Exercise 65A Opportunity costs LO 61 Norman Dowd owns his ow

Exercise 6-5A Opportunity costs LO 6-1 Norman Dowd owns his own taxi, for which he bought a $10,800 permit to operate two years ago. Mr. Dowd earns $32,400 a year operating as an independent but has the opportunity to sell the taxi and permit for $40,500 and take a position as dispatcher for Carter Taxi Co. The dispatcher position pays $31,500 a year for a 40-hour week. Driving his own taxi, Mr. Dowd works approximately 55 hours per week. If he sells his business, he will invest the $40,500 and can earn a 12 percent return. Required a. Determine the opportunity cost of owning and operating the independent business. b. Calculate the earnings of Norman Dowd operating as an independent and the earnings of Norman Dowd working as a dispatcher. Based solely on financial considerations, should Mr. Dowd sell the taxi and accept the position as dispatcher? a. Opportunity cost b. Operating as an independent Working as a dispatcher Should Mr. Dowd sell the taxi and accept the position as dispatcher?

Solution

Answer

A.

Mr.Norman Dowd is losing the opportunity to sell the taxi by holding on to his business i.e. owning and operating the independent business.

Therefore, the opportunity cost of owning and operating the independent business is $40500.

B.

(A).Opportunity cost=$40500

(B).Income - operating as an independent=32400 per year

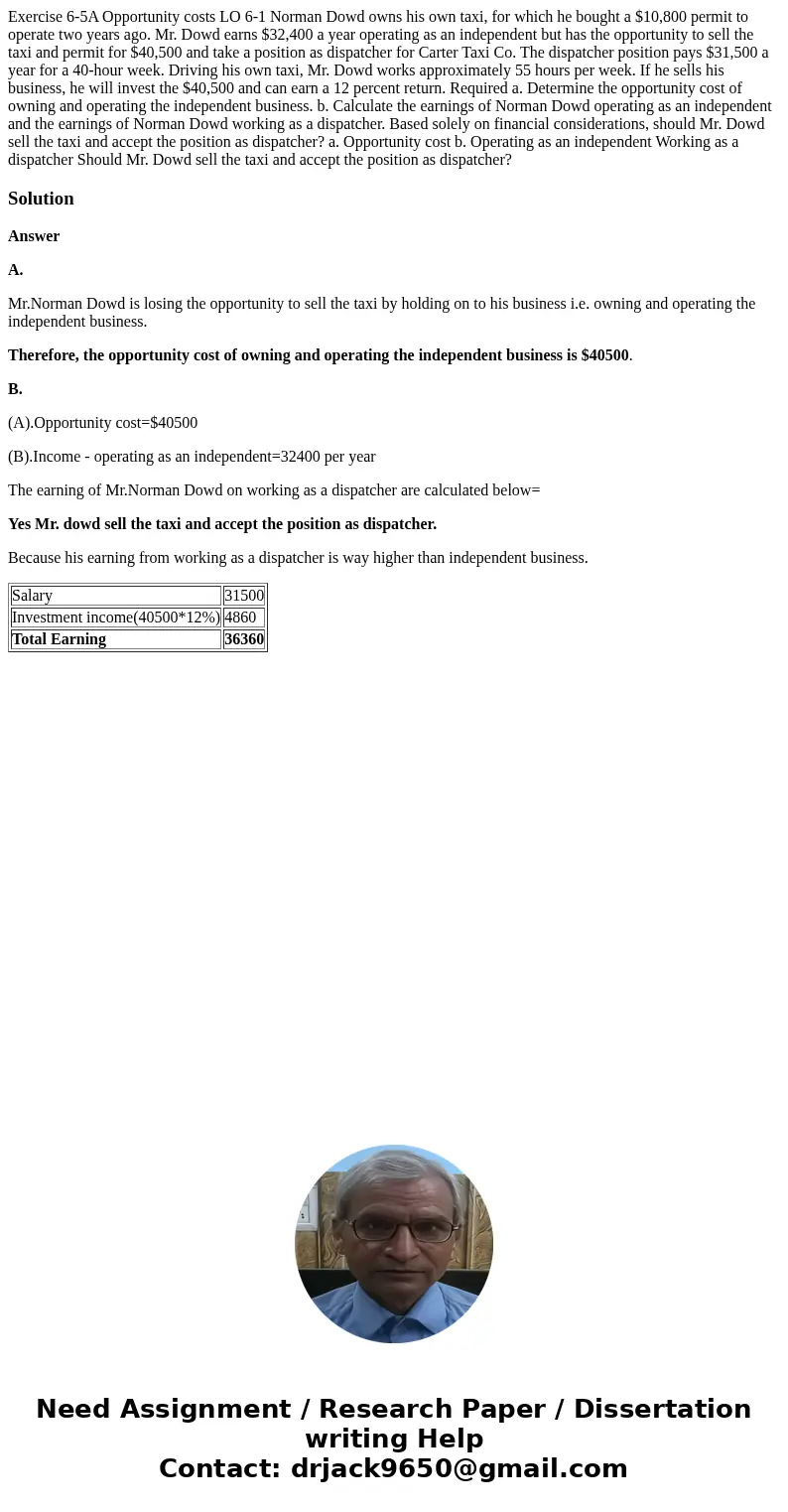

The earning of Mr.Norman Dowd on working as a dispatcher are calculated below=

Yes Mr. dowd sell the taxi and accept the position as dispatcher.

Because his earning from working as a dispatcher is way higher than independent business.

| Salary | 31500 |

| Investment income(40500*12%) | 4860 |

| Total Earning | 36360 |

Homework Sourse

Homework Sourse