BuyCo Inc holds 21 percent of the outstanding shares of Marq

BuyCo, Inc. holds 21 percent of the outstanding shares of Marqueen company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $10,000 per year. For 2017, Marqueen reported earnings of $108,000 and declares cash dividends of $32,000. During that year, Marqueen acquired inventory for $49,000, which it then sold to BuyCo for $70,000. At the end of 2017, BuyCo continued to hold merchandise with a transfer price of $27,000 a. What Equity in Investee Income should BuyCo report for 2017? b. How will the intra-entity transfer affect BuyCo\'s reporting in 2018? c. If BuyCo had sold the inventory to Marqueen, how would the answers to (a) and (b) have changed? (Do not round intermediate calculations.) a. Equity in investee income b. Equity accrual for 2018 will be c. If the inventory was sold, would your answers above change? by

Solution

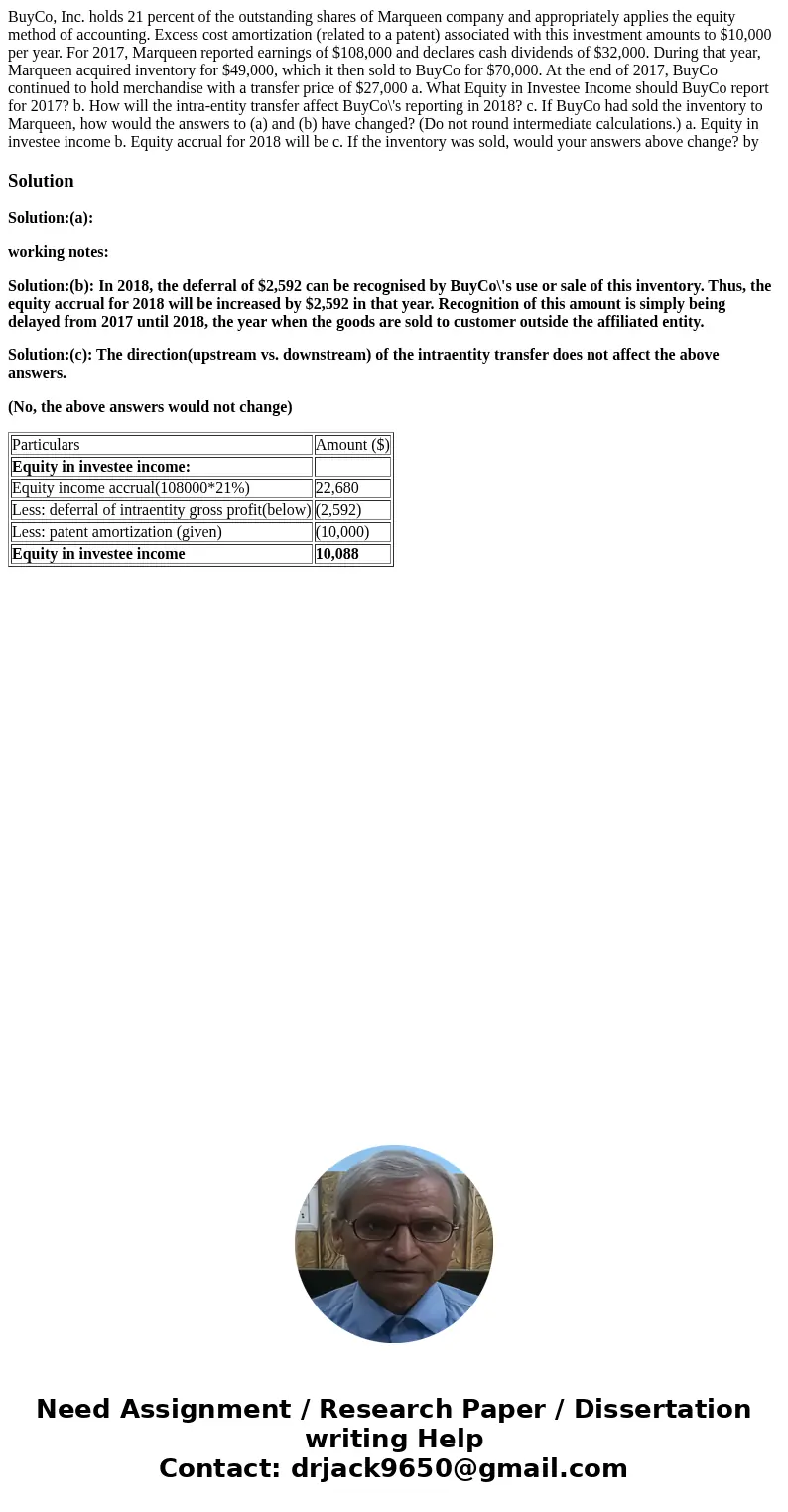

Solution:(a):

working notes:

Solution:(b): In 2018, the deferral of $2,592 can be recognised by BuyCo\'s use or sale of this inventory. Thus, the equity accrual for 2018 will be increased by $2,592 in that year. Recognition of this amount is simply being delayed from 2017 until 2018, the year when the goods are sold to customer outside the affiliated entity.

Solution:(c): The direction(upstream vs. downstream) of the intraentity transfer does not affect the above answers.

(No, the above answers would not change)

| Particulars | Amount ($) |

| Equity in investee income: | |

| Equity income accrual(108000*21%) | 22,680 |

| Less: deferral of intraentity gross profit(below) | (2,592) |

| Less: patent amortization (given) | (10,000) |

| Equity in investee income | 10,088 |

Homework Sourse

Homework Sourse