A study of the volatility of 40 countrys stock market return

A study of the volatility of 40 country\'s stock market returns was conducted by considering the standard deviation of these returns, the country\'s credit rating, and whether or not the country is a developing or emerging country. Analyze this data and summarize your results. (What are the relationships among the data?).

Country

StdDev

Rating

Dev/Emrg

Afghanistan

55.7

8.3

E

Australia

23.9

71.2

D

China

27.2

57.0

E

Cuba

55.0

8.7

E

Germany

20.3

90.9

D

France

20.6

89.1

D

India

30.3

46.1

E

Belgium

22.3

79.2

D

Canada

22.1

80.3

D

Ethiopia

47.9

14.1

E

Haiti

54.9

8.8

E

Japan

20.2

91.6

D

Libya

36.7

30.0

E

Malaysia

24.3

69.1

E

Mexico

31.8

41.8

E

New Zealand

24.3

69.4

D

Nigeria

46.2

15.8

E

Oman

28.6

51.8

D

Panama

38.6

26.4

E

Spain

23.4

73.7

D

Sudan

60.5

6.0

E

Taiwan

22.2

79.9

D

Norway

21.4

84.6

D

Sweden

23.3

74.1

D

Togo

45.1

17.0

E

Ukraine

46.3

15.7

E

UK

20.8

87.8

D

US

20.3

90.7

D

Vietnam

36.9

29.5

E

Zimbabwe

36.2

31.0

E

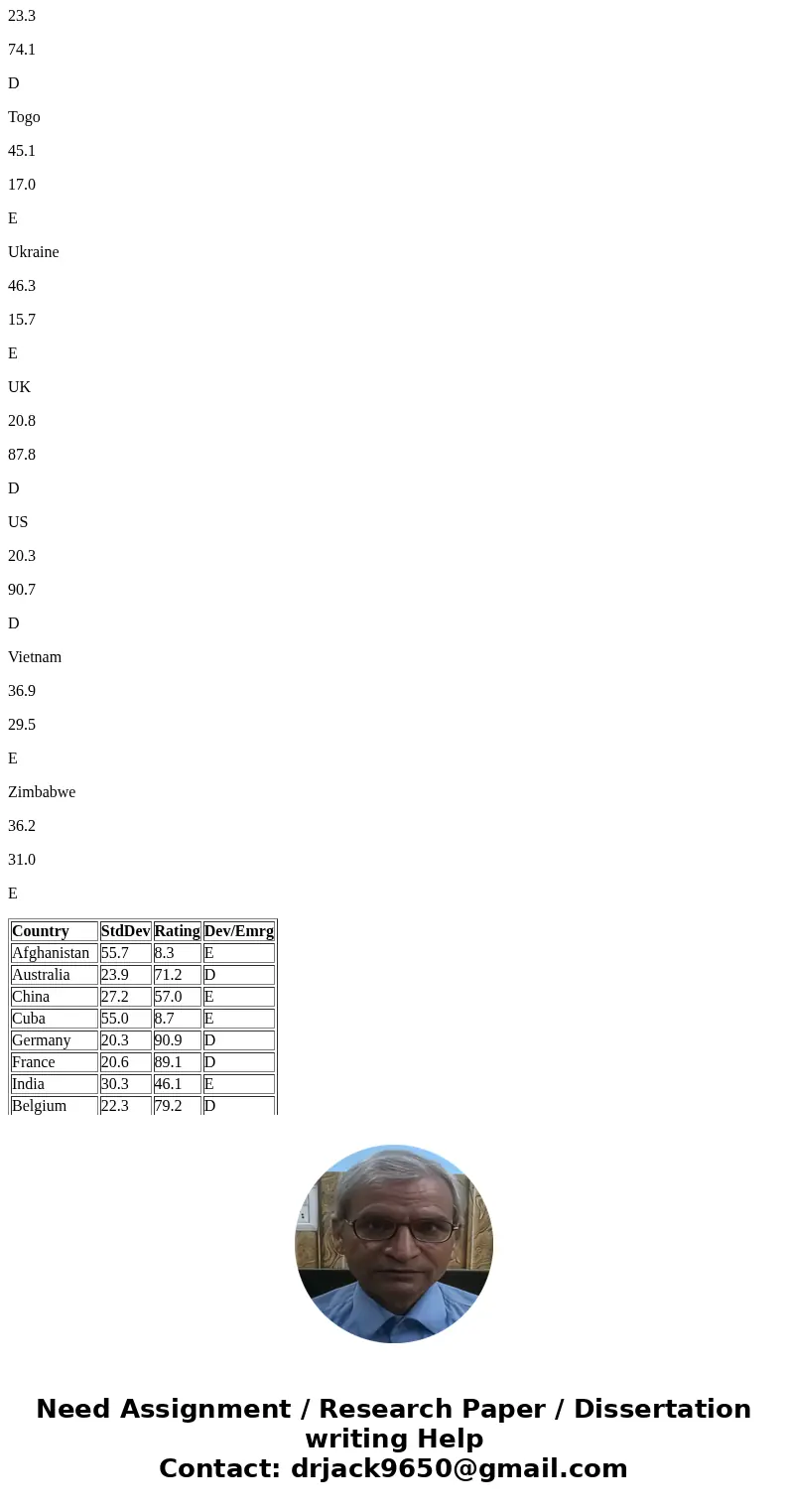

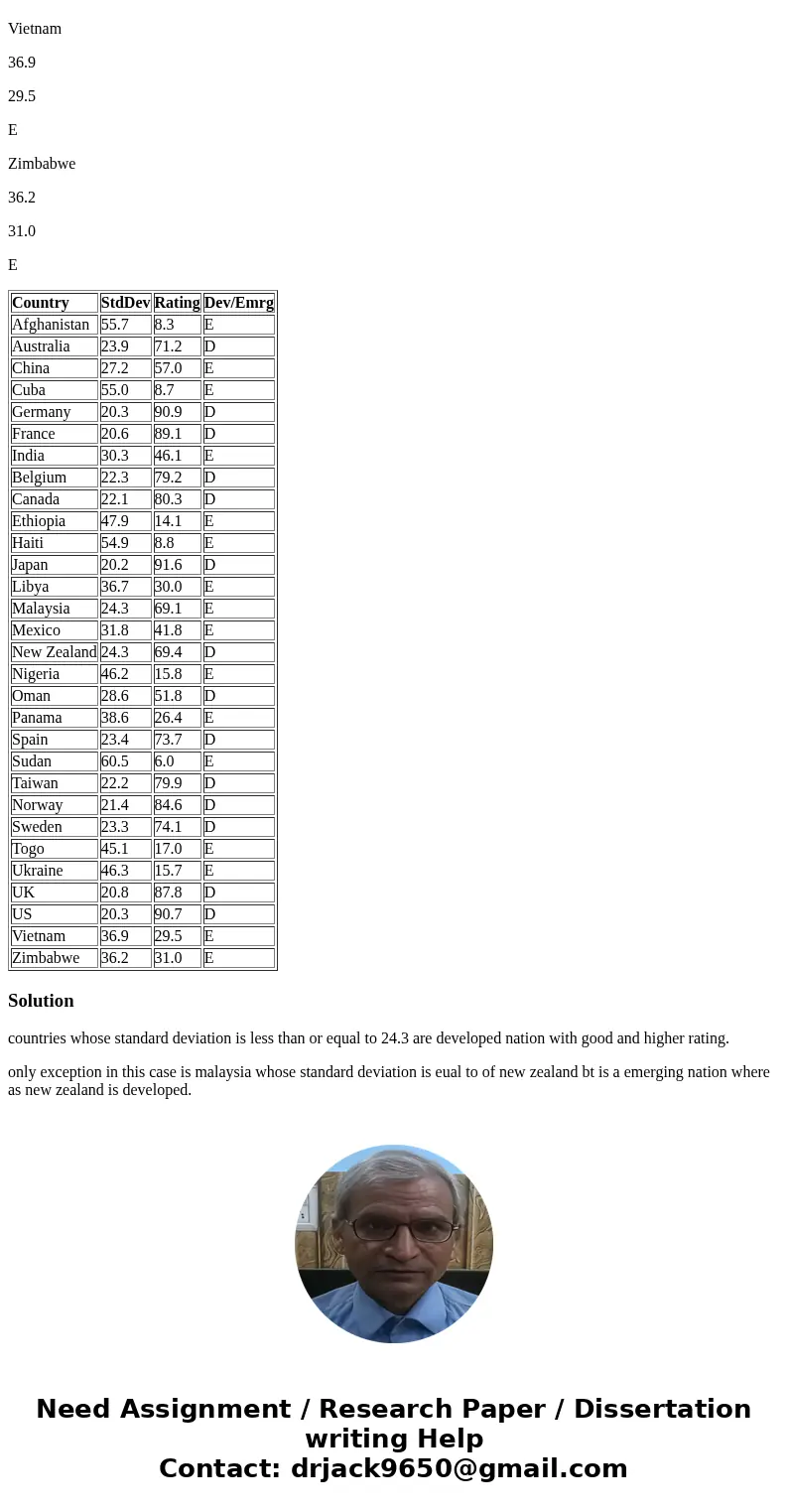

| Country | StdDev | Rating | Dev/Emrg |

| Afghanistan | 55.7 | 8.3 | E |

| Australia | 23.9 | 71.2 | D |

| China | 27.2 | 57.0 | E |

| Cuba | 55.0 | 8.7 | E |

| Germany | 20.3 | 90.9 | D |

| France | 20.6 | 89.1 | D |

| India | 30.3 | 46.1 | E |

| Belgium | 22.3 | 79.2 | D |

| Canada | 22.1 | 80.3 | D |

| Ethiopia | 47.9 | 14.1 | E |

| Haiti | 54.9 | 8.8 | E |

| Japan | 20.2 | 91.6 | D |

| Libya | 36.7 | 30.0 | E |

| Malaysia | 24.3 | 69.1 | E |

| Mexico | 31.8 | 41.8 | E |

| New Zealand | 24.3 | 69.4 | D |

| Nigeria | 46.2 | 15.8 | E |

| Oman | 28.6 | 51.8 | D |

| Panama | 38.6 | 26.4 | E |

| Spain | 23.4 | 73.7 | D |

| Sudan | 60.5 | 6.0 | E |

| Taiwan | 22.2 | 79.9 | D |

| Norway | 21.4 | 84.6 | D |

| Sweden | 23.3 | 74.1 | D |

| Togo | 45.1 | 17.0 | E |

| Ukraine | 46.3 | 15.7 | E |

| UK | 20.8 | 87.8 | D |

| US | 20.3 | 90.7 | D |

| Vietnam | 36.9 | 29.5 | E |

| Zimbabwe | 36.2 | 31.0 | E |

Solution

countries whose standard deviation is less than or equal to 24.3 are developed nation with good and higher rating.

only exception in this case is malaysia whose standard deviation is eual to of new zealand bt is a emerging nation where as new zealand is developed.

Homework Sourse

Homework Sourse