The transactions of Spade Company appear below Kacy Spade ow

The transactions of Spade Company appear below.

Kacy Spade, owner, invested $15,500 cash in the company in exchange for common stock.

The company purchased office supplies for $450 cash.

The company purchased $8,572 of office equipment on credit.

The company received $1,829 cash as fees for services provided to a customer.

The company paid $8,572 cash to settle the payable for the office equipment purchased in transaction c.

The company billed a customer $3,286 as fees for services provided.

The company paid $530 cash for the monthly rent.

The company collected $1,380 cash as partial payment for the account receivable created in transaction f.

The company paid $1,200 cash in dividends to the owner (sole shareholder).

Required:

1. Prepare general journal entries to record the transactions below for Spade Company by using the following accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; Common Stock; Dividends; Fees Earned; and Rent Expense. Use the letters beside each transaction to identify entries.

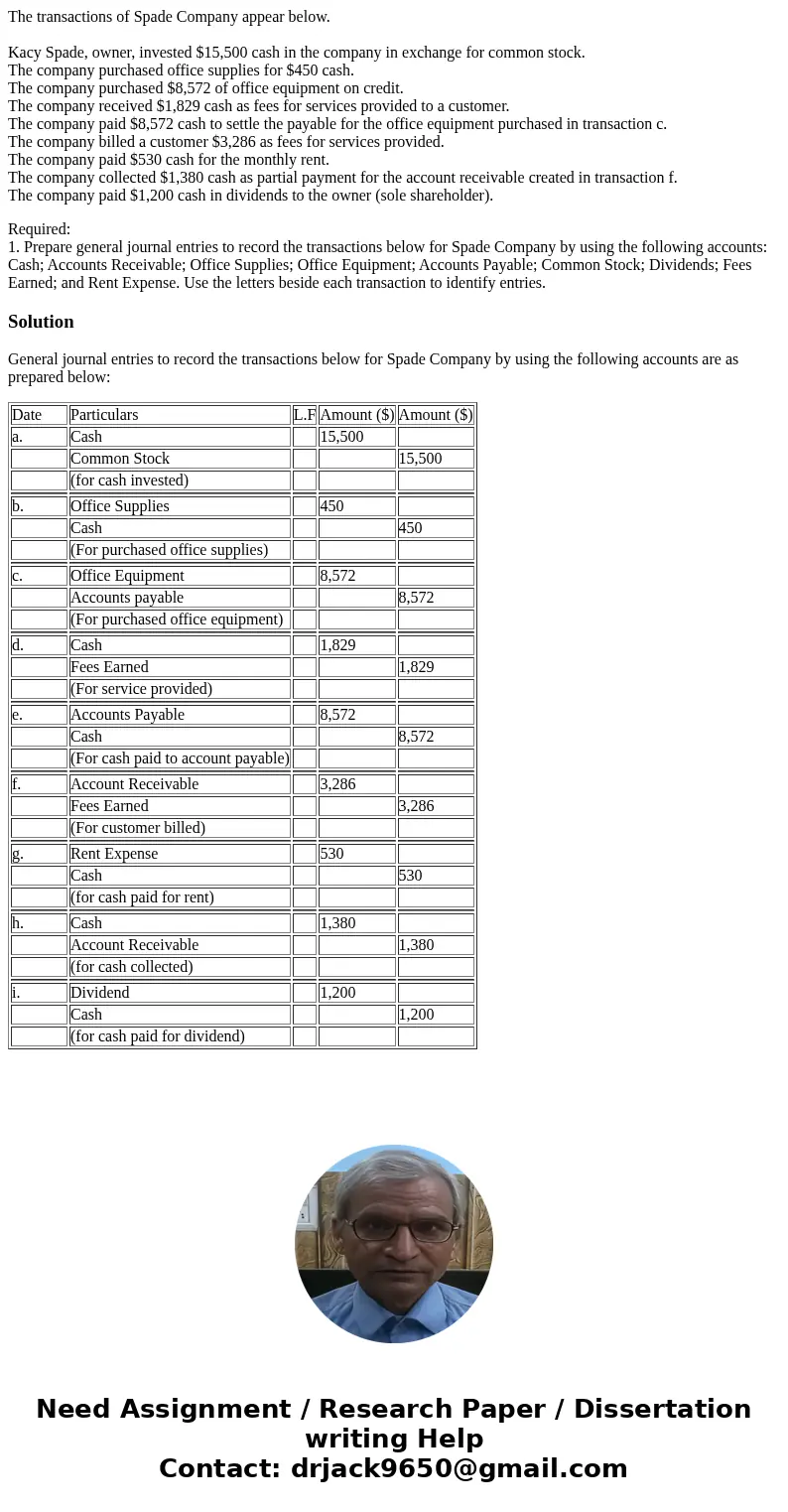

Solution

General journal entries to record the transactions below for Spade Company by using the following accounts are as prepared below:

| Date | Particulars | L.F | Amount ($) | Amount ($) |

| a. | Cash | 15,500 | ||

| Common Stock | 15,500 | |||

| (for cash invested) | ||||

| b. | Office Supplies | 450 | ||

| Cash | 450 | |||

| (For purchased office supplies) | ||||

| c. | Office Equipment | 8,572 | ||

| Accounts payable | 8,572 | |||

| (For purchased office equipment) | ||||

| d. | Cash | 1,829 | ||

| Fees Earned | 1,829 | |||

| (For service provided) | ||||

| e. | Accounts Payable | 8,572 | ||

| Cash | 8,572 | |||

| (For cash paid to account payable) | ||||

| f. | Account Receivable | 3,286 | ||

| Fees Earned | 3,286 | |||

| (For customer billed) | ||||

| g. | Rent Expense | 530 | ||

| Cash | 530 | |||

| (for cash paid for rent) | ||||

| h. | Cash | 1,380 | ||

| Account Receivable | 1,380 | |||

| (for cash collected) | ||||

| i. | Dividend | 1,200 | ||

| Cash | 1,200 | |||

| (for cash paid for dividend) |

Homework Sourse

Homework Sourse