Jack Thyme opened Thyme Company a veterinary business on Aug

Jack Thyme opened Thyme Company, a veterinary business

on August 1, 2017. On August 31, the balance sheet showed Cash

$9,000; Accounts Receivable $1,700; Supplies $600; Equipment

$5,000; Accounts Payable $3,600; Common Stock $10,000; and

Retained Earnings $2,700. During September, the following

transactions occurred.

Sept. 2 Paid $3,400 cash for accounts payable due.

5 Received $1,200 from customers in payment of accounts

receivable.

8 Purchased additional office equipment for $5,100, paying

$1,000 in cash and the balance on account.

13 Performed services worth $10,600, of which $2,300 is paid

in cash and the balance is due in October.

17 Paid a $600 cash dividend.

22 Paid salaries $900, rent for September $1,100, and

advertising expense $250.

26 Incurred utility expenses for the month on account $220.

30 Received $5,000 from Ben Bank on a 6-month note

payable.

Instructions

(a) Prepare a tabular analysis of the September transactions

beginning with August 31 balances. The column headings should

be: Cash + Accounts Receivable + Supplies + Equipment = Notes

Payable + Accounts Payable + Common Stock + Retained

Earnings + Revenues – Expenses – Dividends. Include margin

explanations for any changes in Retained Earnings.

(b) Prepare an income statement for September, a retained earnings

statement for September, and a classified balance sheet at

September 30, 2017.

Analyze transactions

and prepare an income

statement, retained

earnings statement, and

balance sheet.

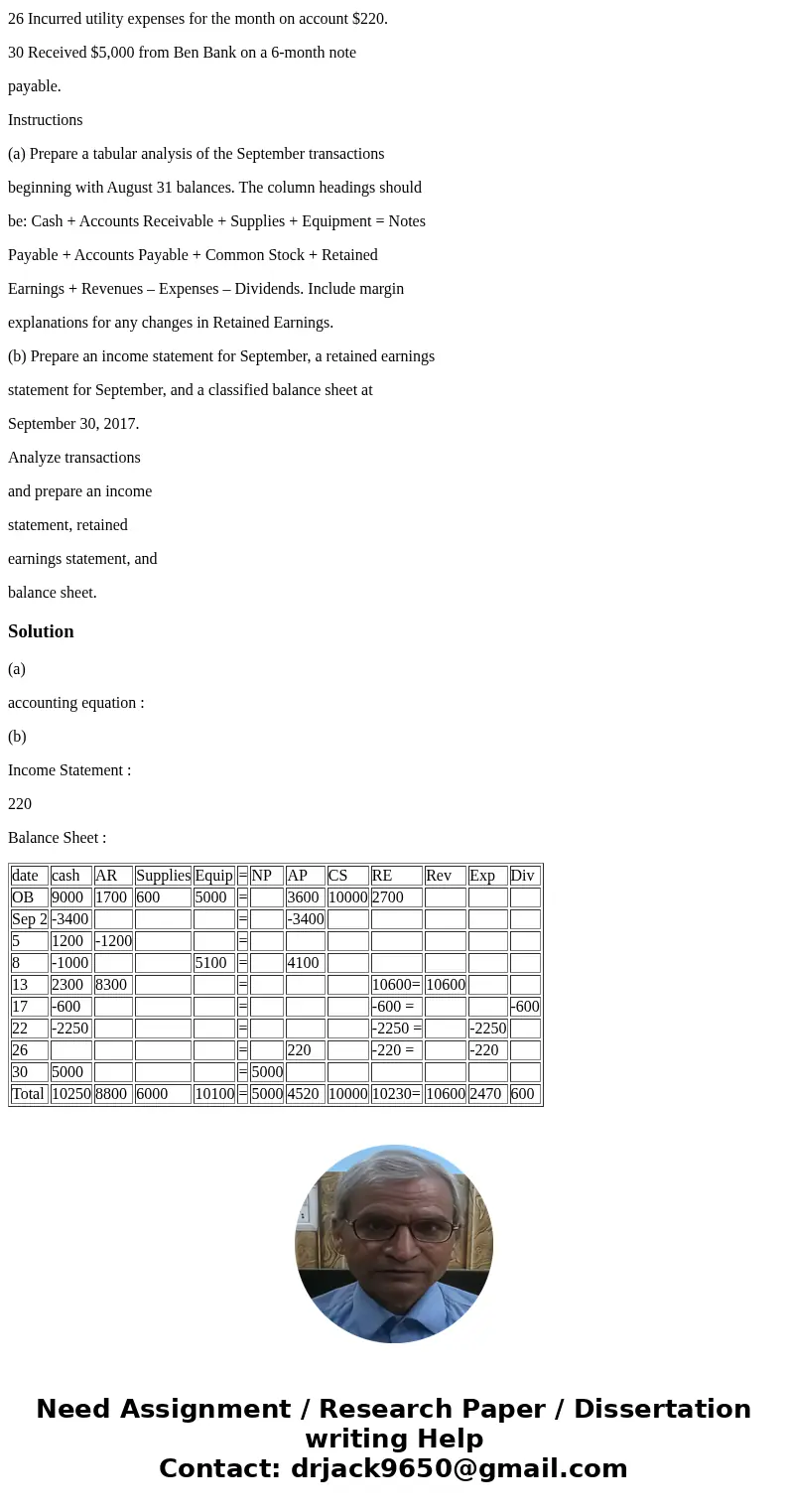

Solution

(a)

accounting equation :

(b)

Income Statement :

220

Balance Sheet :

| date | cash | AR | Supplies | Equip | = | NP | AP | CS | RE | Rev | Exp | Div |

| OB | 9000 | 1700 | 600 | 5000 | = | 3600 | 10000 | 2700 | ||||

| Sep 2 | -3400 | = | -3400 | |||||||||

| 5 | 1200 | -1200 | = | |||||||||

| 8 | -1000 | 5100 | = | 4100 | ||||||||

| 13 | 2300 | 8300 | = | 10600= | 10600 | |||||||

| 17 | -600 | = | -600 = | -600 | ||||||||

| 22 | -2250 | = | -2250 = | -2250 | ||||||||

| 26 | = | 220 | -220 = | -220 | ||||||||

| 30 | 5000 | = | 5000 | |||||||||

| Total | 10250 | 8800 | 6000 | 10100 | = | 5000 | 4520 | 10000 | 10230= | 10600 | 2470 | 600 |

Homework Sourse

Homework Sourse