Norton Construction company purchased a Cement Mixer for its

Norton Construction company purchased a Cement Mixer for its operations at a cost of $14,500 0n January 2, 2005. The Cement Mixer has an estimated useful life of five years and an estimated residual value of $1000. The Cement Mixer is also expected to last 7,500 hours. It was operated 1,500 hours in 2005, 2,625 hours in 2006, 2,250 hours in 2007, 750 hours in 2008, and 375 hours in 2009. compute the annual depreciation and the carrying value for each year using a. straightline b. production c. double-declining-balance

Solution

Answer

A

Cost of Mixer

14500

B

Residual value

1000

C=A-B

Depreciable base

13500

D

Expected Life

5

E=C/D

Annual SLM Depreciation

2700

Year

Opening Book Value/Carrying Value

SLM Depreciation

Closing Carrying Value

2005

14500

[for 364 days] 2693

11807

2006

11807

2700

9107

2007

9107

2700

6407

2008

6407

2700

3707

2009

3707

2700

1007

A

Cost of Mixer

14500

B

Residual value

1000

C=A-B

Depreciable base

13500

D

Expected Hours

7500

E=C/D

Depreciation per hour

1.8

Year

No. of Hours

Opening Book Value/Carrying Value

Depreciation [No of hours x $1.8]

Closing Carrying Value

2005

1500

14500

2700

11800

2006

2625

11800

4725

7075

2007

2250

7075

4050

3025

2008

750

3025

1350

1675

2009

375

1675

675

1000

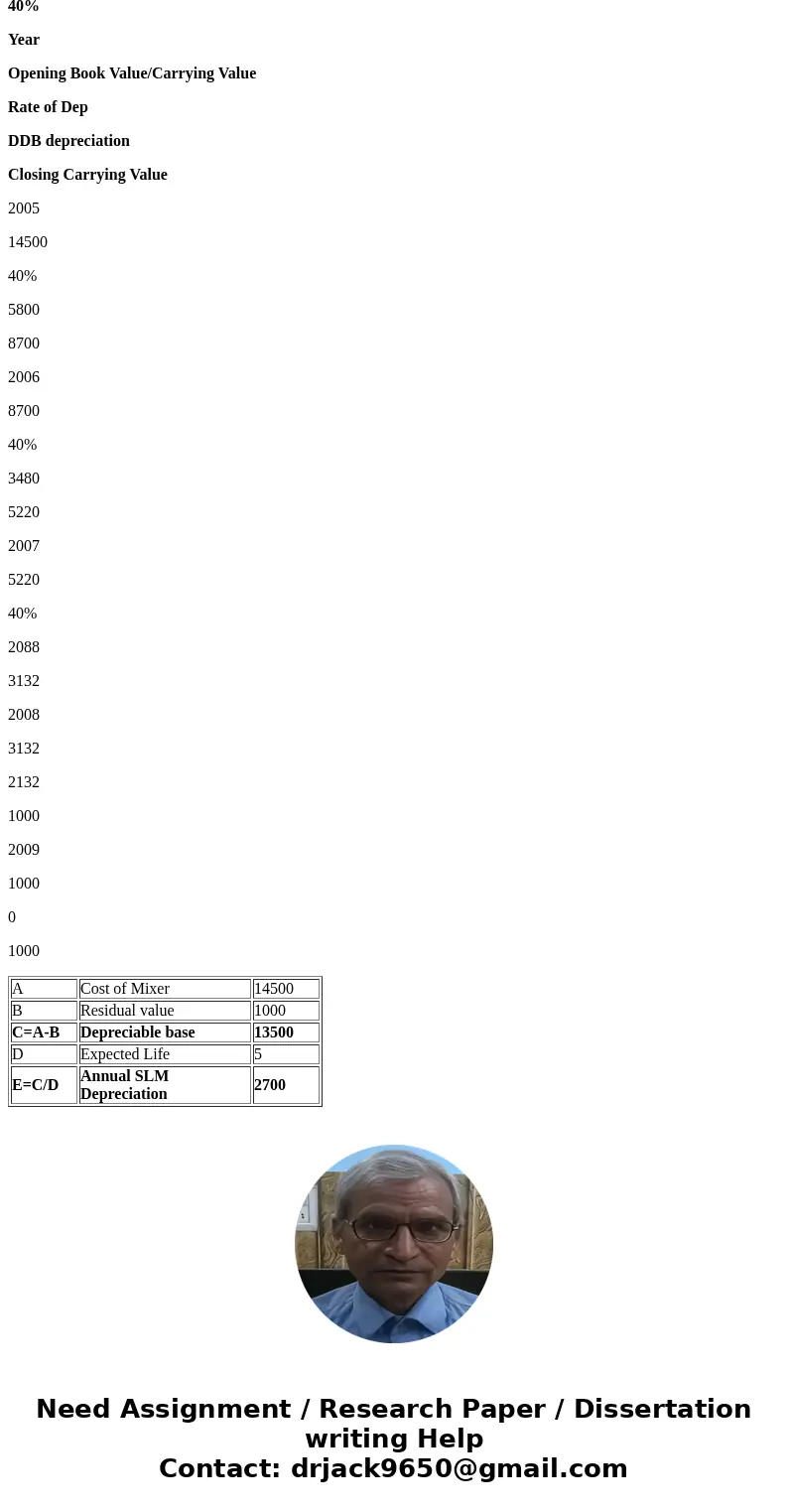

A

Cost of Mixer

14500

B

Residual value

1000

C=A-B

Depreciable base

13500

D

Expected Life

5

E=C/D

Annual SLM Depreciation

2700

F=E/C

SLM Rate

20%

G=F x 2

Double declining Rate

40%

Year

Opening Book Value/Carrying Value

Rate of Dep

DDB depreciation

Closing Carrying Value

2005

14500

40%

5800

8700

2006

8700

40%

3480

5220

2007

5220

40%

2088

3132

2008

3132

2132

1000

2009

1000

0

1000

| A | Cost of Mixer | 14500 |

| B | Residual value | 1000 |

| C=A-B | Depreciable base | 13500 |

| D | Expected Life | 5 |

| E=C/D | Annual SLM Depreciation | 2700 |

Homework Sourse

Homework Sourse