Exercise 211 On January 1 2017 Pina Corporation signed a 5ye

Solution

Here , for calculation of present value of minimum lease payments,

PV = Sum of [P/(1+r)^n] + [RV/(1+r)^n]

where,

Where PV = Present Value, P = Annual Lease Payments, r = Interest rate, n = number of years in the lease term and RV = residual value

Since , the annual payment is made on the begining of each year , value of \'n\' for each year = year -1.

i.e for 1st year , n= 1-1=0 , for 2nd year , n= 2-1 =1 and so on.

P = $ 8482 , useful life = 6 years , RV = $5,000 ( at the end of 6th year), r= 9%

PV = 8482/ (1.09)^0 + 8482/ (1.09)^1 +8482/ (1.09)^2+8482/ (1.09)^3+8482/ (1.09)^4+8482/ (1.09)^5 + 5000/ (1.09)^6

=$ 44455.36 = $ 44455.

PV = $ 44455.

Answer )

YEARLY depreciation = (Value - RV )/ year = (44455 - 5000)/6 = $6576.

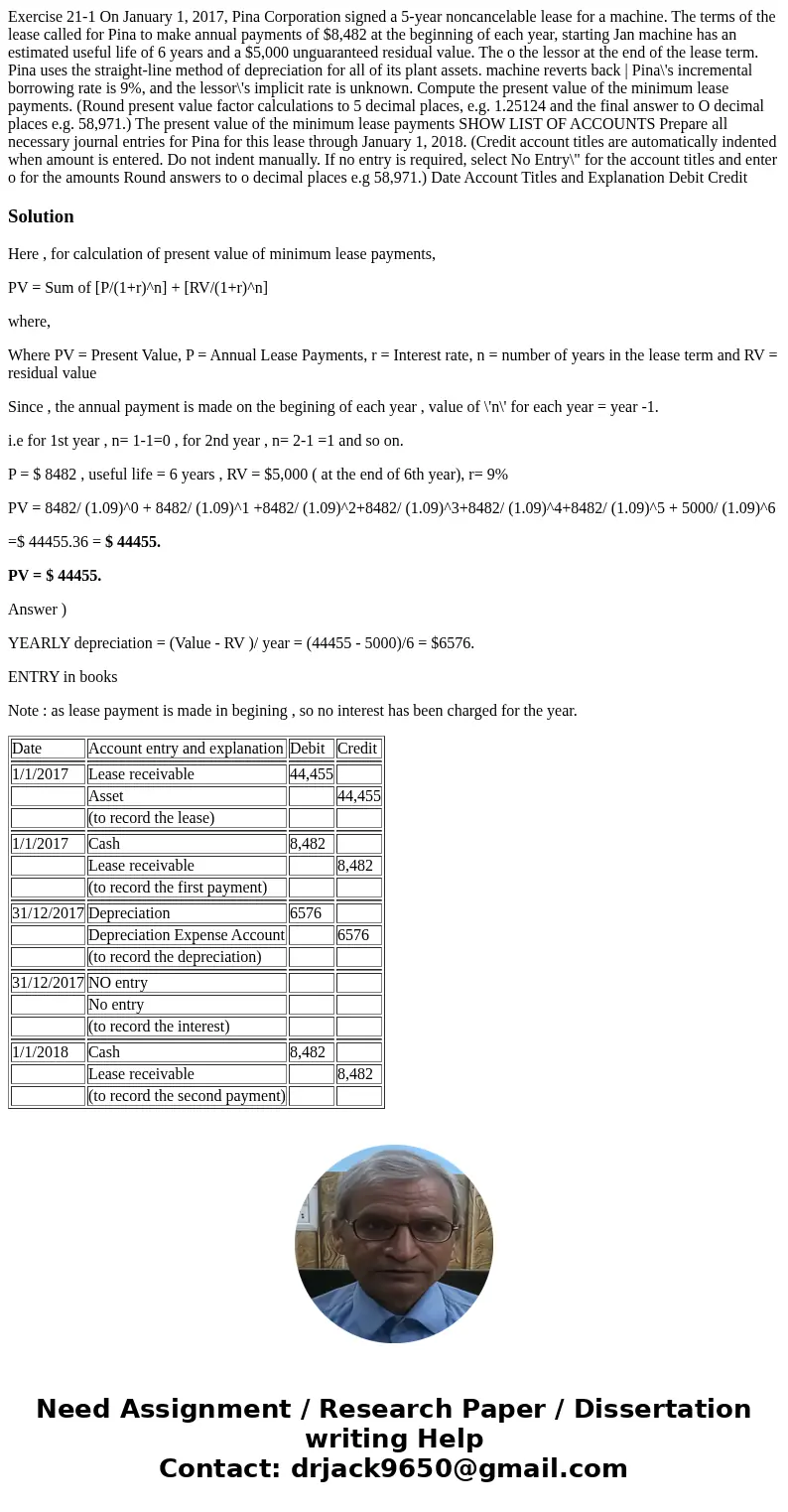

ENTRY in books

Note : as lease payment is made in begining , so no interest has been charged for the year.

| Date | Account entry and explanation | Debit | Credit |

| 1/1/2017 | Lease receivable | 44,455 | |

| Asset | 44,455 | ||

| (to record the lease) | |||

| 1/1/2017 | Cash | 8,482 | |

| Lease receivable | 8,482 | ||

| (to record the first payment) | |||

| 31/12/2017 | Depreciation | 6576 | |

| Depreciation Expense Account | 6576 | ||

| (to record the depreciation) | |||

| 31/12/2017 | NO entry | ||

| No entry | |||

| (to record the interest) | |||

| 1/1/2018 | Cash | 8,482 | |

| Lease receivable | 8,482 | ||

| (to record the second payment) |

Homework Sourse

Homework Sourse