nal ExamChapters 7111416 Time Remaining 130 minutes Back to

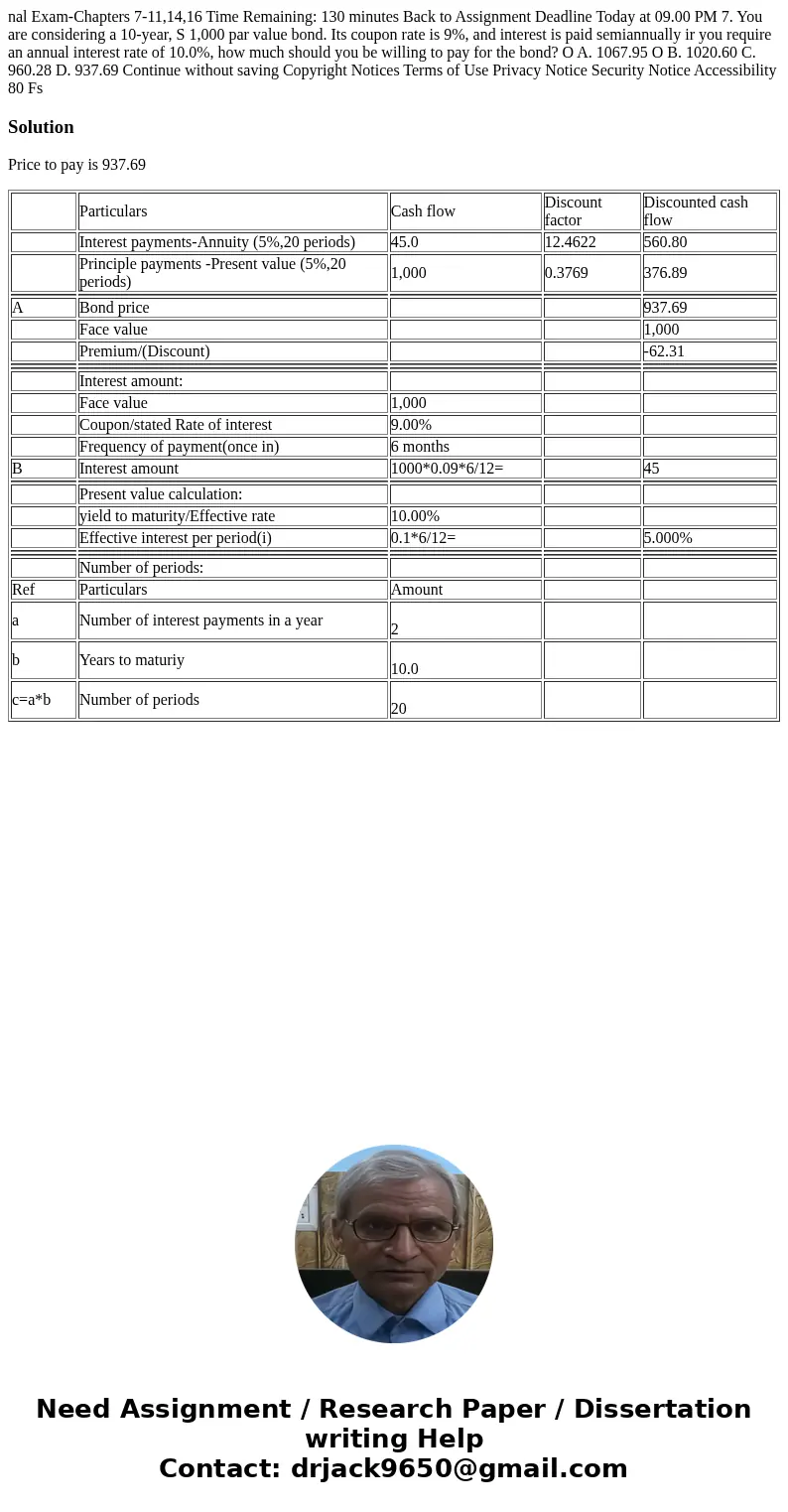

nal Exam-Chapters 7-11,14,16 Time Remaining: 130 minutes Back to Assignment Deadline Today at 09.00 PM 7. You are considering a 10-year, S 1,000 par value bond. Its coupon rate is 9%, and interest is paid semiannually ir you require an annual interest rate of 10.0%, how much should you be willing to pay for the bond? O A. 1067.95 O B. 1020.60 C. 960.28 D. 937.69 Continue without saving Copyright Notices Terms of Use Privacy Notice Security Notice Accessibility 80 Fs

Solution

Price to pay is 937.69

| Particulars | Cash flow | Discount factor | Discounted cash flow | |

| Interest payments-Annuity (5%,20 periods) | 45.0 | 12.4622 | 560.80 | |

| Principle payments -Present value (5%,20 periods) | 1,000 | 0.3769 | 376.89 | |

| A | Bond price | 937.69 | ||

| Face value | 1,000 | |||

| Premium/(Discount) | -62.31 | |||

| Interest amount: | ||||

| Face value | 1,000 | |||

| Coupon/stated Rate of interest | 9.00% | |||

| Frequency of payment(once in) | 6 months | |||

| B | Interest amount | 1000*0.09*6/12= | 45 | |

| Present value calculation: | ||||

| yield to maturity/Effective rate | 10.00% | |||

| Effective interest per period(i) | 0.1*6/12= | 5.000% | ||

| Number of periods: | ||||

| Ref | Particulars | Amount | ||

| a | Number of interest payments in a year | 2 | ||

| b | Years to maturiy | 10.0 | ||

| c=a*b | Number of periods | 20 |

Homework Sourse

Homework Sourse