pter 12 Quz Help Save ExitSubmt sters Hardy and Rowen are di

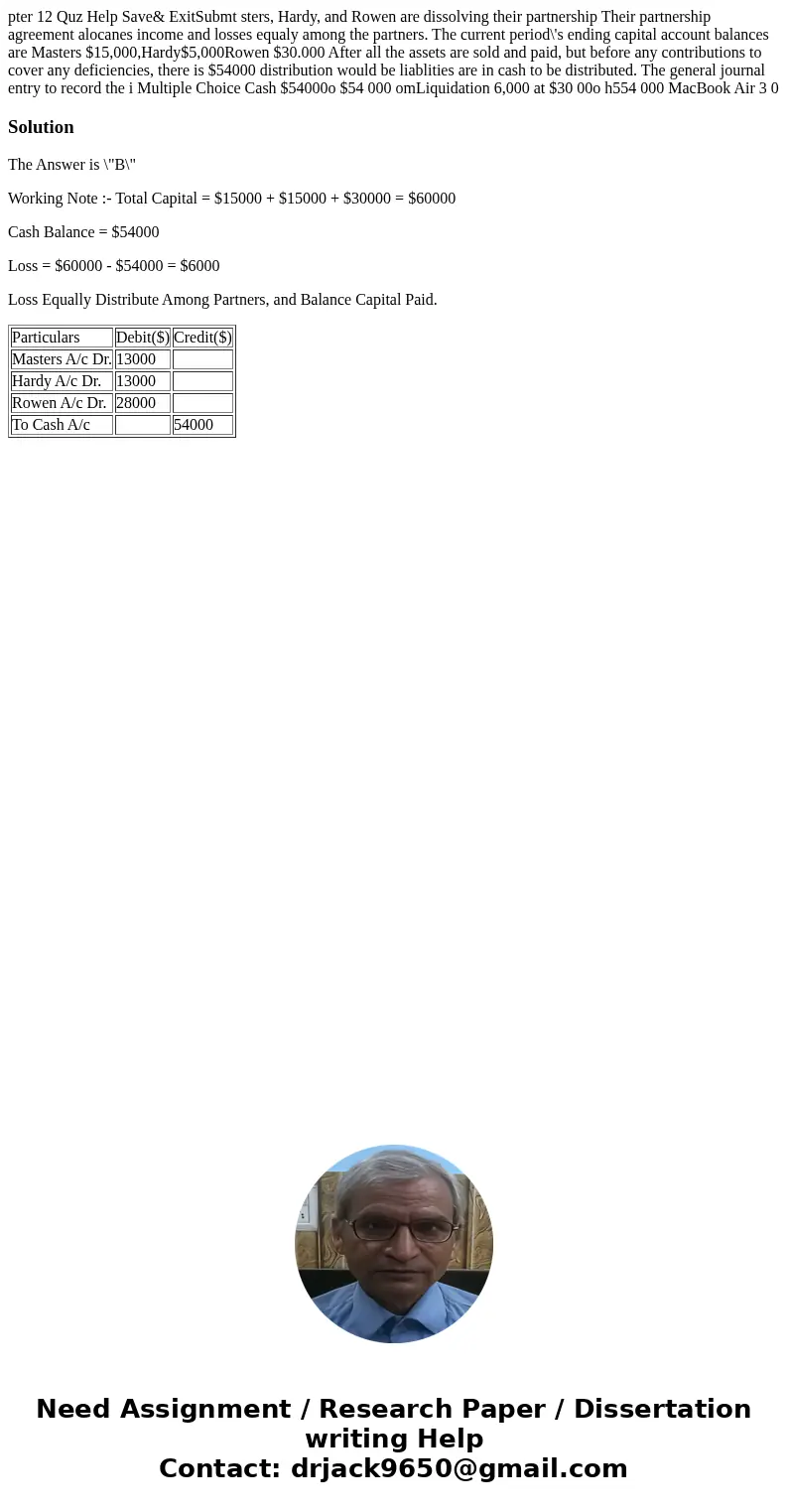

pter 12 Quz Help Save& ExitSubmt sters, Hardy, and Rowen are dissolving their partnership Their partnership agreement alocanes income and losses equaly among the partners. The current period\'s ending capital account balances are Masters $15,000,Hardy$5,000Rowen $30.000 After all the assets are sold and paid, but before any contributions to cover any deficiencies, there is $54000 distribution would be liablities are in cash to be distributed. The general journal entry to record the i Multiple Choice Cash $54000o $54 000 omLiquidation 6,000 at $30 00o h554 000 MacBook Air 3 0

Solution

The Answer is \"B\"

Working Note :- Total Capital = $15000 + $15000 + $30000 = $60000

Cash Balance = $54000

Loss = $60000 - $54000 = $6000

Loss Equally Distribute Among Partners, and Balance Capital Paid.

| Particulars | Debit($) | Credit($) |

| Masters A/c Dr. | 13000 | |

| Hardy A/c Dr. | 13000 | |

| Rowen A/c Dr. | 28000 | |

| To Cash A/c | 54000 |

Homework Sourse

Homework Sourse