EAST COAST LTD is evaluating projects that will not alter th

EAST COAST LTD. is evaluating projects that will not alter the risk of the firm. The financial manager has gathered the following data.

The firm can raise debt by selling $1000 par value, 8% coupon rate, 12-year bonds on which semi-annual interest payments are made. The bonds are selling at 108% of their par value.

Preferred Equity: The firm can sell $100 par value preferred shares with an 8% annual dividend. The market price is expected to be $67 per share.

Common Equity: The firm’s common shares currently sell for $75 per share. The most recent dividend paid by the common shares was $5.25 per share. The firm’s dividends have been growing at an annual rate of 6%, and this rate is expected to continue in the future.

The firm has the following target capital structure weights based on market values:

Debt 35%

Preferred Equity 25%

Common Equity 40%

EAST COAST has a marginal tax rate of 42%. (26 Marks)

Calculate the before-tax cost of debt. (7 Marks)

Calculate the cost of preferred shares. (4 Marks)

Calculate the cost of common equity. (6 Marks)

Calculate the WACC for the firm. (5 Marks)

Suppose this project was going to increase the risk of the company. Explain why or why not the rate you calculated in part (d) would be the appropriate discount rate. (4 marks)

PLEASE SHOW ALL WORK AND CALCULATIONS

Solution

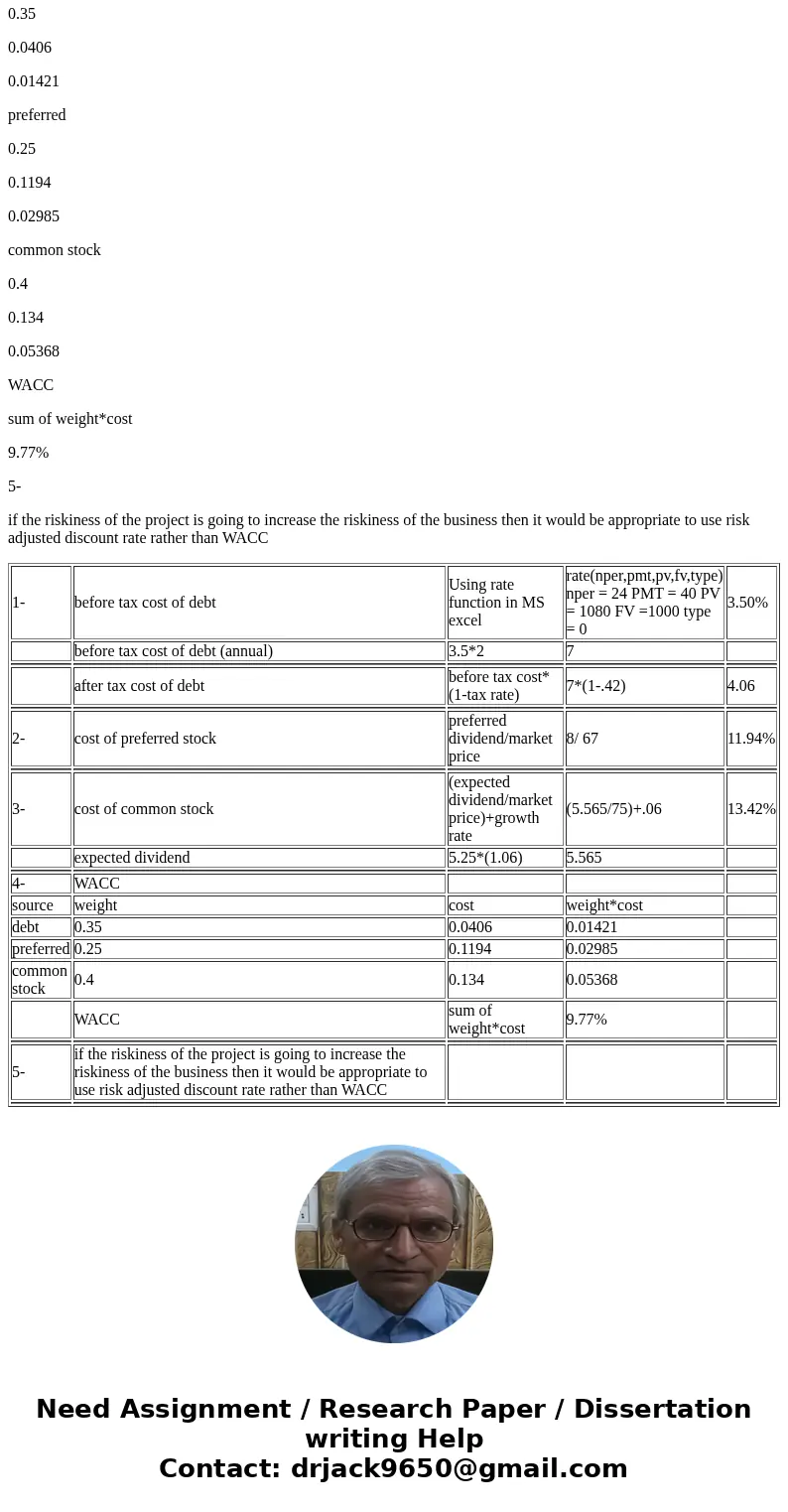

1-

before tax cost of debt

Using rate function in MS excel

rate(nper,pmt,pv,fv,type) nper = 24 PMT = 40 PV = 1080 FV =1000 type = 0

3.50%

before tax cost of debt (annual)

3.5*2

7

after tax cost of debt

before tax cost*(1-tax rate)

7*(1-.42)

4.06

2-

cost of preferred stock

preferred dividend/market price

8/ 67

11.94%

3-

cost of common stock

(expected dividend/market price)+growth rate

(5.565/75)+.06

13.42%

expected dividend

5.25*(1.06)

5.565

4-

WACC

source

weight

cost

weight*cost

debt

0.35

0.0406

0.01421

preferred

0.25

0.1194

0.02985

common stock

0.4

0.134

0.05368

WACC

sum of weight*cost

9.77%

5-

if the riskiness of the project is going to increase the riskiness of the business then it would be appropriate to use risk adjusted discount rate rather than WACC

| 1- | before tax cost of debt | Using rate function in MS excel | rate(nper,pmt,pv,fv,type) nper = 24 PMT = 40 PV = 1080 FV =1000 type = 0 | 3.50% |

| before tax cost of debt (annual) | 3.5*2 | 7 | ||

| after tax cost of debt | before tax cost*(1-tax rate) | 7*(1-.42) | 4.06 | |

| 2- | cost of preferred stock | preferred dividend/market price | 8/ 67 | 11.94% |

| 3- | cost of common stock | (expected dividend/market price)+growth rate | (5.565/75)+.06 | 13.42% |

| expected dividend | 5.25*(1.06) | 5.565 | ||

| 4- | WACC | |||

| source | weight | cost | weight*cost | |

| debt | 0.35 | 0.0406 | 0.01421 | |

| preferred | 0.25 | 0.1194 | 0.02985 | |

| common stock | 0.4 | 0.134 | 0.05368 | |

| WACC | sum of weight*cost | 9.77% | ||

| 5- | if the riskiness of the project is going to increase the riskiness of the business then it would be appropriate to use risk adjusted discount rate rather than WACC | |||

Homework Sourse

Homework Sourse