Check my work 8 One of two alternatives will be selected to

Solution

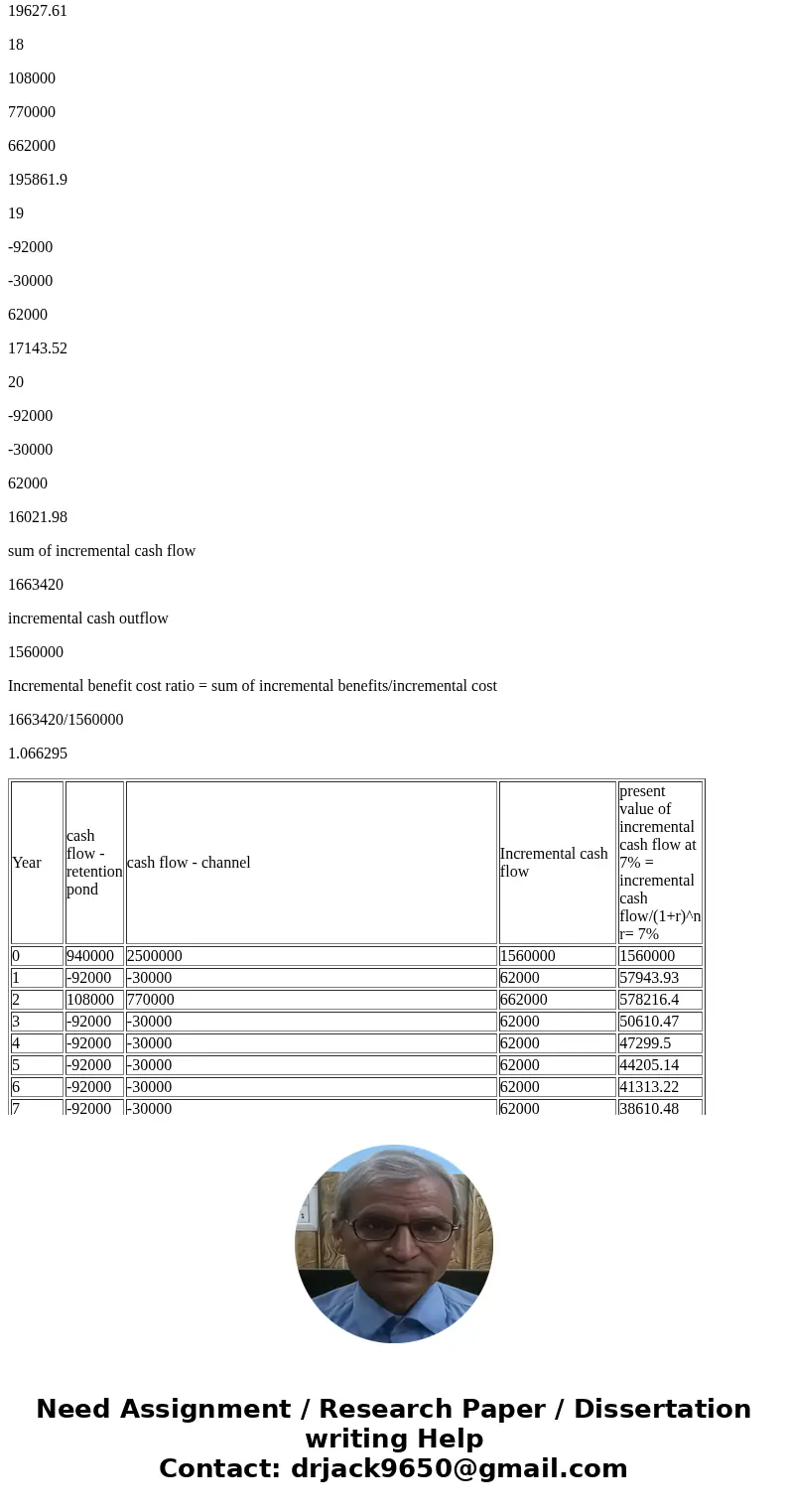

Year

cash flow -retention pond

cash flow - channel

Incremental cash flow

present value of incremental cash flow at 7% = incremental cash flow/(1+r)^n r= 7%

0

940000

2500000

1560000

1560000

1

-92000

-30000

62000

57943.93

2

108000

770000

662000

578216.4

3

-92000

-30000

62000

50610.47

4

-92000

-30000

62000

47299.5

5

-92000

-30000

62000

44205.14

6

-92000

-30000

62000

41313.22

7

-92000

-30000

62000

38610.48

8

-92000

-30000

62000

36084.56

9

-92000

-30000

62000

33723.89

10

108000

770000

662000

336527.2

11

-92000

-30000

62000

29455.75

12

-92000

-30000

62000

27528.74

13

-92000

-30000

62000

25727.8

14

-92000

-30000

62000

24044.67

15

-92000

-30000

62000

22471.65

16

-92000

-30000

62000

21001.55

17

-92000

-30000

62000

19627.61

18

108000

770000

662000

195861.9

19

-92000

-30000

62000

17143.52

20

-92000

-30000

62000

16021.98

sum of incremental cash flow

1663420

incremental cash outflow

1560000

Incremental benefit cost ratio = sum of incremental benefits/incremental cost

1663420/1560000

1.066295

| Year | cash flow -retention pond | cash flow - channel | Incremental cash flow | present value of incremental cash flow at 7% = incremental cash flow/(1+r)^n r= 7% |

| 0 | 940000 | 2500000 | 1560000 | 1560000 |

| 1 | -92000 | -30000 | 62000 | 57943.93 |

| 2 | 108000 | 770000 | 662000 | 578216.4 |

| 3 | -92000 | -30000 | 62000 | 50610.47 |

| 4 | -92000 | -30000 | 62000 | 47299.5 |

| 5 | -92000 | -30000 | 62000 | 44205.14 |

| 6 | -92000 | -30000 | 62000 | 41313.22 |

| 7 | -92000 | -30000 | 62000 | 38610.48 |

| 8 | -92000 | -30000 | 62000 | 36084.56 |

| 9 | -92000 | -30000 | 62000 | 33723.89 |

| 10 | 108000 | 770000 | 662000 | 336527.2 |

| 11 | -92000 | -30000 | 62000 | 29455.75 |

| 12 | -92000 | -30000 | 62000 | 27528.74 |

| 13 | -92000 | -30000 | 62000 | 25727.8 |

| 14 | -92000 | -30000 | 62000 | 24044.67 |

| 15 | -92000 | -30000 | 62000 | 22471.65 |

| 16 | -92000 | -30000 | 62000 | 21001.55 |

| 17 | -92000 | -30000 | 62000 | 19627.61 |

| 18 | 108000 | 770000 | 662000 | 195861.9 |

| 19 | -92000 | -30000 | 62000 | 17143.52 |

| 20 | -92000 | -30000 | 62000 | 16021.98 |

| sum of incremental cash flow | 1663420 | |||

| incremental cash outflow | 1560000 | |||

| Incremental benefit cost ratio = sum of incremental benefits/incremental cost | 1663420/1560000 | 1.066295 |

Homework Sourse

Homework Sourse