Time Value of MoneyThe Basics Compare some of the different

Solution

1 Given: Principal, Rate of Interest and number of years.

To Calculate : Future Value

Future Value = Principal* ( 1+rate in decimals)^number of years

1(a) Future Value ( FV) = 5000* ( 1+.1)^10

= 5000*(1.1)^10

=5000*2.5937425

Answer: =$12968.712

1 (b) Principal= $8000 Nos of years = 7 Interest = 8%

Using the same formula as above in 1(a)

FV= 8000*(1.08)^7= 8000*1.7138243

Answer: $13710.594

1(c) P= $ 775 Nos of years =12 Interest =12%

FV= 775*(1.12)^12= 775*3.895976

Answer: $ 3019.381

1(d) P= $21000 Nos of years = 5 Interest = 5%

FV= 21000*(1.05)^5

= 21000*1.2762816

Answer: $26801.91

3(a) Given: Inheritance amount = $20,000

If invested at 7% per nnum compounded annually, we need to calculate the number of years it will take to become $ 30,000.

Again using the formual stated in 1 above: Future Value = Principal* ( 1+rate in decimals)^number of years

=> 30,000= 20000(1.07)^x

=> 30000/20000= 1.07^x

=> 1.5= 1.07^x

We can find X by using log tables or excel or just multiplying 1.07by itself a number of times.

If we use the last method we find 1,07X1.07X1.07X1.071X1.07= 1.5

In other words it will take 5 years for $20,000 to become $30,000 when invested at 7% compounded annually.

3 (b) If we invested the $20000 at 7% compounded annually for 10.25 years

we get FV= 20000*(1.07)^10.25

= 20000*2.000708

= Answer: $40,014.16

3(c) In this case we need to find the number of years it will take for the $20,000 to grow to $ 30,000 if invested at 3% and if invested at 11%.

If invested at 3% : 30000= 20000*(1.03)^x or

30000/20000= 1.03^x

1.5= 1.03^x

This is roughly 15 years.

If invested at 11%

it will be 1.5= 1.11^x

This is roughly 4 years.

Ans 3(d) All this tells us that when we invest at a higher rate and for a longer period of time the future value gets increased many times. This is the compounding effect of money. Higher the interest rate or higher the period of investment or both will result in higher returns.

The trick here is in calculating the exponential value. You can use Log tables ( learnt from maths) or a calculator or excel or intutively as well by manually multiplying that many number of times to get an answer.

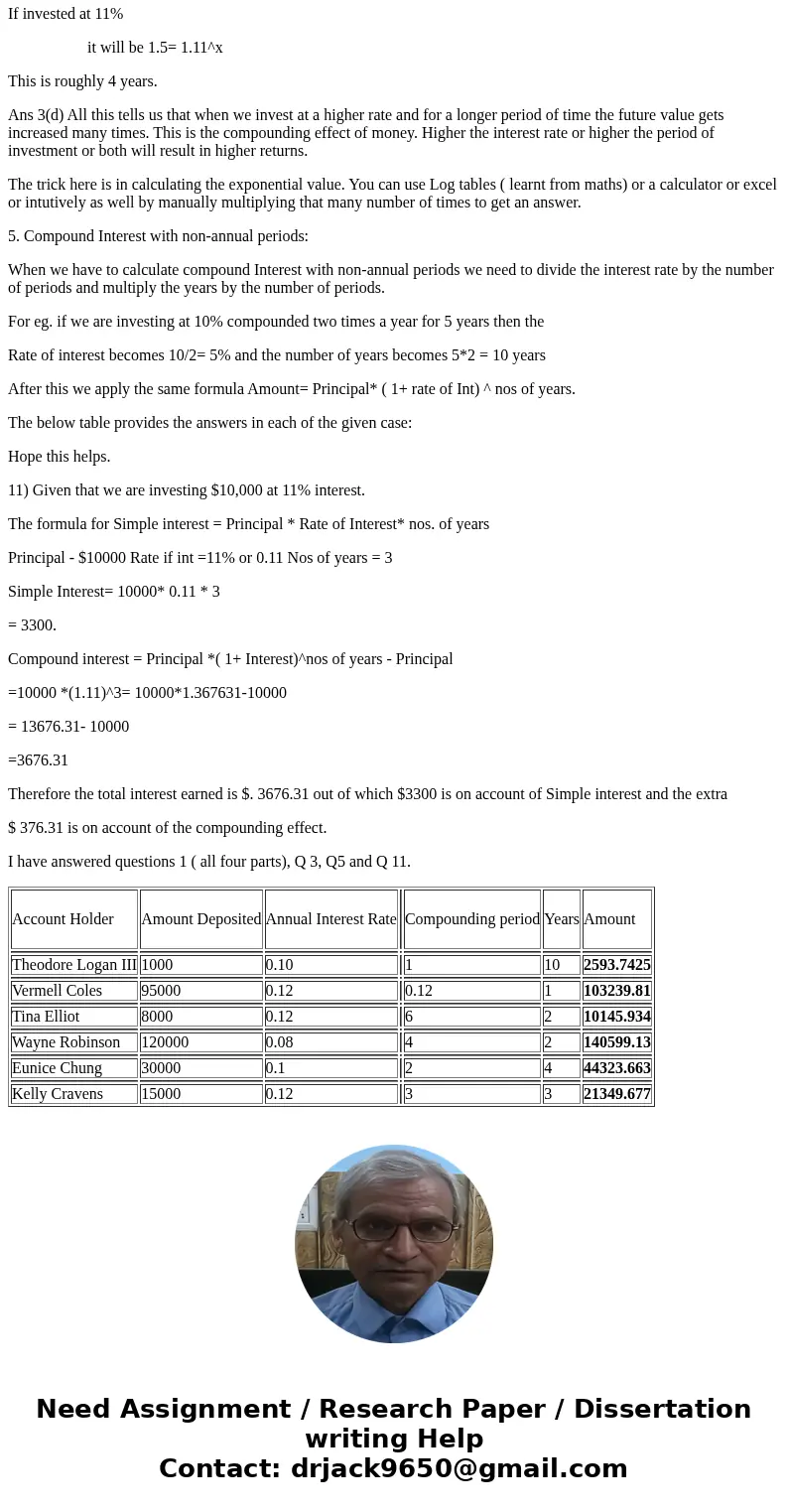

5. Compound Interest with non-annual periods:

When we have to calculate compound Interest with non-annual periods we need to divide the interest rate by the number of periods and multiply the years by the number of periods.

For eg. if we are investing at 10% compounded two times a year for 5 years then the

Rate of interest becomes 10/2= 5% and the number of years becomes 5*2 = 10 years

After this we apply the same formula Amount= Principal* ( 1+ rate of Int) ^ nos of years.

The below table provides the answers in each of the given case:

Hope this helps.

11) Given that we are investing $10,000 at 11% interest.

The formula for Simple interest = Principal * Rate of Interest* nos. of years

Principal - $10000 Rate if int =11% or 0.11 Nos of years = 3

Simple Interest= 10000* 0.11 * 3

= 3300.

Compound interest = Principal *( 1+ Interest)^nos of years - Principal

=10000 *(1.11)^3= 10000*1.367631-10000

= 13676.31- 10000

=3676.31

Therefore the total interest earned is $. 3676.31 out of which $3300 is on account of Simple interest and the extra

$ 376.31 is on account of the compounding effect.

I have answered questions 1 ( all four parts), Q 3, Q5 and Q 11.

| Account Holder | Amount Deposited | Annual Interest Rate | Compounding period | Years | Amount | |

| Theodore Logan III | 1000 | 0.10 | 1 | 10 | 2593.7425 | |

| Vermell Coles | 95000 | 0.12 | 0.12 | 1 | 103239.81 | |

| Tina Elliot | 8000 | 0.12 | 6 | 2 | 10145.934 | |

| Wayne Robinson | 120000 | 0.08 | 4 | 2 | 140599.13 | |

| Eunice Chung | 30000 | 0.1 | 2 | 4 | 44323.663 | |

| Kelly Cravens | 15000 | 0.12 | 3 | 3 | 21349.677 |

Homework Sourse

Homework Sourse