AutoSave oFF Chapter 5 Homework Q Search Sheet Homc Insert P

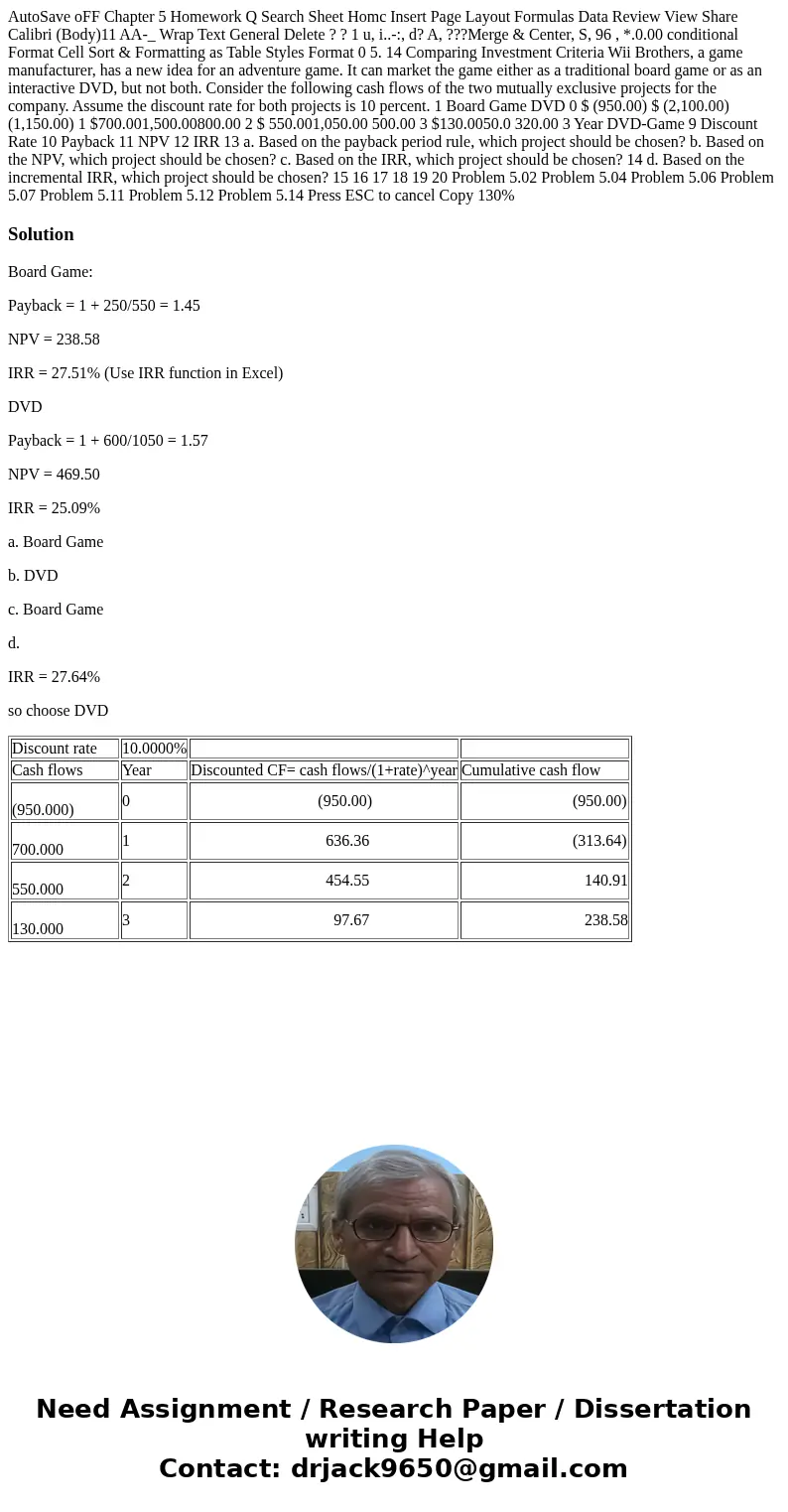

AutoSave oFF Chapter 5 Homework Q Search Sheet Homc Insert Page Layout Formulas Data Review View Share Calibri (Body)11 AA-_ Wrap Text General Delete ? ? 1 u, i..-:, d? A, ???Merge & Center, S, 96 , *.0.00 conditional Format Cell Sort & Formatting as Table Styles Format 0 5. 14 Comparing Investment Criteria Wii Brothers, a game manufacturer, has a new idea for an adventure game. It can market the game either as a traditional board game or as an interactive DVD, but not both. Consider the following cash flows of the two mutually exclusive projects for the company. Assume the discount rate for both projects is 10 percent. 1 Board Game DVD 0 $ (950.00) $ (2,100.00)(1,150.00) 1 $700.001,500.00800.00 2 $ 550.001,050.00 500.00 3 $130.0050.0 320.00 3 Year DVD-Game 9 Discount Rate 10 Payback 11 NPV 12 IRR 13 a. Based on the payback period rule, which project should be chosen? b. Based on the NPV, which project should be chosen? c. Based on the IRR, which project should be chosen? 14 d. Based on the incremental IRR, which project should be chosen? 15 16 17 18 19 20 Problem 5.02 Problem 5.04 Problem 5.06 Problem 5.07 Problem 5.11 Problem 5.12 Problem 5.14 Press ESC to cancel Copy 130%

Solution

Board Game:

Payback = 1 + 250/550 = 1.45

NPV = 238.58

IRR = 27.51% (Use IRR function in Excel)

DVD

Payback = 1 + 600/1050 = 1.57

NPV = 469.50

IRR = 25.09%

a. Board Game

b. DVD

c. Board Game

d.

IRR = 27.64%

so choose DVD

| Discount rate | 10.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| (950.000) | 0 | (950.00) | (950.00) |

| 700.000 | 1 | 636.36 | (313.64) |

| 550.000 | 2 | 454.55 | 140.91 |

| 130.000 | 3 | 97.67 | 238.58 |

Homework Sourse

Homework Sourse