Exercise 1510 Salestype lease lessor balance sheet and incom

Exercise 15-10 Sales-type lease; lessor, balance sheet and income statemen On June 30, 2016, Georgia-Atlantic, Inc., leased a warehouse facility from Builders, Inc. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $468,683 over a 5-year lease term, payable each June 30 and December 31, with the first payment at June 30, 2016. Georgia-Atlantic\'s incremental borrowing rate is 10.0%, the same rate Builders used to calculate lease payment amounts. Builders constructed the warehouse at a cost of $3.3 million. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of S1) (Use appropriate factor(s) from the tables provided.) 1. Determine the price at which Builders is \'selling\" the warehouse (present value of the lease payments) at June 30, 2016. 2. What pretax amounts related to the lease would Builders report in its balance sheot at December 31, 2016? 3. What protax amounta rolated to the lease would Builders report in its incomo statement for the year ended December 31, 20167 0 Fs 2 3 4 6 IA/

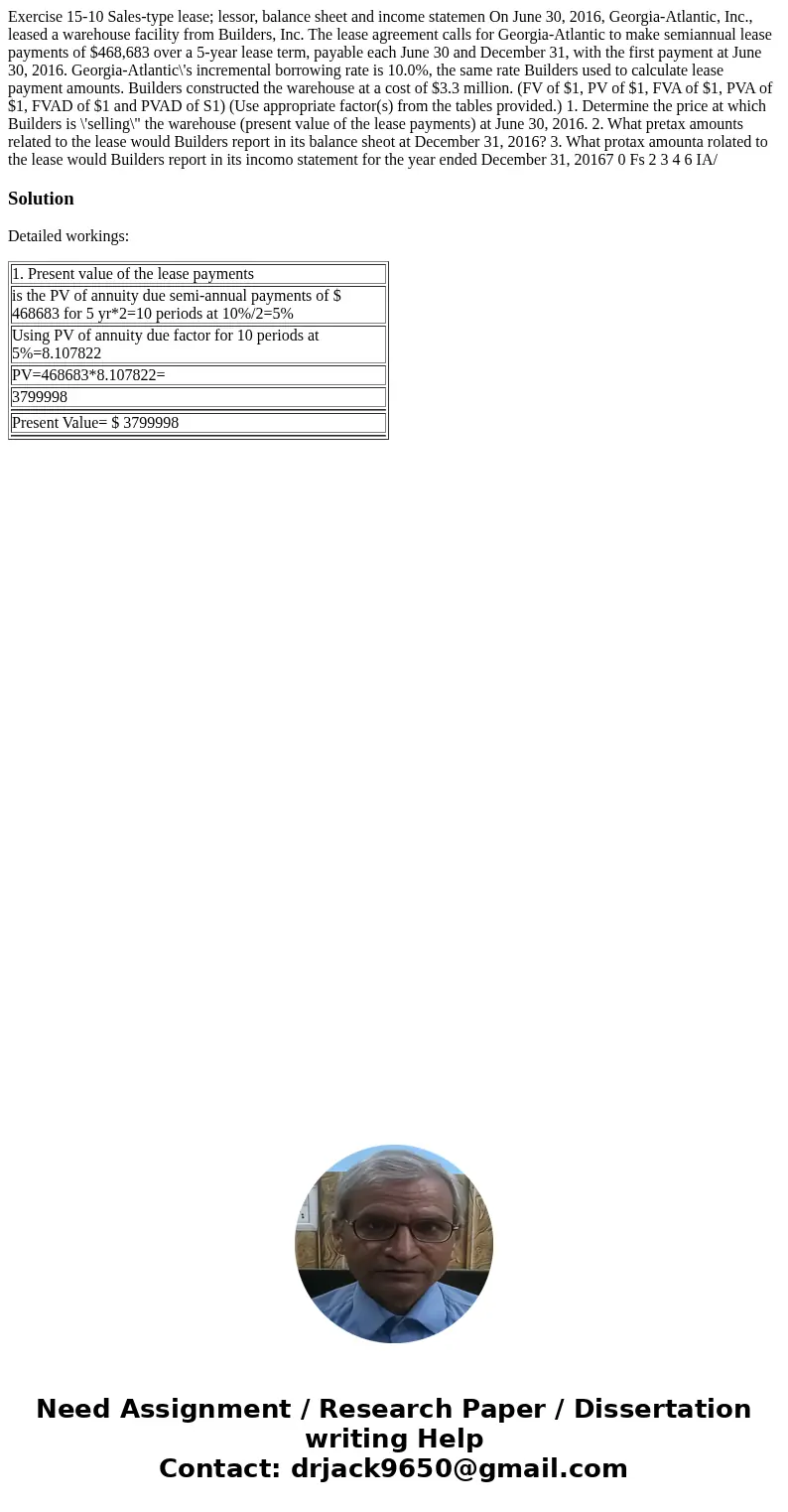

Solution

Detailed workings:

| 1. Present value of the lease payments |

| is the PV of annuity due semi-annual payments of $ 468683 for 5 yr*2=10 periods at 10%/2=5% |

| Using PV of annuity due factor for 10 periods at 5%=8.107822 |

| PV=468683*8.107822= |

| 3799998 |

| Present Value= $ 3799998 |

Homework Sourse

Homework Sourse