IRR Project L costs 5771046 its expected cash inflows are 14

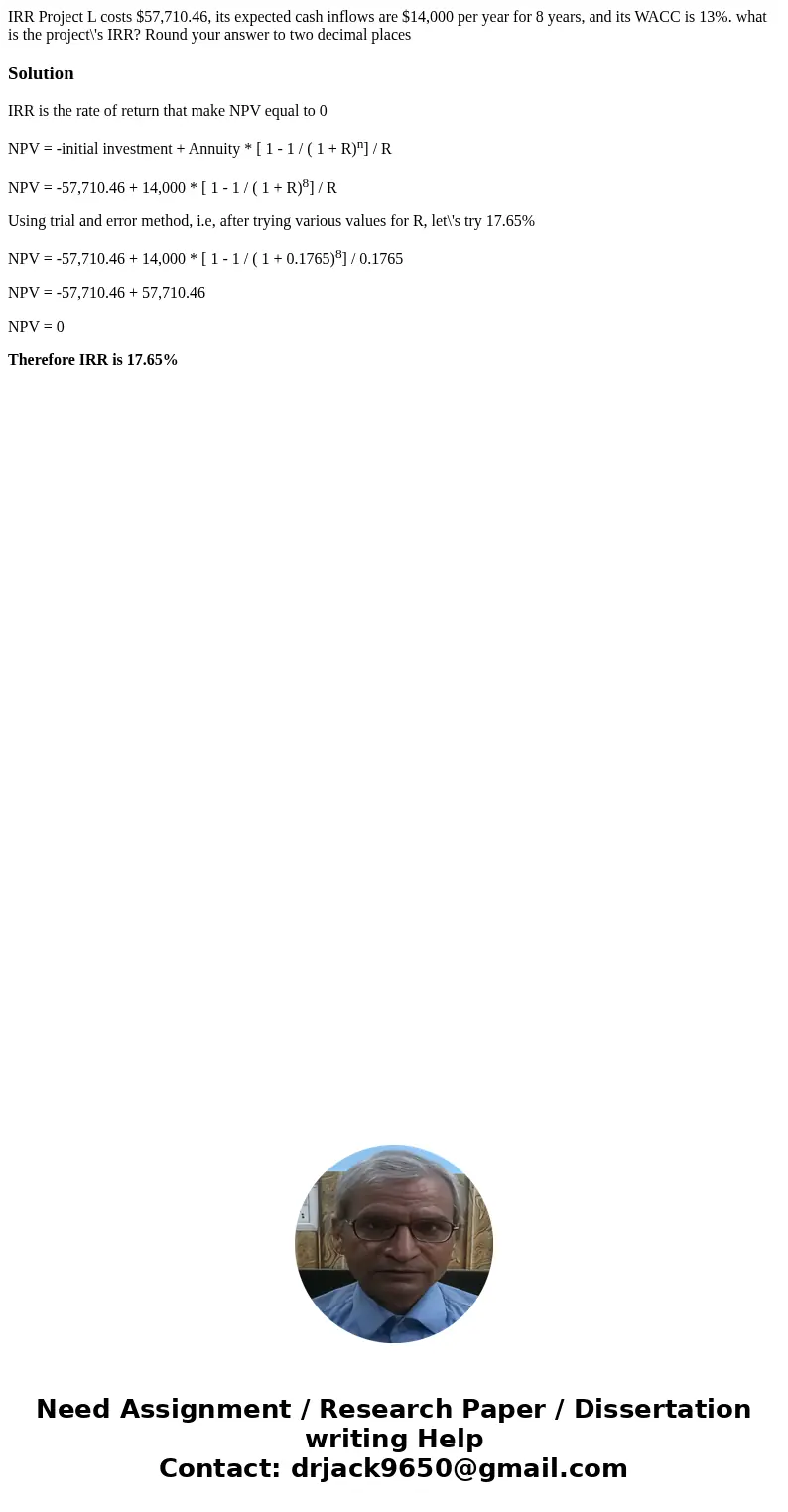

IRR Project L costs $57,710.46, its expected cash inflows are $14,000 per year for 8 years, and its WACC is 13%. what is the project\'s IRR? Round your answer to two decimal places

Solution

IRR is the rate of return that make NPV equal to 0

NPV = -initial investment + Annuity * [ 1 - 1 / ( 1 + R)n] / R

NPV = -57,710.46 + 14,000 * [ 1 - 1 / ( 1 + R)8] / R

Using trial and error method, i.e, after trying various values for R, let\'s try 17.65%

NPV = -57,710.46 + 14,000 * [ 1 - 1 / ( 1 + 0.1765)8] / 0.1765

NPV = -57,710.46 + 57,710.46

NPV = 0

Therefore IRR is 17.65%

Homework Sourse

Homework Sourse