Singer and McMann are partners in a business Singers origina

Singer and McMann are partners in a business. Singer\'s original capital was $40,000 and McMann\'s was $60,000. They agree to salaries of $12,000 and $18,000 for Singer and McMann, respectively, and 10% interest on original capital. If they agree to share the remaining profits and losses on a 3:2 ratio, what will Singer\'s share of the income be if the income for the year is $50,000?

a.$23,400

b.$16,000

c.$22,000

d.$24,000

Solution

Calculate Singer\'s share of the income be if the income for the year is $50,000?

Singer\'s share in income = (12000+4000+6000) = $22000

so answer is c) $22000

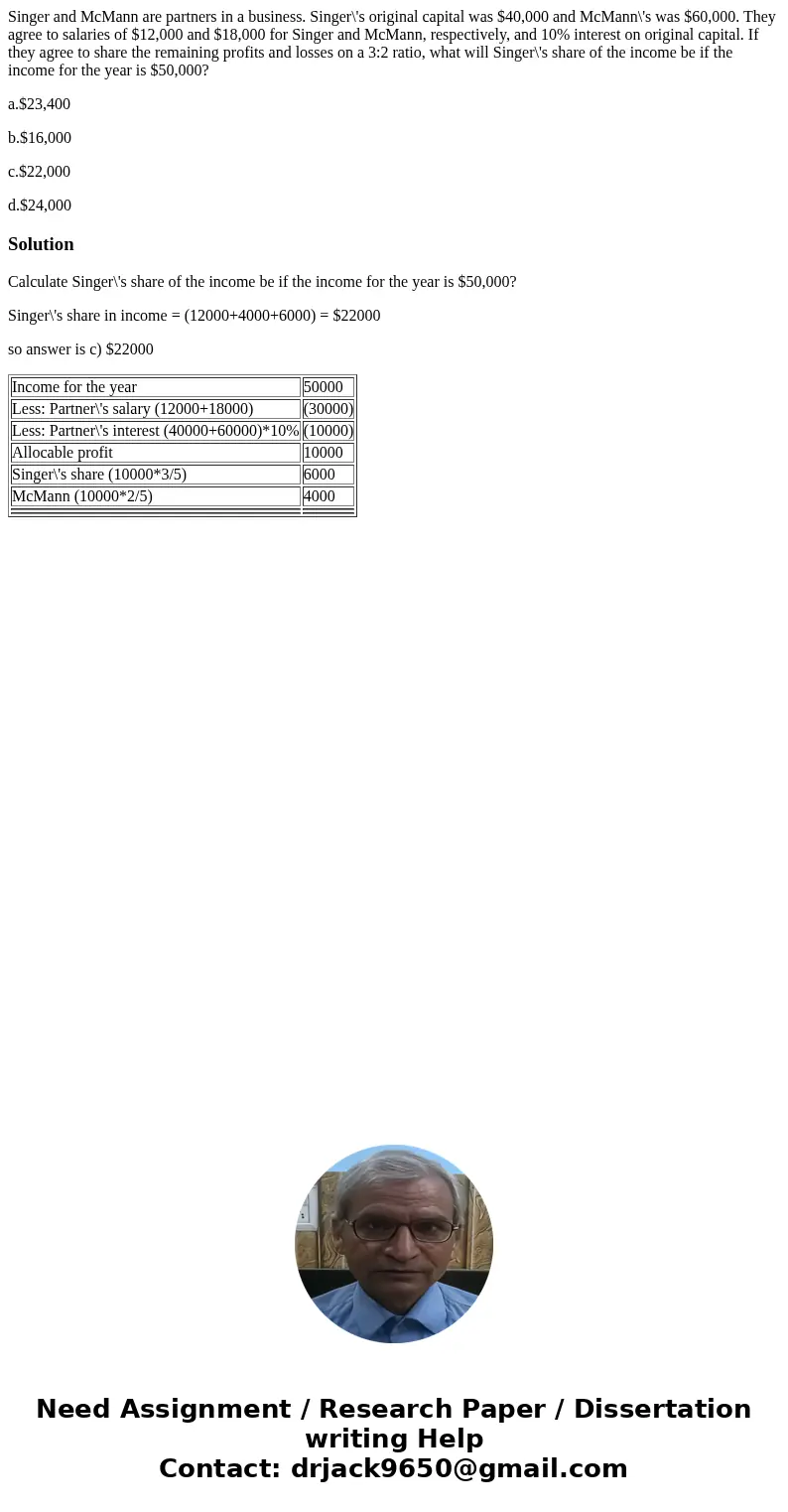

| Income for the year | 50000 |

| Less: Partner\'s salary (12000+18000) | (30000) |

| Less: Partner\'s interest (40000+60000)*10% | (10000) |

| Allocable profit | 10000 |

| Singer\'s share (10000*3/5) | 6000 |

| McMann (10000*2/5) | 4000 |

Homework Sourse

Homework Sourse