Salaries and wages expenses 697500 Loss on disposal of plant

Salaries and wages expenses $697,500

Loss on disposal of plant assets $125,250

Cost of goods sold 1,480,500

Sales Revenue 3,315,000

Interest expense 106,500

Income Tax Expense 37,500

Interest revenue 97,500

Sales discounts 240,000

Depreciation Expense 465,000

Utilities expense 165,000

I

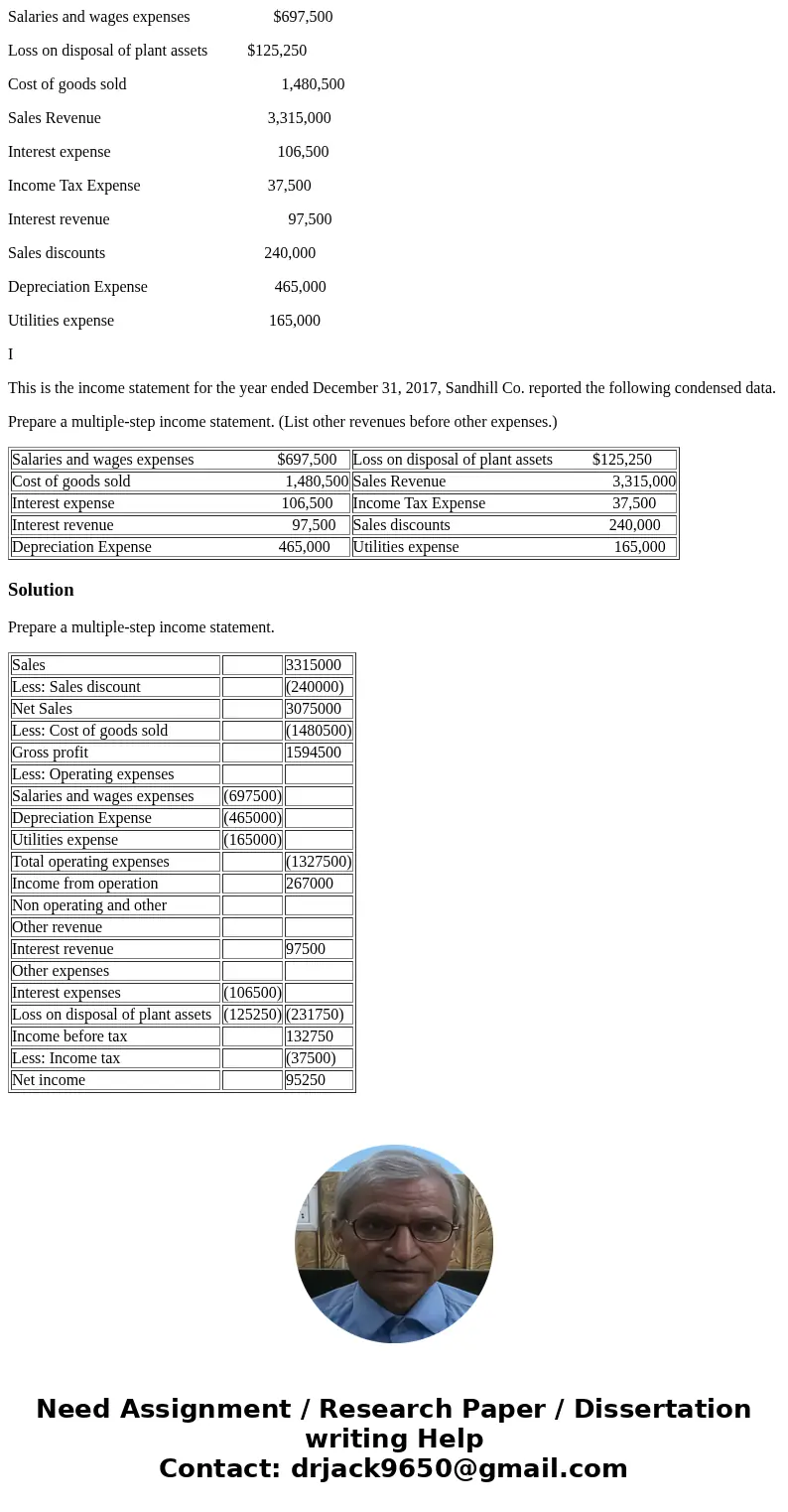

This is the income statement for the year ended December 31, 2017, Sandhill Co. reported the following condensed data.

Prepare a multiple-step income statement. (List other revenues before other expenses.)

| Salaries and wages expenses $697,500 | Loss on disposal of plant assets $125,250 |

| Cost of goods sold 1,480,500 | Sales Revenue 3,315,000 |

| Interest expense 106,500 | Income Tax Expense 37,500 |

| Interest revenue 97,500 | Sales discounts 240,000 |

| Depreciation Expense 465,000 | Utilities expense 165,000 |

Solution

Prepare a multiple-step income statement.

| Sales | 3315000 | |

| Less: Sales discount | (240000) | |

| Net Sales | 3075000 | |

| Less: Cost of goods sold | (1480500) | |

| Gross profit | 1594500 | |

| Less: Operating expenses | ||

| Salaries and wages expenses | (697500) | |

| Depreciation Expense | (465000) | |

| Utilities expense | (165000) | |

| Total operating expenses | (1327500) | |

| Income from operation | 267000 | |

| Non operating and other | ||

| Other revenue | ||

| Interest revenue | 97500 | |

| Other expenses | ||

| Interest expenses | (106500) | |

| Loss on disposal of plant assets | (125250) | (231750) |

| Income before tax | 132750 | |

| Less: Income tax | (37500) | |

| Net income | 95250 |

Homework Sourse

Homework Sourse