Strange Manufacturing Company is purchasing a production fac

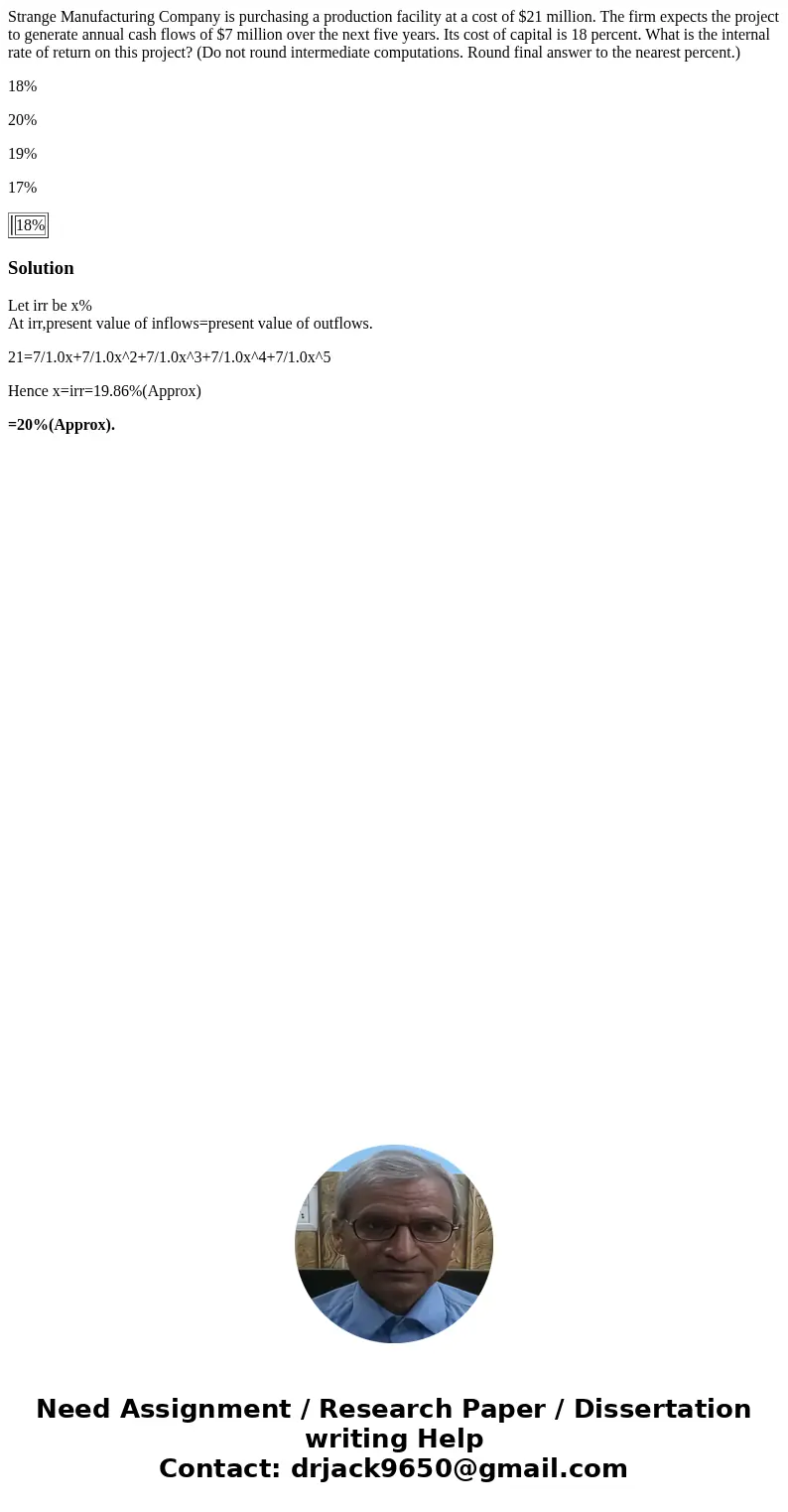

Strange Manufacturing Company is purchasing a production facility at a cost of $21 million. The firm expects the project to generate annual cash flows of $7 million over the next five years. Its cost of capital is 18 percent. What is the internal rate of return on this project? (Do not round intermediate computations. Round final answer to the nearest percent.)

18%

20%

19%

17%

| 18% |

Solution

Let irr be x%

At irr,present value of inflows=present value of outflows.

21=7/1.0x+7/1.0x^2+7/1.0x^3+7/1.0x^4+7/1.0x^5

Hence x=irr=19.86%(Approx)

=20%(Approx).

Homework Sourse

Homework Sourse