Wingate Company a wholesale distributor of electronic equipm

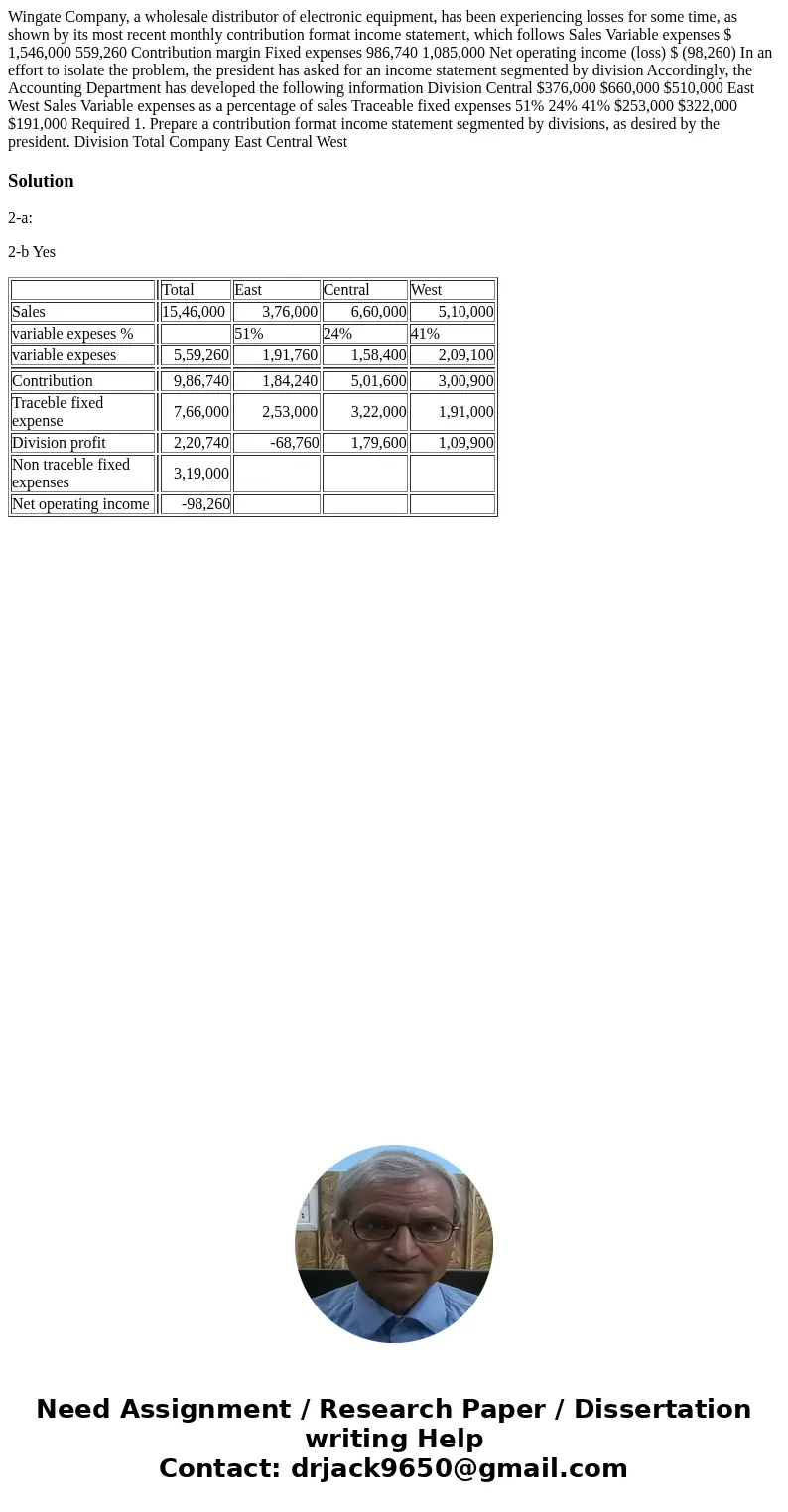

Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement, which follows Sales Variable expenses $ 1,546,000 559,260 Contribution margin Fixed expenses 986,740 1,085,000 Net operating income (loss) $ (98,260) In an effort to isolate the problem, the president has asked for an income statement segmented by division Accordingly, the Accounting Department has developed the following information Division Central $376,000 $660,000 $510,000 East West Sales Variable expenses as a percentage of sales Traceable fixed expenses 51% 24% 41% $253,000 $322,000 $191,000 Required 1. Prepare a contribution format income statement segmented by divisions, as desired by the president. Division Total Company East Central West

Solution

2-a:

2-b Yes

| Total | East | Central | West | ||

| Sales | 15,46,000 | 3,76,000 | 6,60,000 | 5,10,000 | |

| variable expeses % | 51% | 24% | 41% | ||

| variable expeses | 5,59,260 | 1,91,760 | 1,58,400 | 2,09,100 | |

| Contribution | 9,86,740 | 1,84,240 | 5,01,600 | 3,00,900 | |

| Traceble fixed expense | 7,66,000 | 2,53,000 | 3,22,000 | 1,91,000 | |

| Division profit | 2,20,740 | -68,760 | 1,79,600 | 1,09,900 | |

| Non traceble fixed expenses | 3,19,000 | ||||

| Net operating income | -98,260 |

Homework Sourse

Homework Sourse