14 Toolkit Decision Rules PBAK IRR NPV Calculating NPV IR

14. (Toolkit – Decision Rules – PBAK, IRR, NPV) Calculating NPV & IRR: Your next project provides an annual cash flow of $15,400 for nine years and costs $67,000 today. Is this a good project at 8% required return? How about 20%?

Question 14 options:

Yes, Yes

Yes, No

No, Yes

No, No

| Yes, Yes | |

| Yes, No | |

| No, Yes | |

| No, No |

Solution

Correct option is > Yes, No

Reason: NPV is positive for 8% required rate of return and NPV is negative for 20% required rate of return.

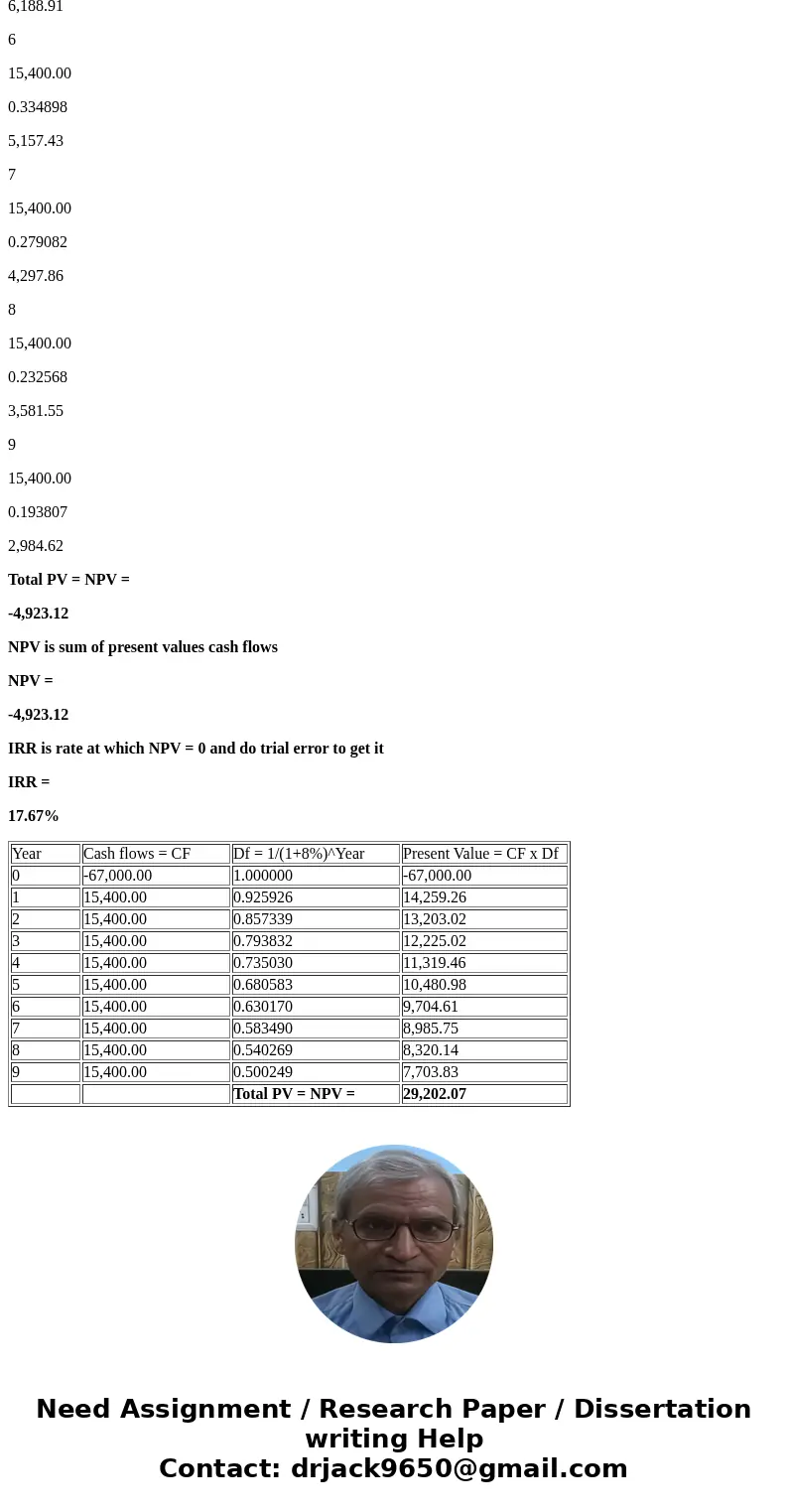

NPV with 8% required return

Year

Cash flows = CF

Df = 1/(1+8%)^Year

Present Value = CF x Df

0

-67,000.00

1.000000

-67,000.00

1

15,400.00

0.925926

14,259.26

2

15,400.00

0.857339

13,203.02

3

15,400.00

0.793832

12,225.02

4

15,400.00

0.735030

11,319.46

5

15,400.00

0.680583

10,480.98

6

15,400.00

0.630170

9,704.61

7

15,400.00

0.583490

8,985.75

8

15,400.00

0.540269

8,320.14

9

15,400.00

0.500249

7,703.83

Total PV = NPV =

29,202.07

NPV is sum of present values cash flows

NPV =

29,202.07

IRR is rate at which NPV = 0 and do trial error to get it

IRR =

17.67%

NPV with 20% required return

Year

Cash flows = CF

Df = 1/(1+20)^Year

Present Value = CF x Df

0

-67,000.00

1.000000

-67,000.00

1

15,400.00

0.833333

12,833.33

2

15,400.00

0.694444

10,694.44

3

15,400.00

0.578704

8,912.04

4

15,400.00

0.482253

7,426.70

5

15,400.00

0.401878

6,188.91

6

15,400.00

0.334898

5,157.43

7

15,400.00

0.279082

4,297.86

8

15,400.00

0.232568

3,581.55

9

15,400.00

0.193807

2,984.62

Total PV = NPV =

-4,923.12

NPV is sum of present values cash flows

NPV =

-4,923.12

IRR is rate at which NPV = 0 and do trial error to get it

IRR =

17.67%

| Year | Cash flows = CF | Df = 1/(1+8%)^Year | Present Value = CF x Df |

| 0 | -67,000.00 | 1.000000 | -67,000.00 |

| 1 | 15,400.00 | 0.925926 | 14,259.26 |

| 2 | 15,400.00 | 0.857339 | 13,203.02 |

| 3 | 15,400.00 | 0.793832 | 12,225.02 |

| 4 | 15,400.00 | 0.735030 | 11,319.46 |

| 5 | 15,400.00 | 0.680583 | 10,480.98 |

| 6 | 15,400.00 | 0.630170 | 9,704.61 |

| 7 | 15,400.00 | 0.583490 | 8,985.75 |

| 8 | 15,400.00 | 0.540269 | 8,320.14 |

| 9 | 15,400.00 | 0.500249 | 7,703.83 |

| Total PV = NPV = | 29,202.07 |

Homework Sourse

Homework Sourse