Delph Company uses a joborder costing system and has two man

Delph Company uses a job-order costing system and has two manufacturing departments-Molding and Fabrication. The company provided the following estimates at the beginning of the year: Total 64,000 Molding Fabrication Machine-hours Fixed manufacturing overhead costs Variable manufacturing overhead cost per machine-hour 37,000 790,000 270,000 $1,060,000 27,000 $5.50 5.50 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs- Job D-70 and Job C-200. It provided the following information related to those two jobs: Job D-70: Direct materials cost 373,000 Direct labor cost Machine-hours Molding Fabrication Total 702,000 $ 210,000 120,000 330,000 27,000 329,000 20,000 7,000 Molding Fabrication Total Job C-200: Direct materials cost 270,000 Direct labor cost Machine-hours 520,000 $ 140,000230,000 370,000 37,000 250,000 7,000 30,000 Delph had no underapplied or overapplied manufacturing overhead during the year

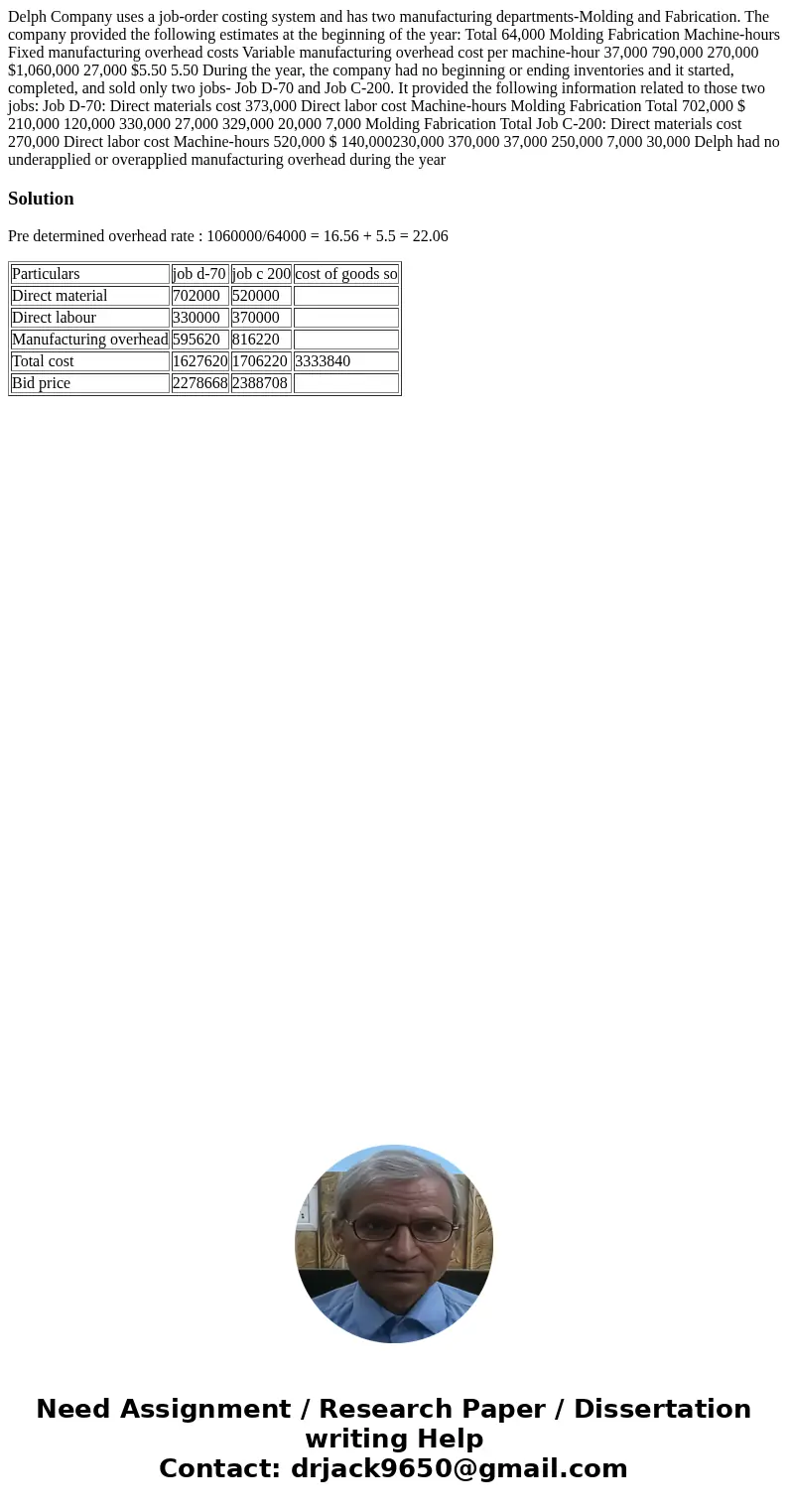

Solution

Pre determined overhead rate : 1060000/64000 = 16.56 + 5.5 = 22.06

| Particulars | job d-70 | job c 200 | cost of goods so |

| Direct material | 702000 | 520000 | |

| Direct labour | 330000 | 370000 | |

| Manufacturing overhead | 595620 | 816220 | |

| Total cost | 1627620 | 1706220 | 3333840 |

| Bid price | 2278668 | 2388708 |

Homework Sourse

Homework Sourse