You are given the following regression statistics sort of RB

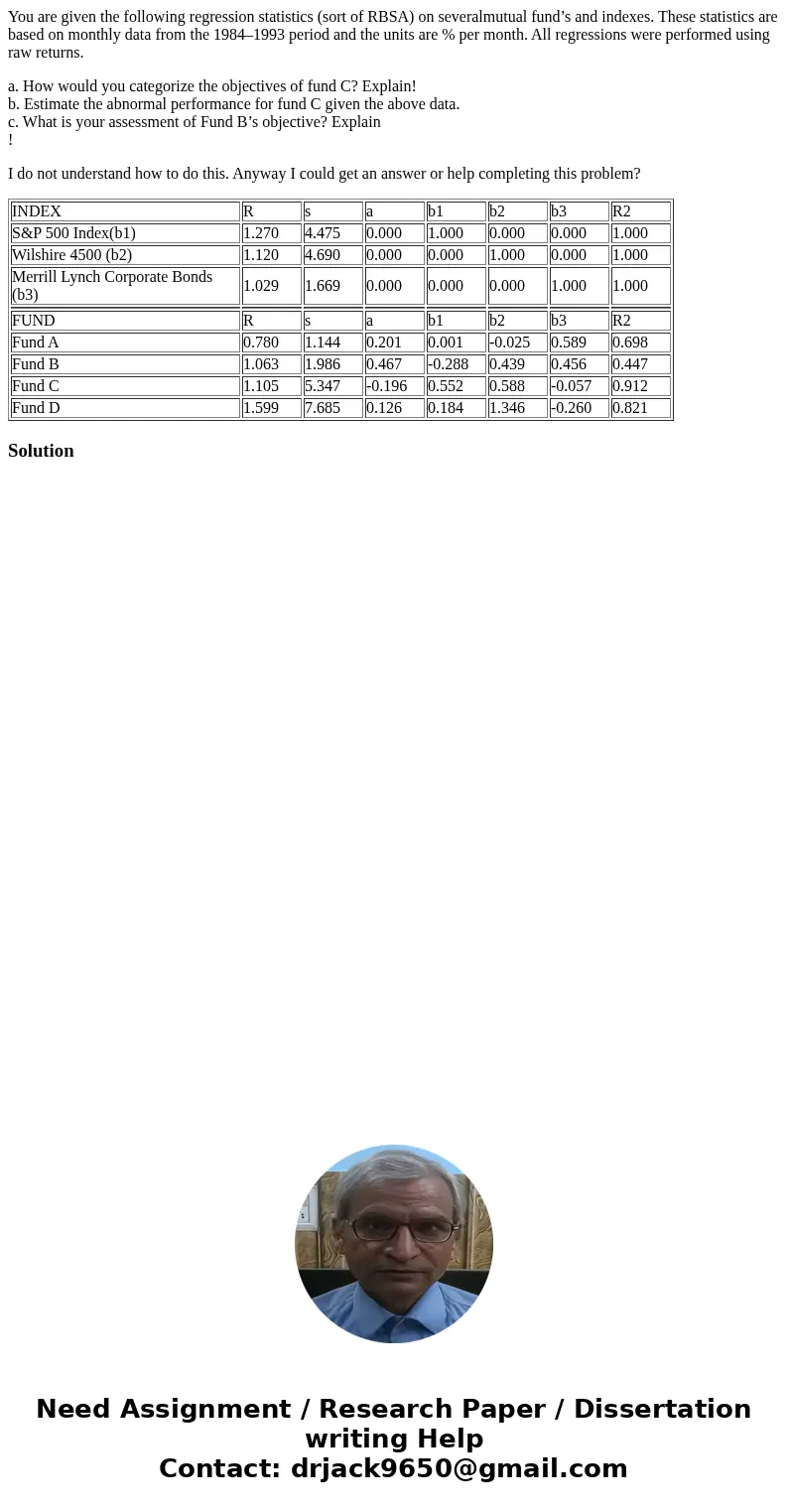

You are given the following regression statistics (sort of RBSA) on severalmutual fund’s and indexes. These statistics are based on monthly data from the 1984–1993 period and the units are % per month. All regressions were performed using raw returns.

a. How would you categorize the objectives of fund C? Explain!

b. Estimate the abnormal performance for fund C given the above data.

c. What is your assessment of Fund B’s objective? Explain

!

I do not understand how to do this. Anyway I could get an answer or help completing this problem?

| INDEX | R | s | a | b1 | b2 | b3 | R2 |

| S&P 500 Index(b1) | 1.270 | 4.475 | 0.000 | 1.000 | 0.000 | 0.000 | 1.000 |

| Wilshire 4500 (b2) | 1.120 | 4.690 | 0.000 | 0.000 | 1.000 | 0.000 | 1.000 |

| Merrill Lynch Corporate Bonds (b3) | 1.029 | 1.669 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 |

| FUND | R | s | a | b1 | b2 | b3 | R2 |

| Fund A | 0.780 | 1.144 | 0.201 | 0.001 | -0.025 | 0.589 | 0.698 |

| Fund B | 1.063 | 1.986 | 0.467 | -0.288 | 0.439 | 0.456 | 0.447 |

| Fund C | 1.105 | 5.347 | -0.196 | 0.552 | 0.588 | -0.057 | 0.912 |

| Fund D | 1.599 | 7.685 | 0.126 | 0.184 | 1.346 | -0.260 | 0.821 |

Solution

Homework Sourse

Homework Sourse