Nalu and Kamaile takeout a mortgage in the amount of 790000

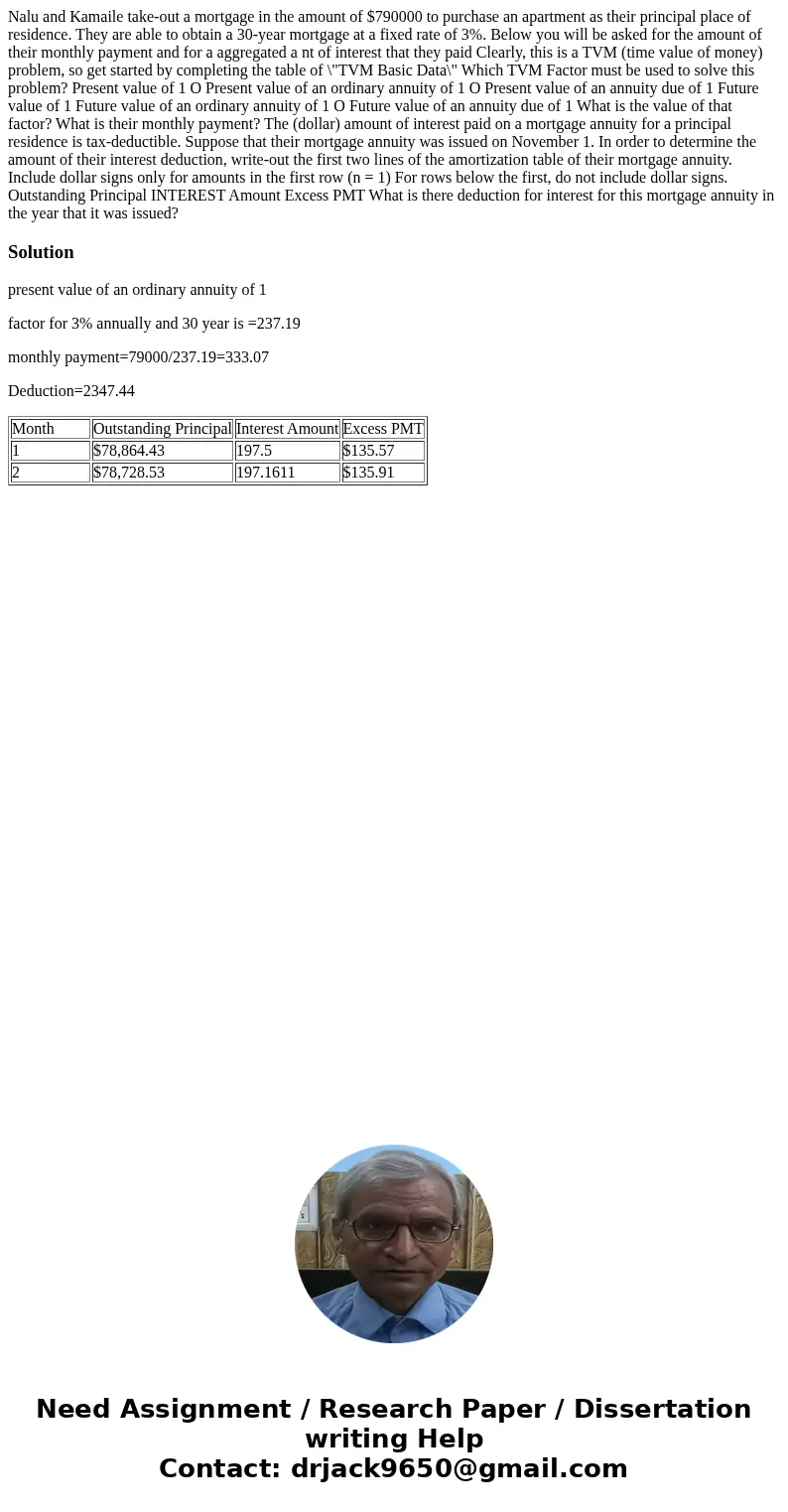

Nalu and Kamaile take-out a mortgage in the amount of $790000 to purchase an apartment as their principal place of residence. They are able to obtain a 30-year mortgage at a fixed rate of 3%. Below you will be asked for the amount of their monthly payment and for a aggregated a nt of interest that they paid Clearly, this is a TVM (time value of money) problem, so get started by completing the table of \"TVM Basic Data\" Which TVM Factor must be used to solve this problem? Present value of 1 O Present value of an ordinary annuity of 1 O Present value of an annuity due of 1 Future value of 1 Future value of an ordinary annuity of 1 O Future value of an annuity due of 1 What is the value of that factor? What is their monthly payment? The (dollar) amount of interest paid on a mortgage annuity for a principal residence is tax-deductible. Suppose that their mortgage annuity was issued on November 1. In order to determine the amount of their interest deduction, write-out the first two lines of the amortization table of their mortgage annuity. Include dollar signs only for amounts in the first row (n = 1) For rows below the first, do not include dollar signs. Outstanding Principal INTEREST Amount Excess PMT What is there deduction for interest for this mortgage annuity in the year that it was issued?

Solution

present value of an ordinary annuity of 1

factor for 3% annually and 30 year is =237.19

monthly payment=79000/237.19=333.07

Deduction=2347.44

| Month | Outstanding Principal | Interest Amount | Excess PMT |

| 1 | $78,864.43 | 197.5 | $135.57 |

| 2 | $78,728.53 | 197.1611 | $135.91 |

Homework Sourse

Homework Sourse