This Question 1 pt 19 of 30 0 complete This Test 30 pts pos

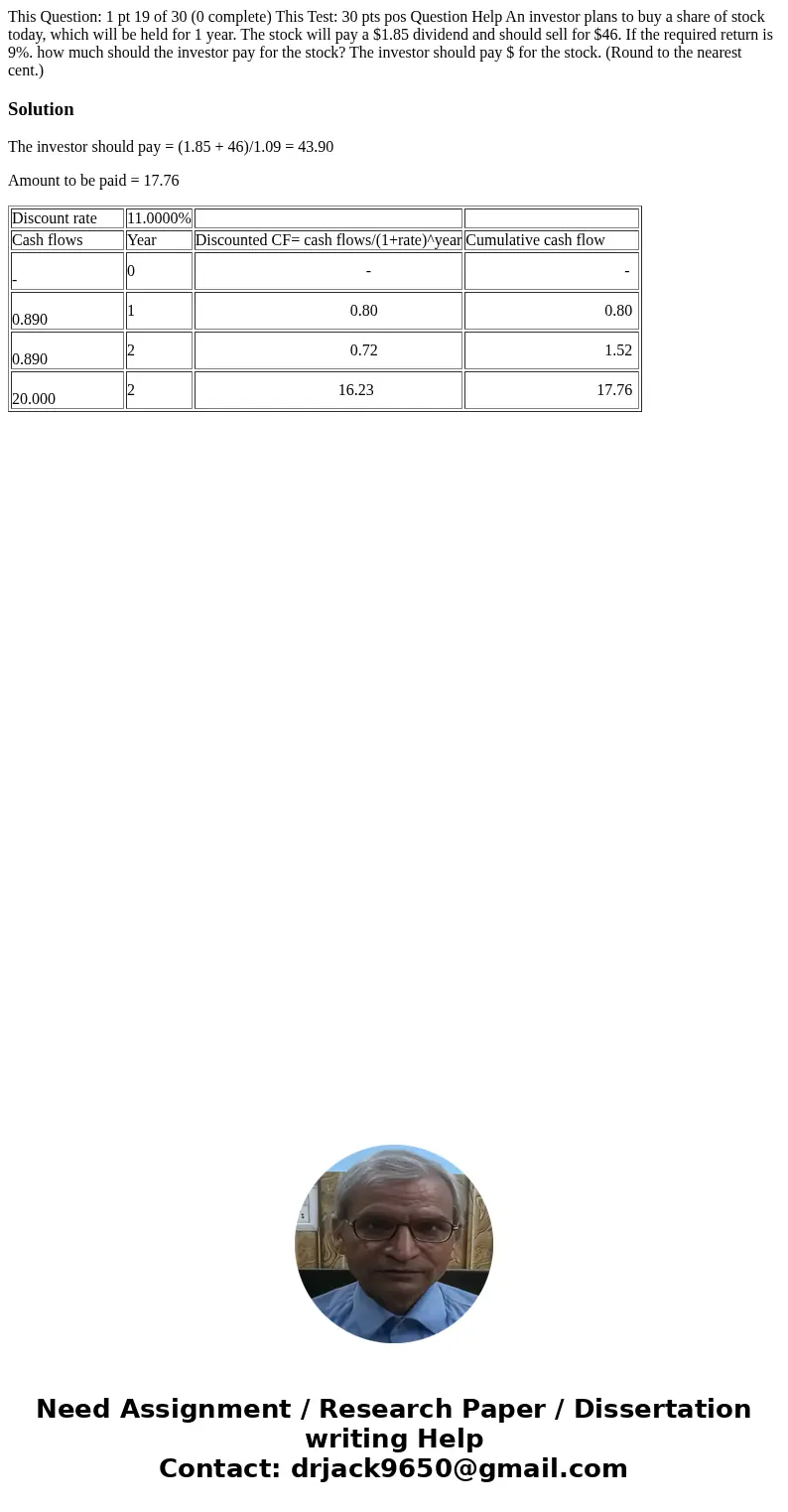

This Question: 1 pt 19 of 30 (0 complete) This Test: 30 pts pos Question Help An investor plans to buy a share of stock today, which will be held for 1 year. The stock will pay a $1.85 dividend and should sell for $46. If the required return is 9%. how much should the investor pay for the stock? The investor should pay $ for the stock. (Round to the nearest cent.)

Solution

The investor should pay = (1.85 + 46)/1.09 = 43.90

Amount to be paid = 17.76

| Discount rate | 11.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| - | 0 | - | - |

| 0.890 | 1 | 0.80 | 0.80 |

| 0.890 | 2 | 0.72 | 1.52 |

| 20.000 | 2 | 16.23 | 17.76 |

Homework Sourse

Homework Sourse