Dook Show Me How Calcuiator ost Concept n March 31 Higgins R

Solution

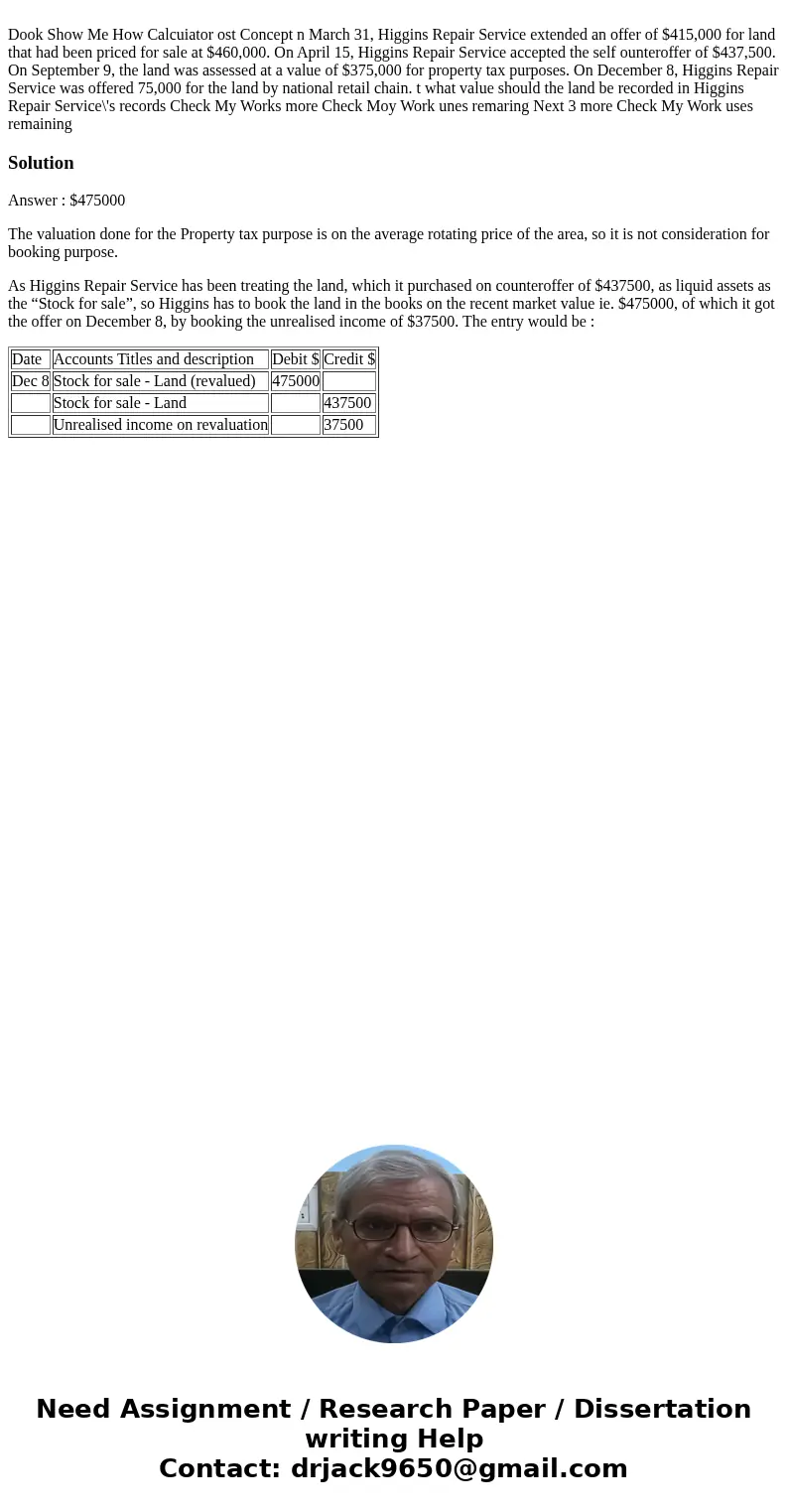

Answer : $475000

The valuation done for the Property tax purpose is on the average rotating price of the area, so it is not consideration for booking purpose.

As Higgins Repair Service has been treating the land, which it purchased on counteroffer of $437500, as liquid assets as the “Stock for sale”, so Higgins has to book the land in the books on the recent market value ie. $475000, of which it got the offer on December 8, by booking the unrealised income of $37500. The entry would be :

| Date | Accounts Titles and description | Debit $ | Credit $ |

| Dec 8 | Stock for sale - Land (revalued) | 475000 | |

| Stock for sale - Land | 437500 | ||

| Unrealised income on revaluation | 37500 |

Homework Sourse

Homework Sourse