HttpslingcengagecomstaticnbuievofindexhtmieISBN9781305403390

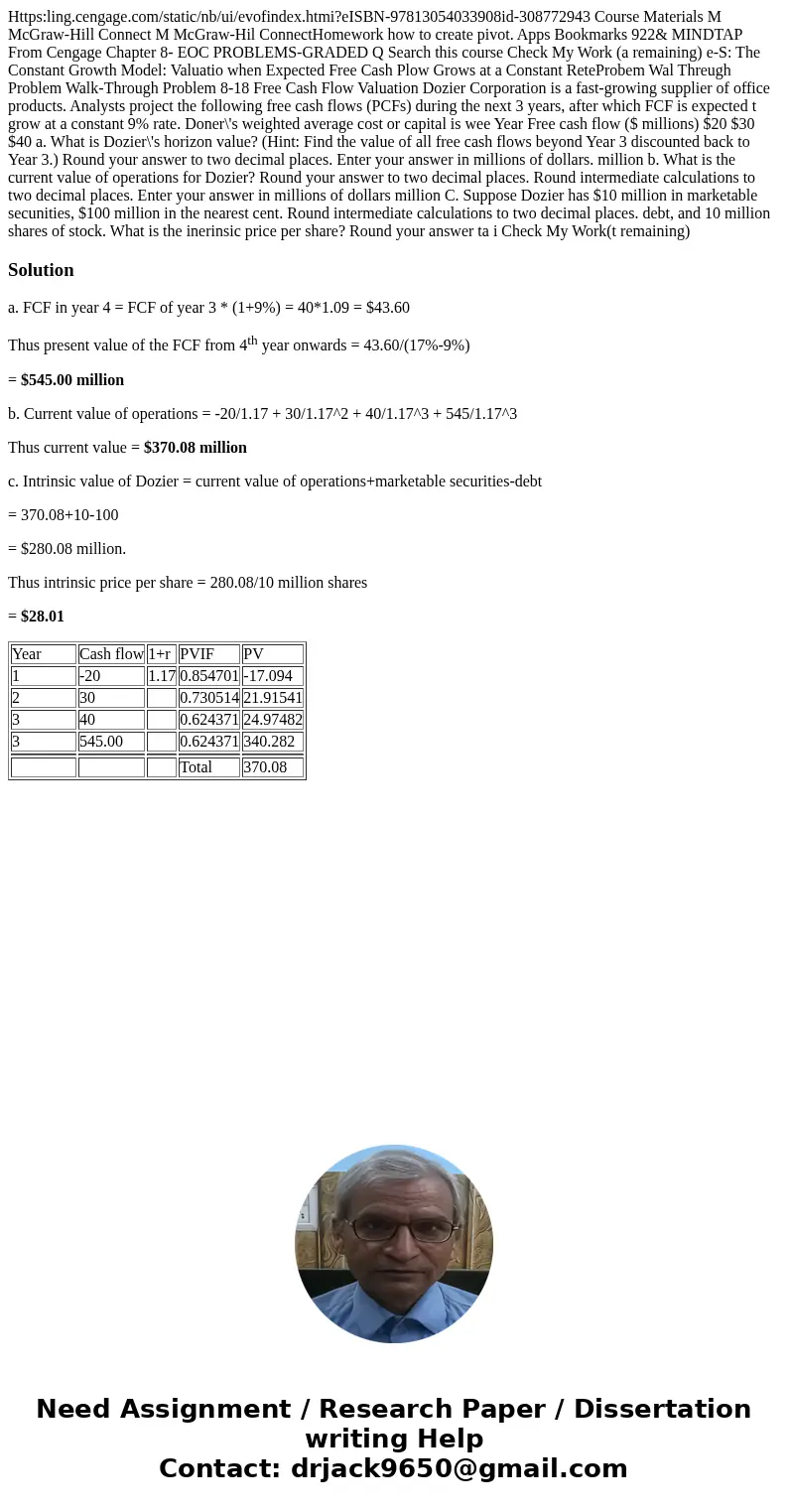

Https:ling.cengage.com/static/nb/ui/evofindex.htmi?eISBN-97813054033908id-308772943 Course Materials M McGraw-Hill Connect M McGraw-Hil ConnectHomework how to create pivot. Apps Bookmarks 922& MINDTAP From Cengage Chapter 8- EOC PROBLEMS-GRADED Q Search this course Check My Work (a remaining) e-S: The Constant Growth Model: Valuatio when Expected Free Cash Plow Grows at a Constant ReteProbem Wal Threugh Problem Walk-Through Problem 8-18 Free Cash Flow Valuation Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (PCFs) during the next 3 years, after which FCF is expected t grow at a constant 9% rate. Doner\'s weighted average cost or capital is wee Year Free cash flow ($ millions) $20 $30 $40 a. What is Dozier\'s horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your answer to two decimal places. Enter your answer in millions of dollars. million b. What is the current value of operations for Dozier? Round your answer to two decimal places. Round intermediate calculations to two decimal places. Enter your answer in millions of dollars million C. Suppose Dozier has $10 million in marketable secunities, $100 million in the nearest cent. Round intermediate calculations to two decimal places. debt, and 10 million shares of stock. What is the inerinsic price per share? Round your answer ta i Check My Work(t remaining)

Solution

a. FCF in year 4 = FCF of year 3 * (1+9%) = 40*1.09 = $43.60

Thus present value of the FCF from 4th year onwards = 43.60/(17%-9%)

= $545.00 million

b. Current value of operations = -20/1.17 + 30/1.17^2 + 40/1.17^3 + 545/1.17^3

Thus current value = $370.08 million

c. Intrinsic value of Dozier = current value of operations+marketable securities-debt

= 370.08+10-100

= $280.08 million.

Thus intrinsic price per share = 280.08/10 million shares

= $28.01

| Year | Cash flow | 1+r | PVIF | PV |

| 1 | -20 | 1.17 | 0.854701 | -17.094 |

| 2 | 30 | 0.730514 | 21.91541 | |

| 3 | 40 | 0.624371 | 24.97482 | |

| 3 | 545.00 | 0.624371 | 340.282 | |

| Total | 370.08 |

Homework Sourse

Homework Sourse