Accounting Al Example no 1 On January 1 2012 DeCarlo Company

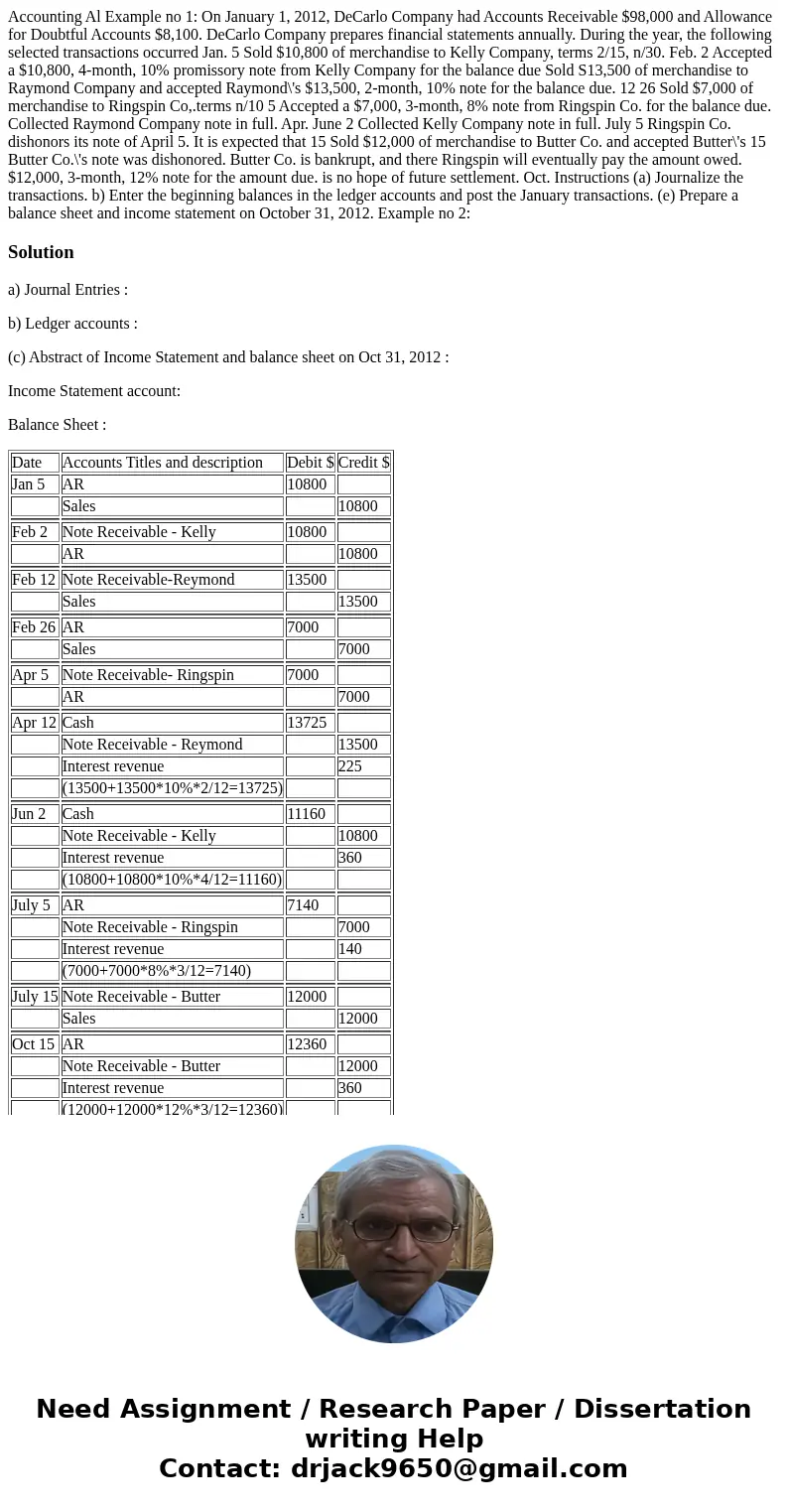

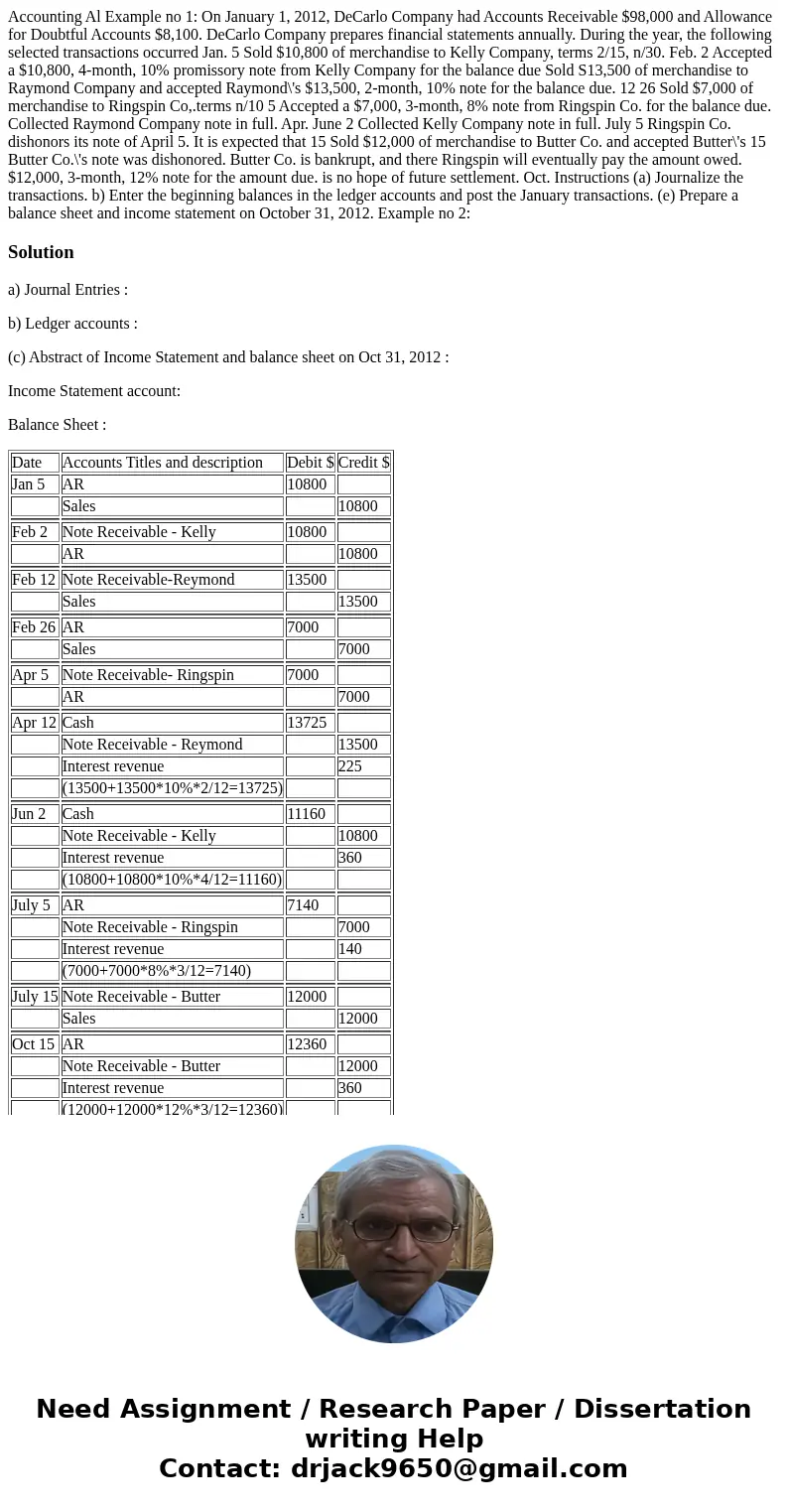

Accounting Al Example no 1: On January 1, 2012, DeCarlo Company had Accounts Receivable $98,000 and Allowance for Doubtful Accounts $8,100. DeCarlo Company prepares financial statements annually. During the year, the following selected transactions occurred Jan. 5 Sold $10,800 of merchandise to Kelly Company, terms 2/15, n/30. Feb. 2 Accepted a $10,800, 4-month, 10% promissory note from Kelly Company for the balance due Sold S13,500 of merchandise to Raymond Company and accepted Raymond\'s $13,500, 2-month, 10% note for the balance due. 12 26 Sold $7,000 of merchandise to Ringspin Co,.terms n/10 5 Accepted a $7,000, 3-month, 8% note from Ringspin Co. for the balance due. Collected Raymond Company note in full. Apr. June 2 Collected Kelly Company note in full. July 5 Ringspin Co. dishonors its note of April 5. It is expected that 15 Sold $12,000 of merchandise to Butter Co. and accepted Butter\'s 15 Butter Co.\'s note was dishonored. Butter Co. is bankrupt, and there Ringspin will eventually pay the amount owed. $12,000, 3-month, 12% note for the amount due. is no hope of future settlement. Oct. Instructions (a) Journalize the transactions. b) Enter the beginning balances in the ledger accounts and post the January transactions. (e) Prepare a balance sheet and income statement on October 31, 2012. Example no 2:

Solution

a) Journal Entries :

b) Ledger accounts :

(c) Abstract of Income Statement and balance sheet on Oct 31, 2012 :

Income Statement account:

Balance Sheet :

| Date | Accounts Titles and description | Debit $ | Credit $ |

| Jan 5 | AR | 10800 | |

| Sales | 10800 | ||

| Feb 2 | Note Receivable - Kelly | 10800 | |

| AR | 10800 | ||

| Feb 12 | Note Receivable-Reymond | 13500 | |

| Sales | 13500 | ||

| Feb 26 | AR | 7000 | |

| Sales | 7000 | ||

| Apr 5 | Note Receivable- Ringspin | 7000 | |

| AR | 7000 | ||

| Apr 12 | Cash | 13725 | |

| Note Receivable - Reymond | 13500 | ||

| Interest revenue | 225 | ||

| (13500+13500*10%*2/12=13725) | |||

| Jun 2 | Cash | 11160 | |

| Note Receivable - Kelly | 10800 | ||

| Interest revenue | 360 | ||

| (10800+10800*10%*4/12=11160) | |||

| July 5 | AR | 7140 | |

| Note Receivable - Ringspin | 7000 | ||

| Interest revenue | 140 | ||

| (7000+7000*8%*3/12=7140) | |||

| July 15 | Note Receivable - Butter | 12000 | |

| Sales | 12000 | ||

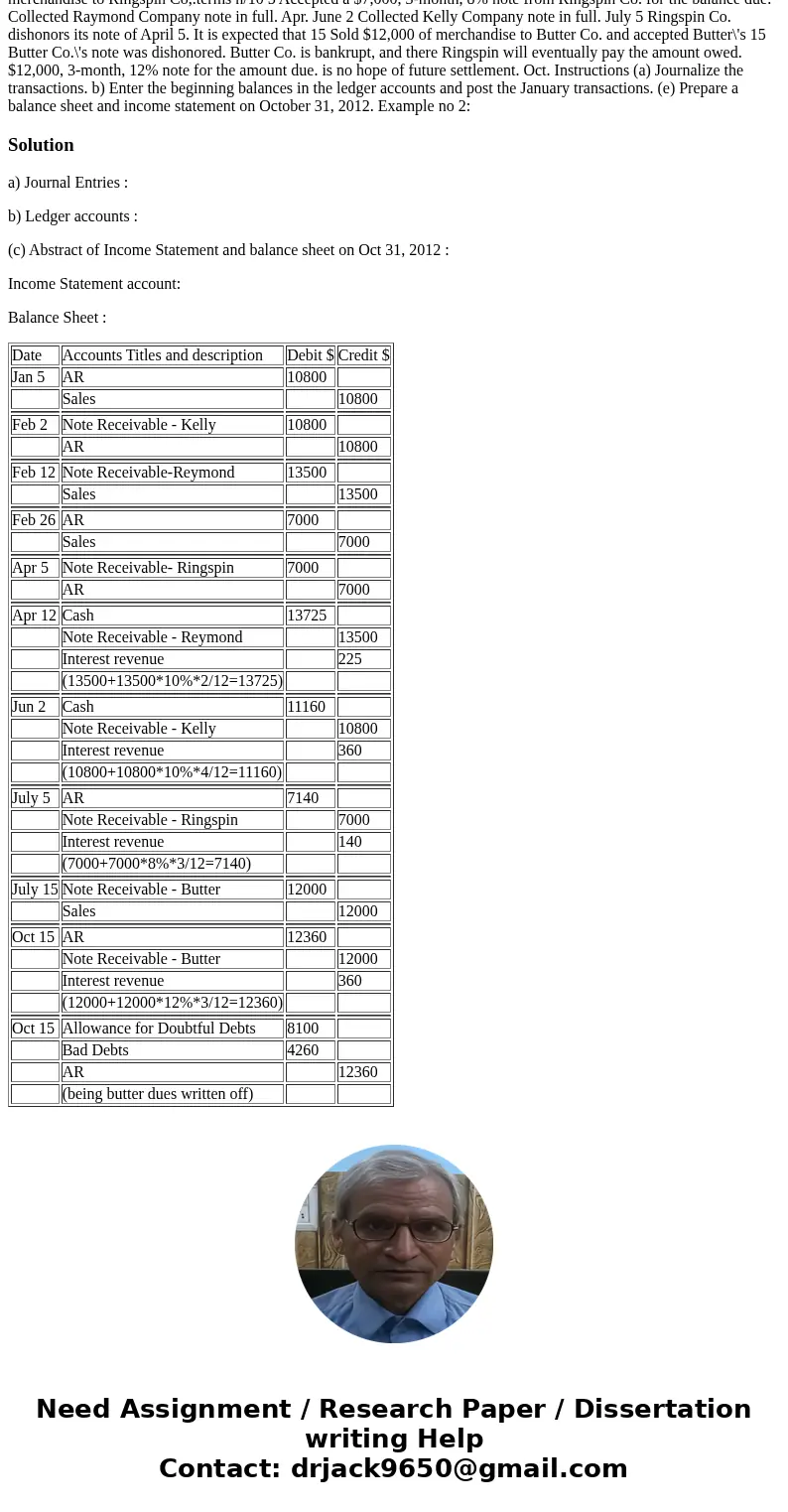

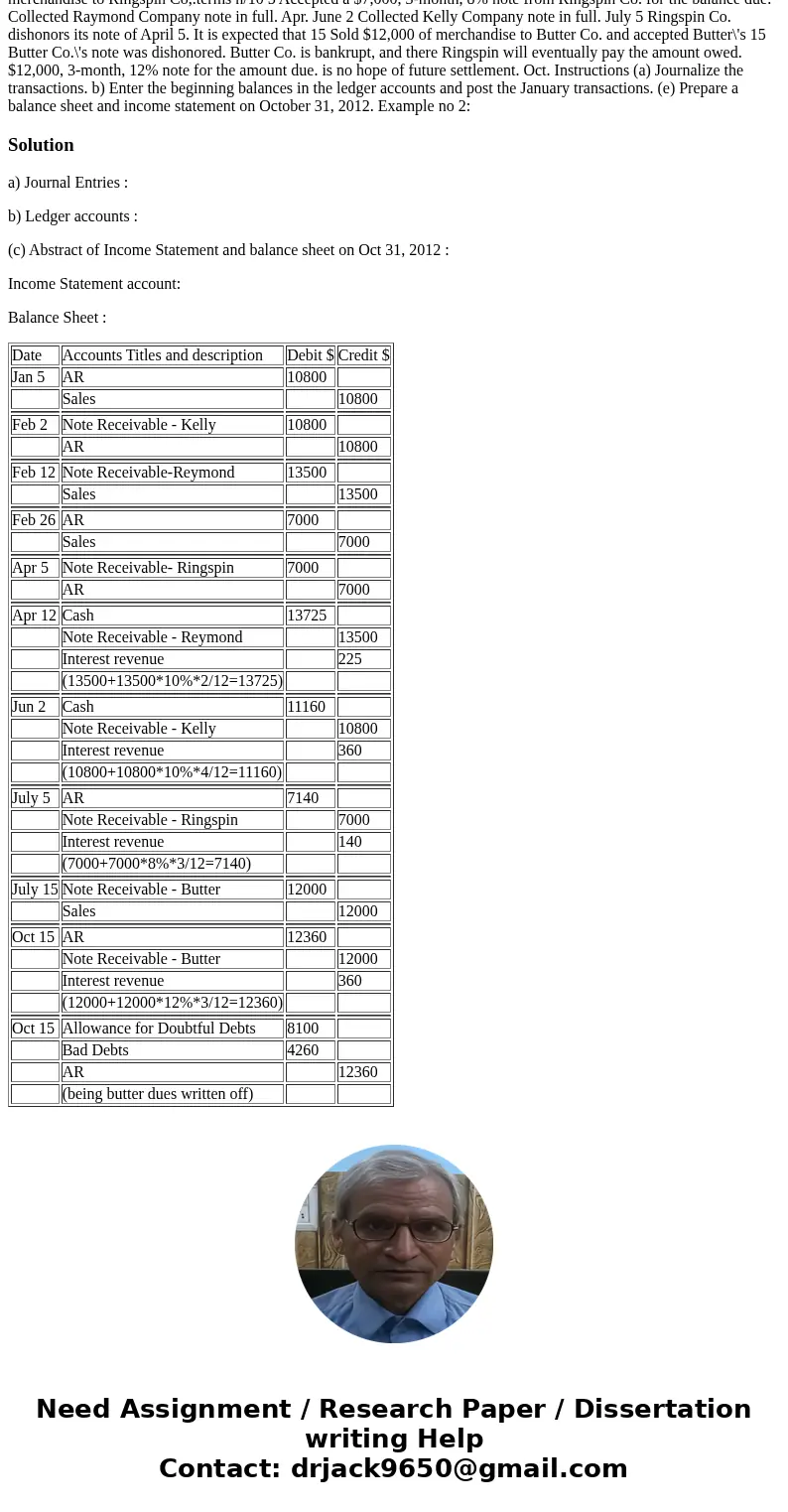

| Oct 15 | AR | 12360 | |

| Note Receivable - Butter | 12000 | ||

| Interest revenue | 360 | ||

| (12000+12000*12%*3/12=12360) | |||

| Oct 15 | Allowance for Doubtful Debts | 8100 | |

| Bad Debts | 4260 | ||

| AR | 12360 | ||

| (being butter dues written off) |

Homework Sourse

Homework Sourse