On January 1 2016 Nick issued a 100000 bond that matures in

On January 1, 2016 Nick issued a $100,000 bond that matures in 20 years and pays 4% interest (stated or coupon rate) a year. (Payment date is December 31.) The market (yield) rate is 6%.assume the bond was sold @ 95.

Complete the first two years of the following table:

Year

Interest Expense

Book

1/1/16

1

2

4. Complete the entries at the end of the year for the first two years. Please use the table above.

Date

Accounts

Debit(s)

Credit(s)

12/31/16

Date

Accounts

Debit(s)

Credit(s)

12/31/17

| Year | Interest Expense | Book | ||

| 1/1/16 | ||||

| 1 | ||||

| 2 |

Solution

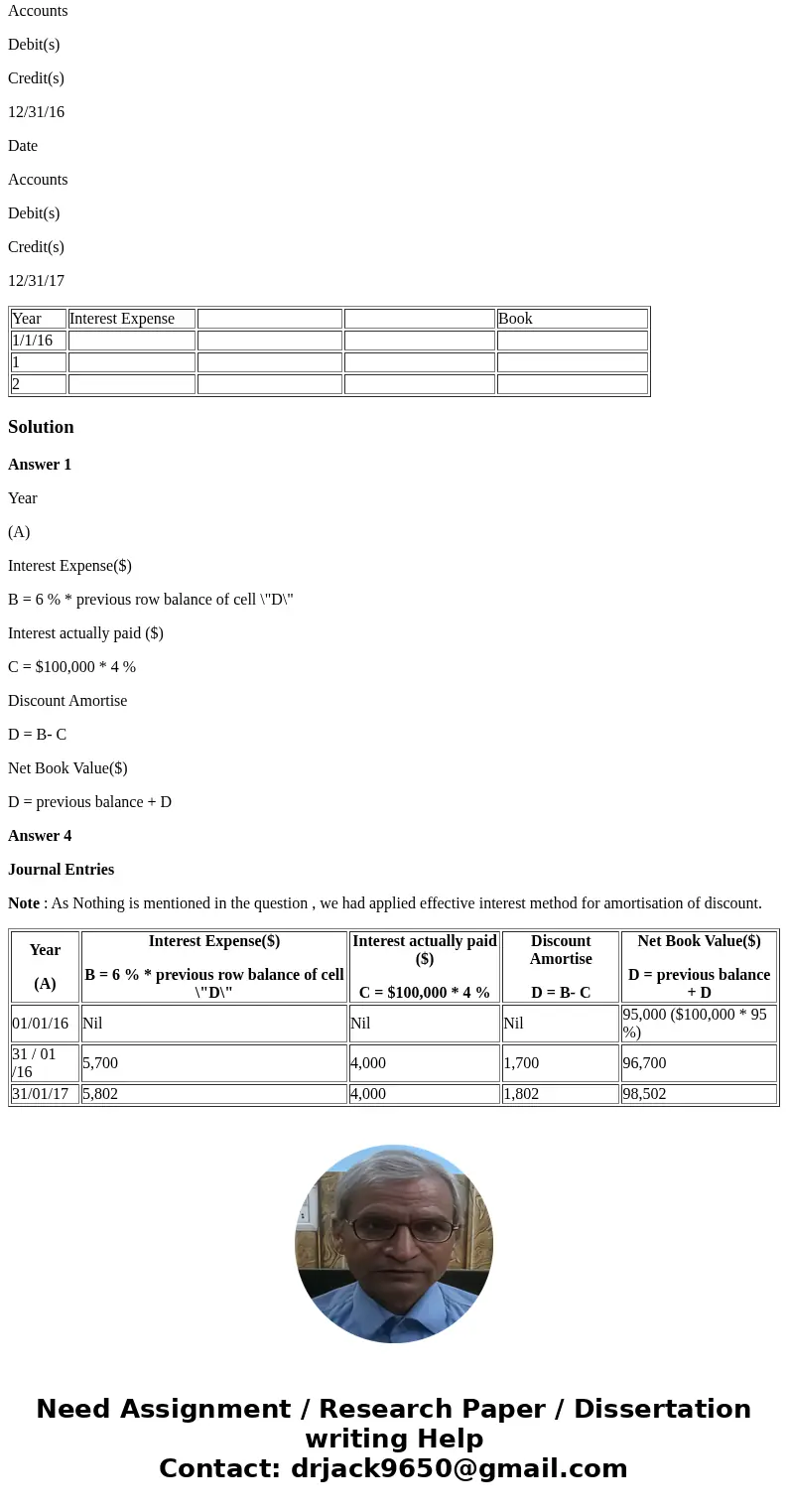

Answer 1

Year

(A)

Interest Expense($)

B = 6 % * previous row balance of cell \"D\"

Interest actually paid ($)

C = $100,000 * 4 %

Discount Amortise

D = B- C

Net Book Value($)

D = previous balance + D

Answer 4

Journal Entries

Note : As Nothing is mentioned in the question , we had applied effective interest method for amortisation of discount.

| Year (A) | Interest Expense($) B = 6 % * previous row balance of cell \"D\" | Interest actually paid ($) C = $100,000 * 4 % | Discount Amortise D = B- C | Net Book Value($) D = previous balance + D |

|---|---|---|---|---|

| 01/01/16 | Nil | Nil | Nil | 95,000 ($100,000 * 95 %) |

| 31 / 01 /16 | 5,700 | 4,000 | 1,700 | 96,700 |

| 31/01/17 | 5,802 | 4,000 | 1,802 | 98,502 |

Homework Sourse

Homework Sourse