Purchased 3300 shares of Escalante Corporation common stock

Purchased 3,300 shares of Escalante Corporation common stock (4%) for $200,640 cash. Recelved a cash dividend of $3 per share. Sold 660 shares of Escalante Corporation common stock for $42,240 cash. Received a cash dividend of $3 per share. Jan. July 1 1 Dec. 1 Dec. 31 Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select \"No entry\" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit

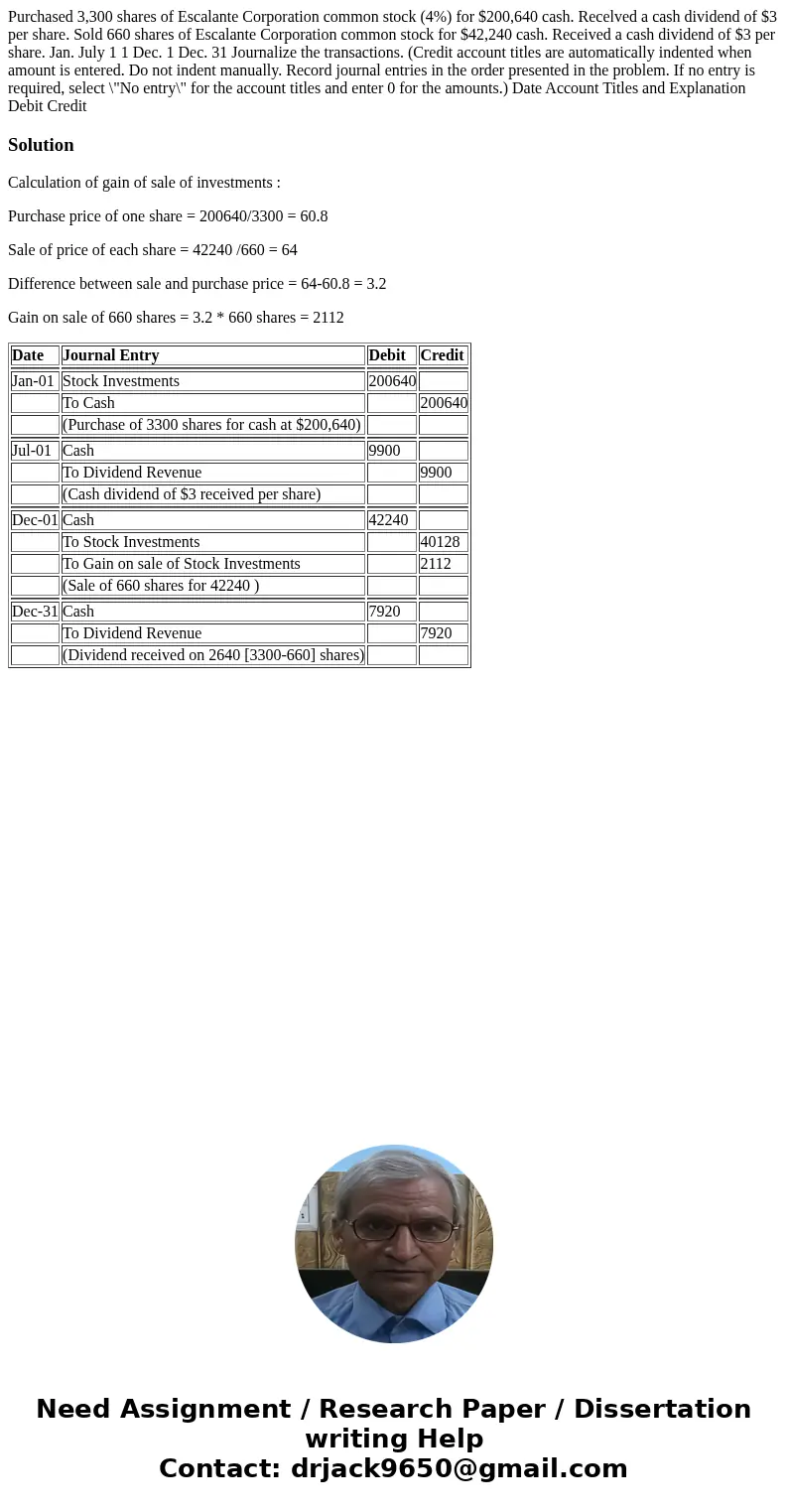

Solution

Calculation of gain of sale of investments :

Purchase price of one share = 200640/3300 = 60.8

Sale of price of each share = 42240 /660 = 64

Difference between sale and purchase price = 64-60.8 = 3.2

Gain on sale of 660 shares = 3.2 * 660 shares = 2112

| Date | Journal Entry | Debit | Credit |

| Jan-01 | Stock Investments | 200640 | |

| To Cash | 200640 | ||

| (Purchase of 3300 shares for cash at $200,640) | |||

| Jul-01 | Cash | 9900 | |

| To Dividend Revenue | 9900 | ||

| (Cash dividend of $3 received per share) | |||

| Dec-01 | Cash | 42240 | |

| To Stock Investments | 40128 | ||

| To Gain on sale of Stock Investments | 2112 | ||

| (Sale of 660 shares for 42240 ) | |||

| Dec-31 | Cash | 7920 | |

| To Dividend Revenue | 7920 | ||

| (Dividend received on 2640 [3300-660] shares) |

Homework Sourse

Homework Sourse