322 Allen Young has always been proud of his personal invest

3-22 Allen Young has always been proud of his personal

investment strategies and has done very well over

the past several years. He invests primarily in the

stock market. Over the past several months, however,

Allen has become very concerned about the

stock market as a good investment. In some cases it

would have been better for Allen to have his money

in a bank than in the market. During the next year,

Allen must decide whether to invest $10,000 in the

stock market or in a certificate of deposit (CD) at an

interest rate of 9%. If the market is good, Allen

believes that he could get a 14% return on his

money. With a fair market, he expects to get an 8%

return. If the market is bad, he will most likely get

no return at all—in other words, the return would be

0%. Allen estimates that the probability of a good

market is 0.4, the probability of a fair market is 0.4,

and the probability of a bad market is 0.2, and he

wishes to maximize his long-run average return.

(a) Develop a decision table for this problem.

(b) What is the best decision?

----------------

In Problem 3-22 you helped Allen Young determine the best investment strategy. Now, Young is thinking about paying for a stock market newsletter. A friend of Young said that these types of letters could predict very accurately whether the market would be good, fair, or poor. Then, based on these predictions, Allen could make better investment decisions. (a) What is the most that Allen would be willing to pay for a newsletter? (b) Young now believes that a good market will give a return of only 11% instead of 14%. Will this information change the amount that Allen would be willing to pay for the newsletter? If your answer is yes, determine the most that Allen would be willing to pay, given this new information.

Solution

(a)

Expected return

( 0.4*14+0.4*8+0.2*0)%

=8.8%

(b)

Depositing in a bank is a better decision as the expected return from the stock market is 8.8% of the amount $10,000, while the bank offers 9% return on the same amount.

(c)

If Allen has access to the newsletter, he would invets only in case of good market (as predicted by the newsletter).

P(good market)=0.4

P(market is fair or bad)=1-0.4=0.6

Expected return= (0.4*14+0.6*9)% of $10,000=(0.4*14+0.6*9)*100=1100

When he has no access to any such newsletter, he deposits the money in a bank (as seen in part (b)). Expected return in this scenario is 9% of $10,000=900

Hence, he would spend atmost $200 on the newsletter.

(d)

If the good market return was 11% instead of 14%

Expected return (with access to the newsletter)=(0.4*11+0.6*9)% of $10,000=$980

Hence, he would pay atmost $80 in this case.

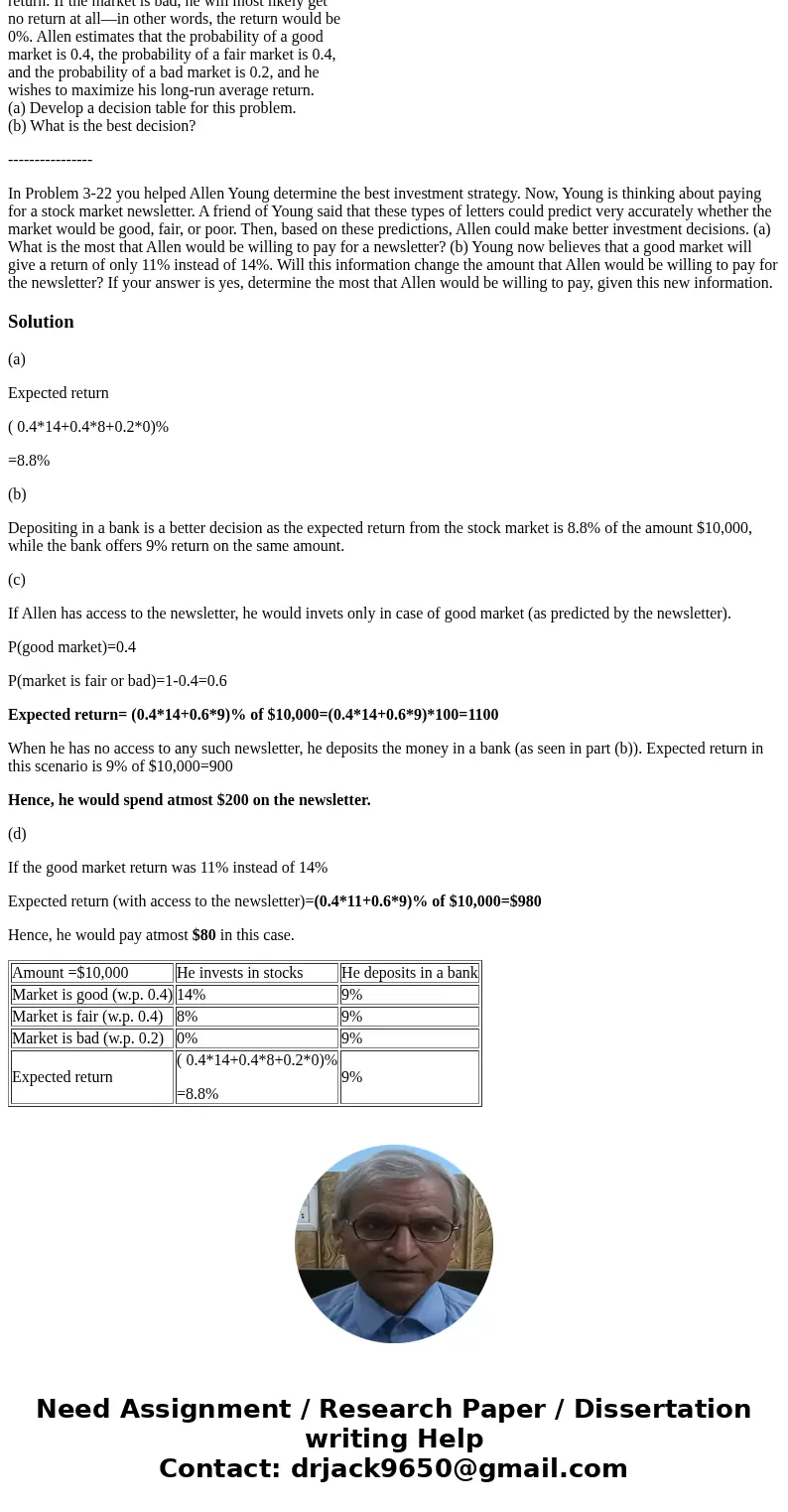

| Amount =$10,000 | He invests in stocks | He deposits in a bank |

| Market is good (w.p. 0.4) | 14% | 9% |

| Market is fair (w.p. 0.4) | 8% | 9% |

| Market is bad (w.p. 0.2) | 0% | 9% |

| Expected return | ( 0.4*14+0.4*8+0.2*0)% =8.8% | 9% |

Homework Sourse

Homework Sourse