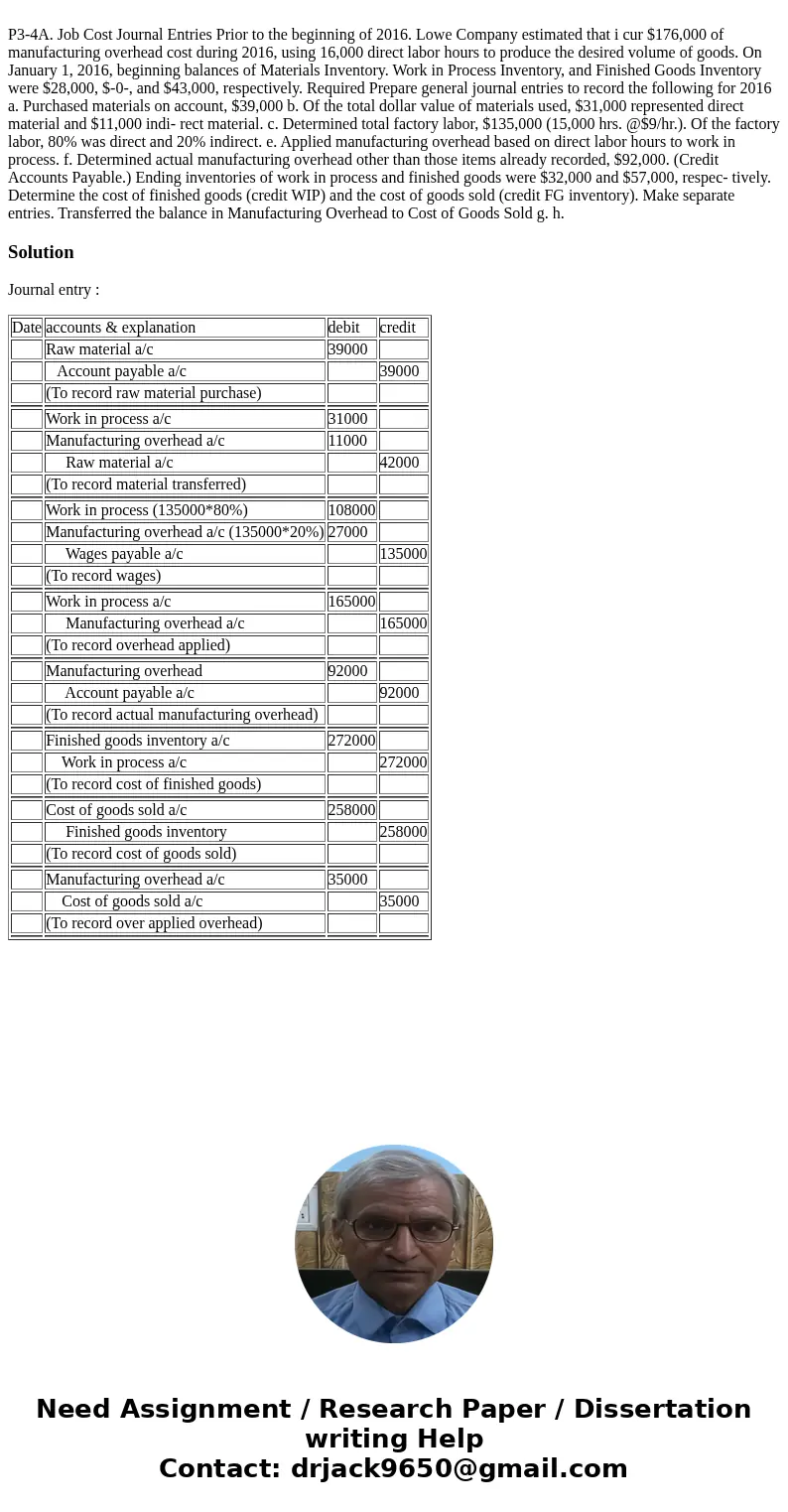

P3-4A. Job Cost Journal Entries Prior to the beginning of 2016. Lowe Company estimated that i cur $176,000 of manufacturing overhead cost during 2016, using 16,000 direct labor hours to produce the desired volume of goods. On January 1, 2016, beginning balances of Materials Inventory. Work in Process Inventory, and Finished Goods Inventory were $28,000, $-0-, and $43,000, respectively. Required Prepare general journal entries to record the following for 2016 a. Purchased materials on account, $39,000 b. Of the total dollar value of materials used, $31,000 represented direct material and $11,000 indi- rect material. c. Determined total factory labor, $135,000 (15,000 hrs. @$9/hr.). Of the factory labor, 80% was direct and 20% indirect. e. Applied manufacturing overhead based on direct labor hours to work in process. f. Determined actual manufacturing overhead other than those items already recorded, $92,000. (Credit Accounts Payable.) Ending inventories of work in process and finished goods were $32,000 and $57,000, respec- tively. Determine the cost of finished goods (credit WIP) and the cost of goods sold (credit FG inventory). Make separate entries. Transferred the balance in Manufacturing Overhead to Cost of Goods Sold g. h.

Journal entry :

| Date | accounts & explanation | debit | credit |

| Raw material a/c | 39000 | |

| Account payable a/c | | 39000 |

| (To record raw material purchase) | | |

| | | |

| Work in process a/c | 31000 | |

| Manufacturing overhead a/c | 11000 | |

| Raw material a/c | | 42000 |

| (To record material transferred) | | |

| | | |

| Work in process (135000*80%) | 108000 | |

| Manufacturing overhead a/c (135000*20%) | 27000 | |

| Wages payable a/c | | 135000 |

| (To record wages) | | |

| | | |

| Work in process a/c | 165000 | |

| Manufacturing overhead a/c | | 165000 |

| (To record overhead applied) | | |

| | | |

| Manufacturing overhead | 92000 | |

| Account payable a/c | | 92000 |

| (To record actual manufacturing overhead) | | |

| | | |

| Finished goods inventory a/c | 272000 | |

| Work in process a/c | | 272000 |

| (To record cost of finished goods) | | |

| | | |

| Cost of goods sold a/c | 258000 | |

| Finished goods inventory | | 258000 |

| (To record cost of goods sold) | | |

| | | |

| Manufacturing overhead a/c | 35000 | |

| Cost of goods sold a/c | | 35000 |

| (To record over applied overhead) | | |

| | | |

Homework Sourse

Homework Sourse