ii Talbot plc has in issue 5000000 050 ordinary shares throu

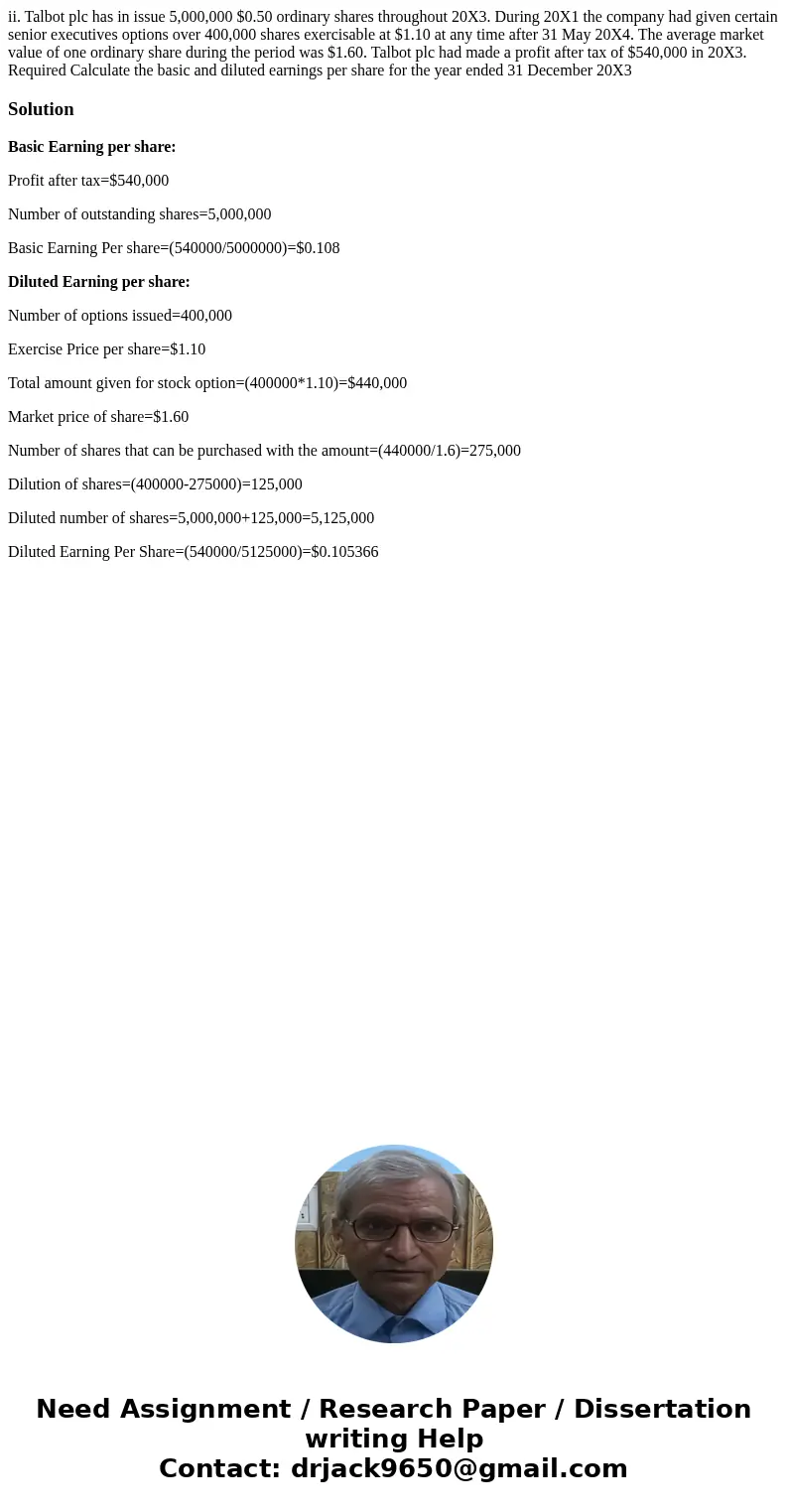

ii. Talbot plc has in issue 5,000,000 $0.50 ordinary shares throughout 20X3. During 20X1 the company had given certain senior executives options over 400,000 shares exercisable at $1.10 at any time after 31 May 20X4. The average market value of one ordinary share during the period was $1.60. Talbot plc had made a profit after tax of $540,000 in 20X3. Required Calculate the basic and diluted earnings per share for the year ended 31 December 20X3

Solution

Basic Earning per share:

Profit after tax=$540,000

Number of outstanding shares=5,000,000

Basic Earning Per share=(540000/5000000)=$0.108

Diluted Earning per share:

Number of options issued=400,000

Exercise Price per share=$1.10

Total amount given for stock option=(400000*1.10)=$440,000

Market price of share=$1.60

Number of shares that can be purchased with the amount=(440000/1.6)=275,000

Dilution of shares=(400000-275000)=125,000

Diluted number of shares=5,000,000+125,000=5,125,000

Diluted Earning Per Share=(540000/5125000)=$0.105366

Homework Sourse

Homework Sourse