A firm has established a revolving line of credit for 900000

A firm has established a revolving line of credit for $900,000 with a bank at a rate of prime plus 2%. There is an annual fee of 1/2% on any unused funds. Interest is discounted on loans. Prime was 5% when the agreement was made. Assume the firm decides to take down the line for $500,000 for 60 days when the prime is at 6%. What is the effective annual rate?

Solution

Revolving line of credit = $900,000

Bank rate = Prime + 2%

Annual fee on unused funds = 0.5%

Prime at the time of agreement = 5%

Amount the firm decides to take down the line = $500,000

Tenure = 60 days

Prime at the time of taking down the line = 6%

Interest rate on the funds taken by the firm = Prime + 2% = 6% + 2% = 8%

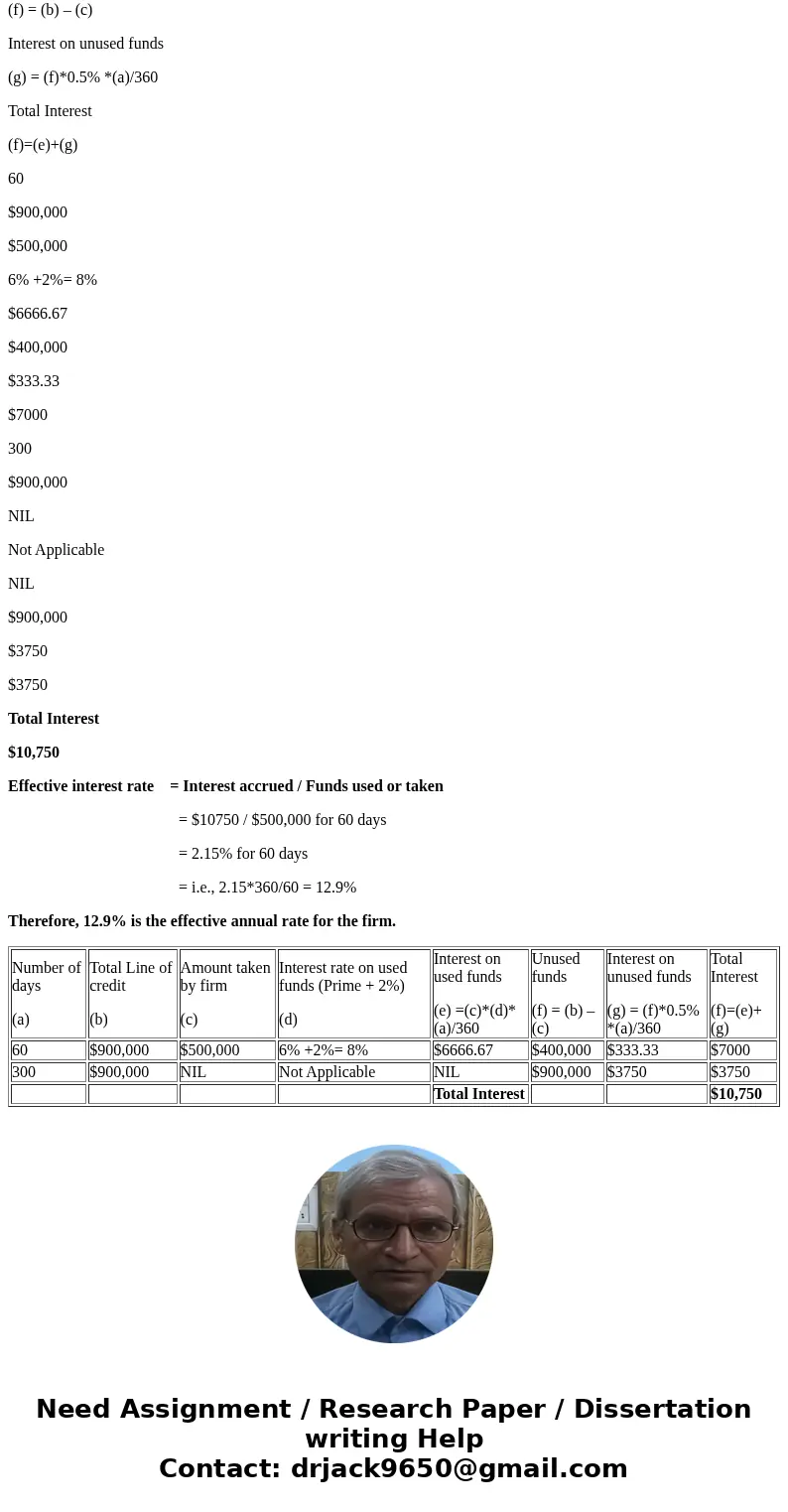

Number of days

(a)

Total Line of credit

(b)

Amount taken by firm

(c)

Interest rate on used funds (Prime + 2%)

(d)

Interest on used funds

(e) =(c)*(d)*(a)/360

Unused funds

(f) = (b) – (c)

Interest on unused funds

(g) = (f)*0.5% *(a)/360

Total Interest

(f)=(e)+(g)

60

$900,000

$500,000

6% +2%= 8%

$6666.67

$400,000

$333.33

$7000

300

$900,000

NIL

Not Applicable

NIL

$900,000

$3750

$3750

Total Interest

$10,750

Effective interest rate = Interest accrued / Funds used or taken

= $10750 / $500,000 for 60 days

= 2.15% for 60 days

= i.e., 2.15*360/60 = 12.9%

Therefore, 12.9% is the effective annual rate for the firm.

| Number of days (a) | Total Line of credit (b) | Amount taken by firm (c) | Interest rate on used funds (Prime + 2%) (d) | Interest on used funds (e) =(c)*(d)*(a)/360 | Unused funds (f) = (b) – (c) | Interest on unused funds (g) = (f)*0.5% *(a)/360 | Total Interest (f)=(e)+(g) |

| 60 | $900,000 | $500,000 | 6% +2%= 8% | $6666.67 | $400,000 | $333.33 | $7000 |

| 300 | $900,000 | NIL | Not Applicable | NIL | $900,000 | $3750 | $3750 |

| Total Interest | $10,750 |

Homework Sourse

Homework Sourse