ngcengagecom e wwwi hotmiamis supporttu MyUSF Module 5 MindT

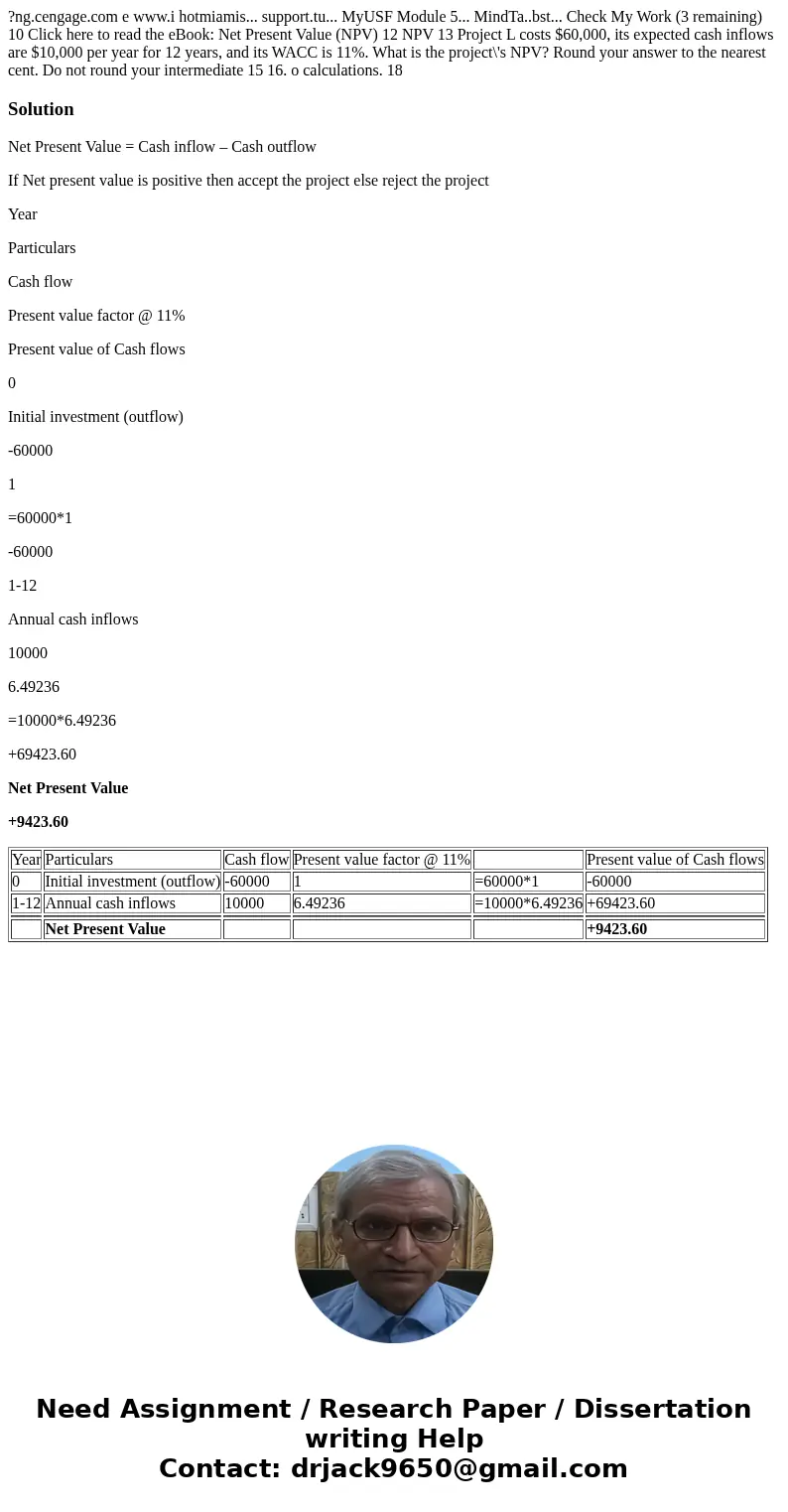

?ng.cengage.com e www.i hotmiamis... support.tu... MyUSF Module 5... MindTa..bst... Check My Work (3 remaining) 10 Click here to read the eBook: Net Present Value (NPV) 12 NPV 13 Project L costs $60,000, its expected cash inflows are $10,000 per year for 12 years, and its WACC is 11%. What is the project\'s NPV? Round your answer to the nearest cent. Do not round your intermediate 15 16. o calculations. 18

Solution

Net Present Value = Cash inflow – Cash outflow

If Net present value is positive then accept the project else reject the project

Year

Particulars

Cash flow

Present value factor @ 11%

Present value of Cash flows

0

Initial investment (outflow)

-60000

1

=60000*1

-60000

1-12

Annual cash inflows

10000

6.49236

=10000*6.49236

+69423.60

Net Present Value

+9423.60

| Year | Particulars | Cash flow | Present value factor @ 11% | Present value of Cash flows | |

| 0 | Initial investment (outflow) | -60000 | 1 | =60000*1 | -60000 |

| 1-12 | Annual cash inflows | 10000 | 6.49236 | =10000*6.49236 | +69423.60 |

| Net Present Value | +9423.60 |

Homework Sourse

Homework Sourse