37 What is the Net Present Value for a project costing 200K

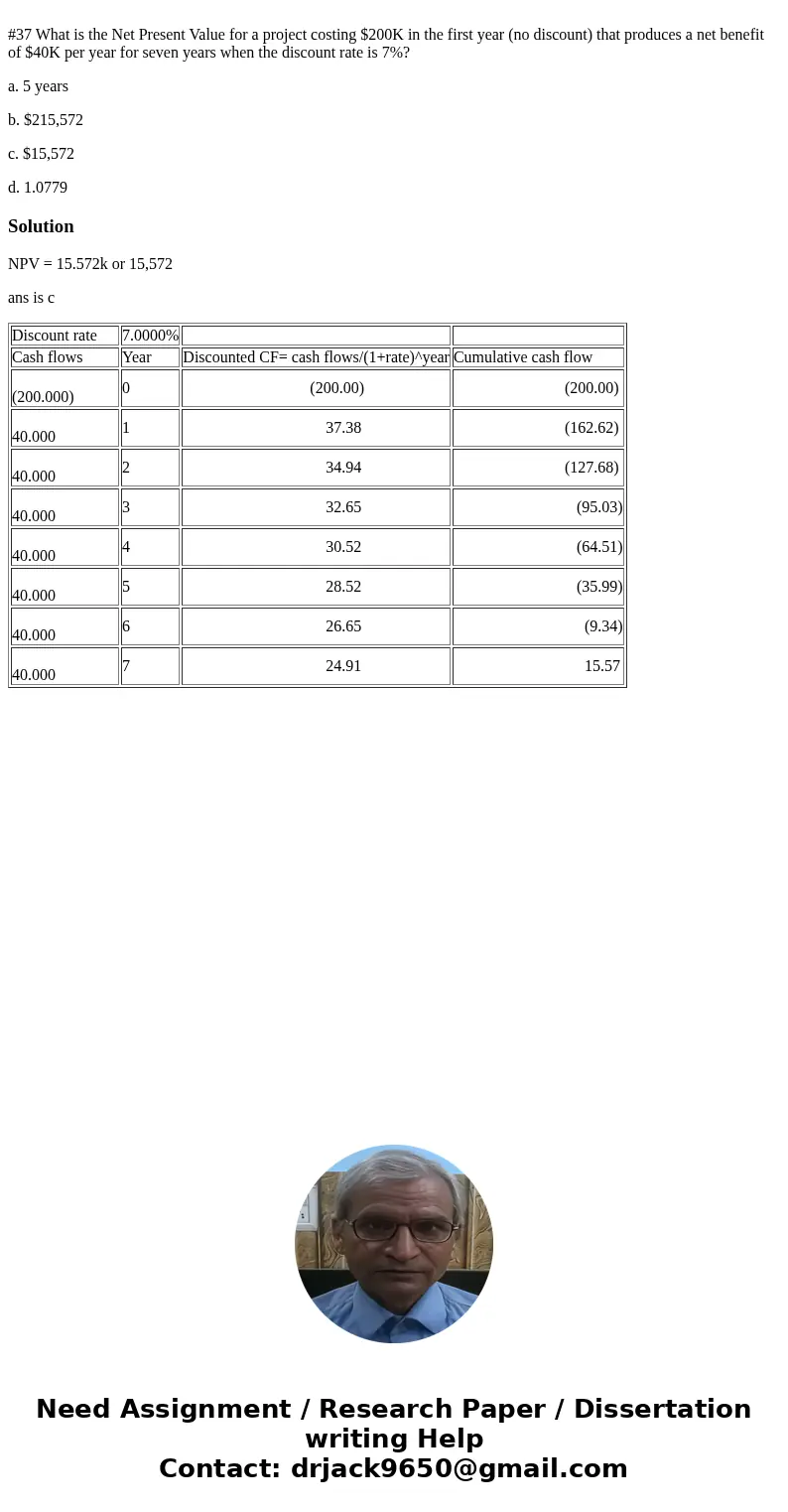

#37 What is the Net Present Value for a project costing $200K in the first year (no discount) that produces a net benefit of $40K per year for seven years when the discount rate is 7%?

a. 5 years

b. $215,572

c. $15,572

d. 1.0779

Solution

NPV = 15.572k or 15,572

ans is c

| Discount rate | 7.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| (200.000) | 0 | (200.00) | (200.00) |

| 40.000 | 1 | 37.38 | (162.62) |

| 40.000 | 2 | 34.94 | (127.68) |

| 40.000 | 3 | 32.65 | (95.03) |

| 40.000 | 4 | 30.52 | (64.51) |

| 40.000 | 5 | 28.52 | (35.99) |

| 40.000 | 6 | 26.65 | (9.34) |

| 40.000 | 7 | 24.91 | 15.57 |

Homework Sourse

Homework Sourse