You decide to invest in a portfolio consisting of 30 percent

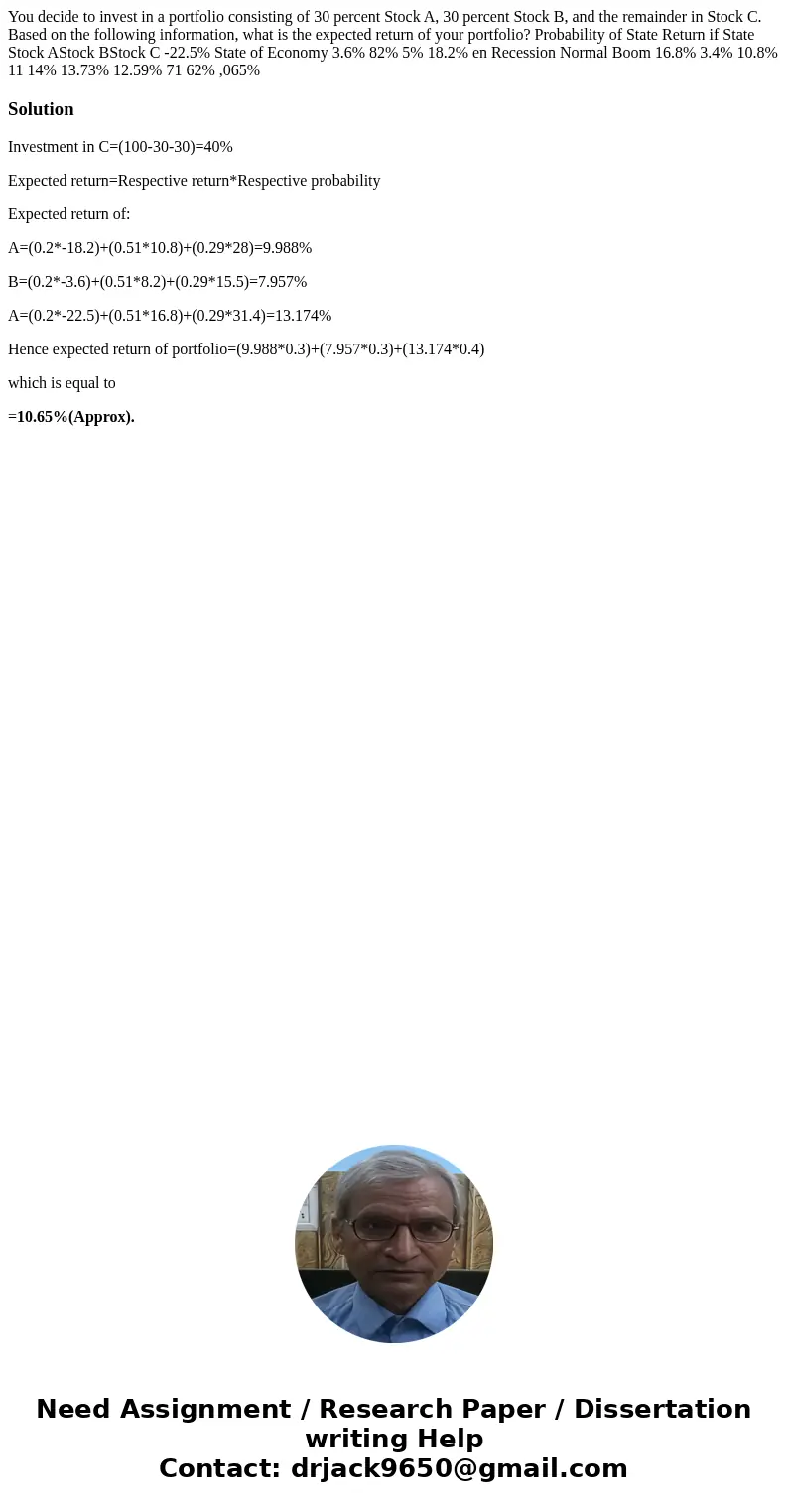

You decide to invest in a portfolio consisting of 30 percent Stock A, 30 percent Stock B, and the remainder in Stock C. Based on the following information, what is the expected return of your portfolio? Probability of State Return if State Stock AStock BStock C -22.5% State of Economy 3.6% 82% 5% 18.2% en Recession Normal Boom 16.8% 3.4% 10.8% 11 14% 13.73% 12.59% 71 62% ,065%

Solution

Investment in C=(100-30-30)=40%

Expected return=Respective return*Respective probability

Expected return of:

A=(0.2*-18.2)+(0.51*10.8)+(0.29*28)=9.988%

B=(0.2*-3.6)+(0.51*8.2)+(0.29*15.5)=7.957%

A=(0.2*-22.5)+(0.51*16.8)+(0.29*31.4)=13.174%

Hence expected return of portfolio=(9.988*0.3)+(7.957*0.3)+(13.174*0.4)

which is equal to

=10.65%(Approx).

Homework Sourse

Homework Sourse