You are considering purchasing a CNC machine which costs 190

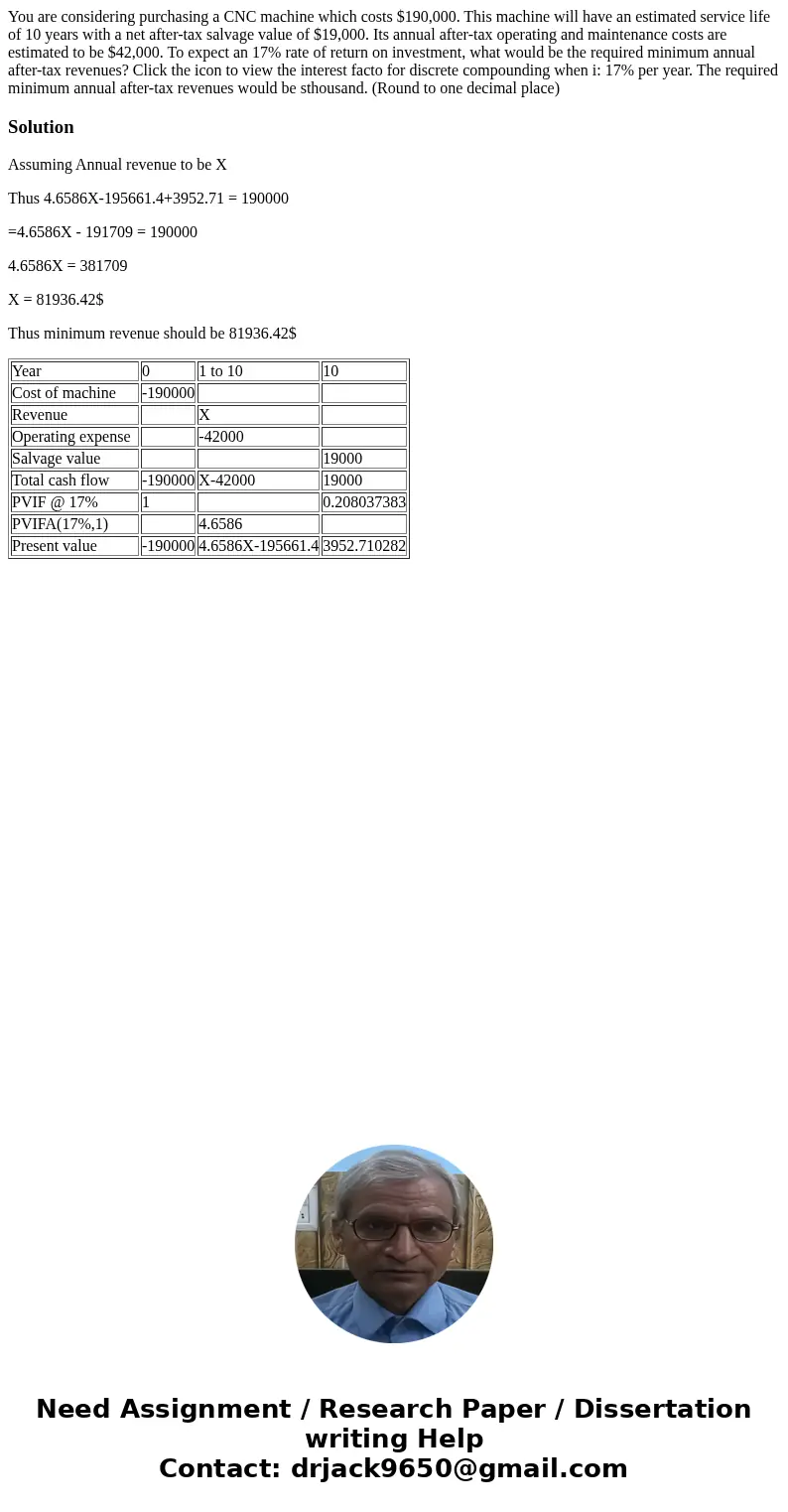

You are considering purchasing a CNC machine which costs $190,000. This machine will have an estimated service life of 10 years with a net after-tax salvage value of $19,000. Its annual after-tax operating and maintenance costs are estimated to be $42,000. To expect an 17% rate of return on investment, what would be the required minimum annual after-tax revenues? Click the icon to view the interest facto for discrete compounding when i: 17% per year. The required minimum annual after-tax revenues would be sthousand. (Round to one decimal place)

Solution

Assuming Annual revenue to be X

Thus 4.6586X-195661.4+3952.71 = 190000

=4.6586X - 191709 = 190000

4.6586X = 381709

X = 81936.42$

Thus minimum revenue should be 81936.42$

| Year | 0 | 1 to 10 | 10 |

| Cost of machine | -190000 | ||

| Revenue | X | ||

| Operating expense | -42000 | ||

| Salvage value | 19000 | ||

| Total cash flow | -190000 | X-42000 | 19000 |

| PVIF @ 17% | 1 | 0.208037383 | |

| PVIFA(17%,1) | 4.6586 | ||

| Present value | -190000 | 4.6586X-195661.4 | 3952.710282 |

Homework Sourse

Homework Sourse