P12A Judi Salem opened a law office on July 1 2017 On July 3

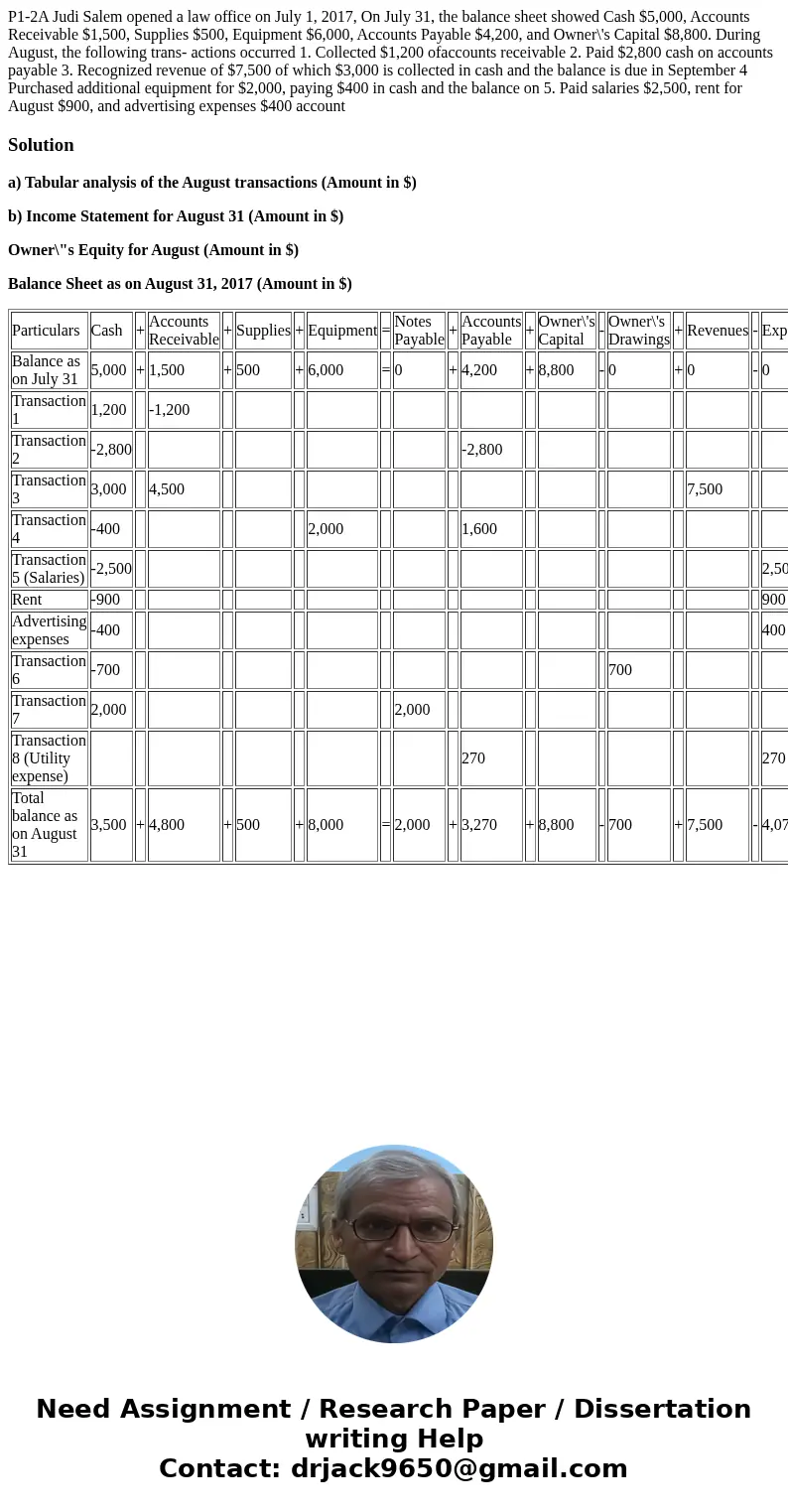

P1-2A Judi Salem opened a law office on July 1, 2017, On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500, Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owner\'s Capital $8,800. During August, the following trans- actions occurred 1. Collected $1,200 ofaccounts receivable 2. Paid $2,800 cash on accounts payable 3. Recognized revenue of $7,500 of which $3,000 is collected in cash and the balance is due in September 4 Purchased additional equipment for $2,000, paying $400 in cash and the balance on 5. Paid salaries $2,500, rent for August $900, and advertising expenses $400 account

Solution

a) Tabular analysis of the August transactions (Amount in $)

b) Income Statement for August 31 (Amount in $)

Owner\"s Equity for August (Amount in $)

Balance Sheet as on August 31, 2017 (Amount in $)

| Particulars | Cash | + | Accounts Receivable | + | Supplies | + | Equipment | = | Notes Payable | + | Accounts Payable | + | Owner\'s Capital | - | Owner\'s Drawings | + | Revenues | - | Expenses |

| Balance as on July 31 | 5,000 | + | 1,500 | + | 500 | + | 6,000 | = | 0 | + | 4,200 | + | 8,800 | - | 0 | + | 0 | - | 0 |

| Transaction 1 | 1,200 | -1,200 | |||||||||||||||||

| Transaction 2 | -2,800 | -2,800 | |||||||||||||||||

| Transaction 3 | 3,000 | 4,500 | 7,500 | ||||||||||||||||

| Transaction 4 | -400 | 2,000 | 1,600 | ||||||||||||||||

| Transaction 5 (Salaries) | -2,500 | 2,500 | |||||||||||||||||

| Rent | -900 | 900 | |||||||||||||||||

| Advertising expenses | -400 | 400 | |||||||||||||||||

| Transaction 6 | -700 | 700 | |||||||||||||||||

| Transaction 7 | 2,000 | 2,000 | |||||||||||||||||

| Transaction 8 (Utility expense) | 270 | 270 | |||||||||||||||||

| Total balance as on August 31 | 3,500 | + | 4,800 | + | 500 | + | 8,000 | = | 2,000 | + | 3,270 | + | 8,800 | - | 700 | + | 7,500 | - | 4,070 |

Homework Sourse

Homework Sourse