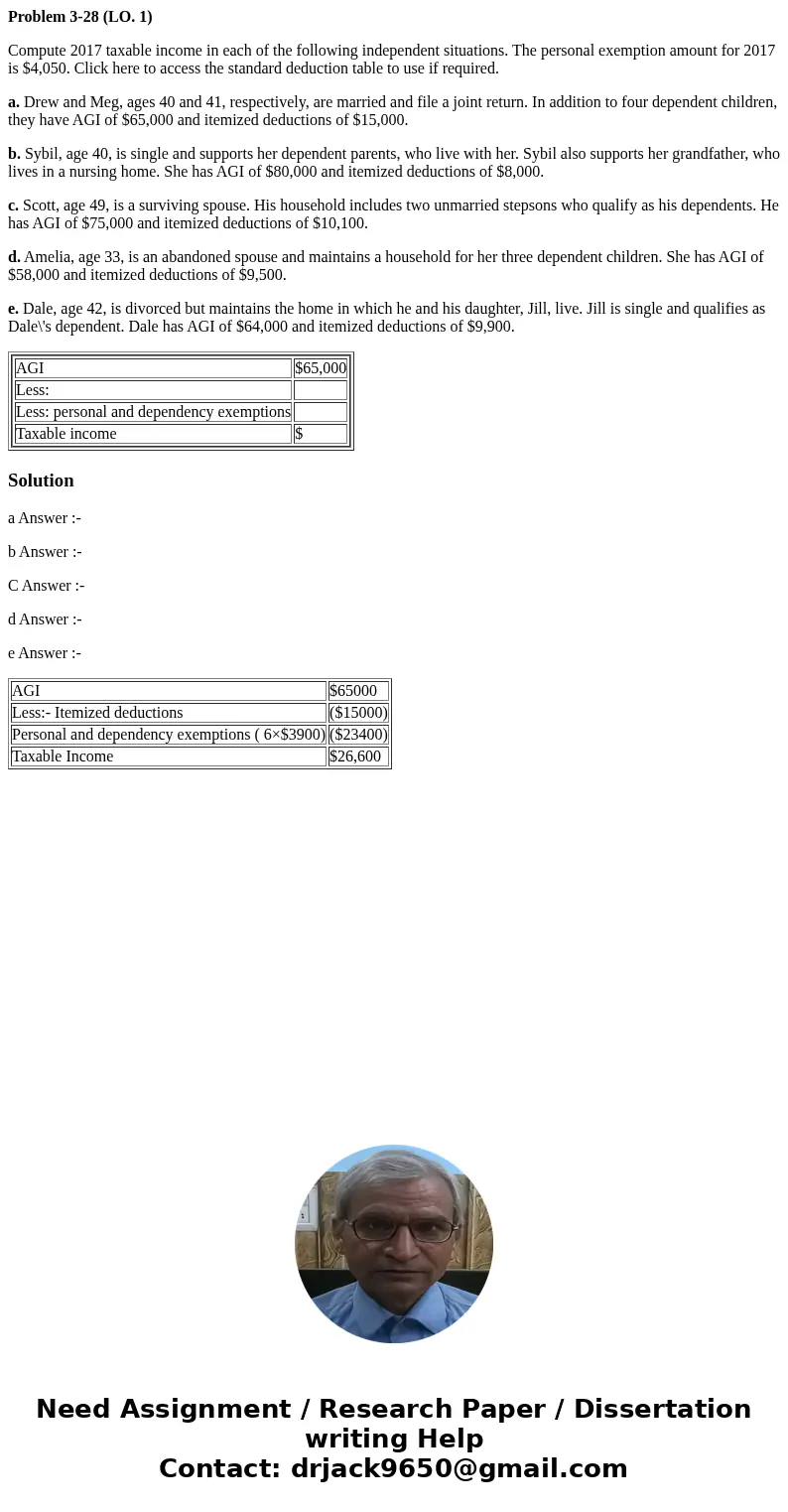

a. Drew and Meg, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $65,000 and itemized deductions of $15,000.

b. Sybil, age 40, is single and supports her dependent parents, who live with her. Sybil also supports her grandfather, who lives in a nursing home. She has AGI of $80,000 and itemized deductions of $8,000.

c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of $75,000 and itemized deductions of $10,100.

d. Amelia, age 33, is an abandoned spouse and maintains a household for her three dependent children. She has AGI of $58,000 and itemized deductions of $9,500.

e. Dale, age 42, is divorced but maintains the home in which he and his daughter, Jill, live. Jill is single and qualifies as Dale\'s dependent. Dale has AGI of $64,000 and itemized deductions of $9,900.

|

Solution

a Answer :-

b Answer :-

C Answer :-

d Answer :-

e Answer :-

| AGI | $65000 |

| Less:- Itemized deductions | ($15000) |

| Personal and dependency exemptions ( 6×$3900) | ($23400) |

| Taxable Income | $26,600 |

Homework Sourse

Homework Sourse