Concord Corporations accounting records reflect the followin

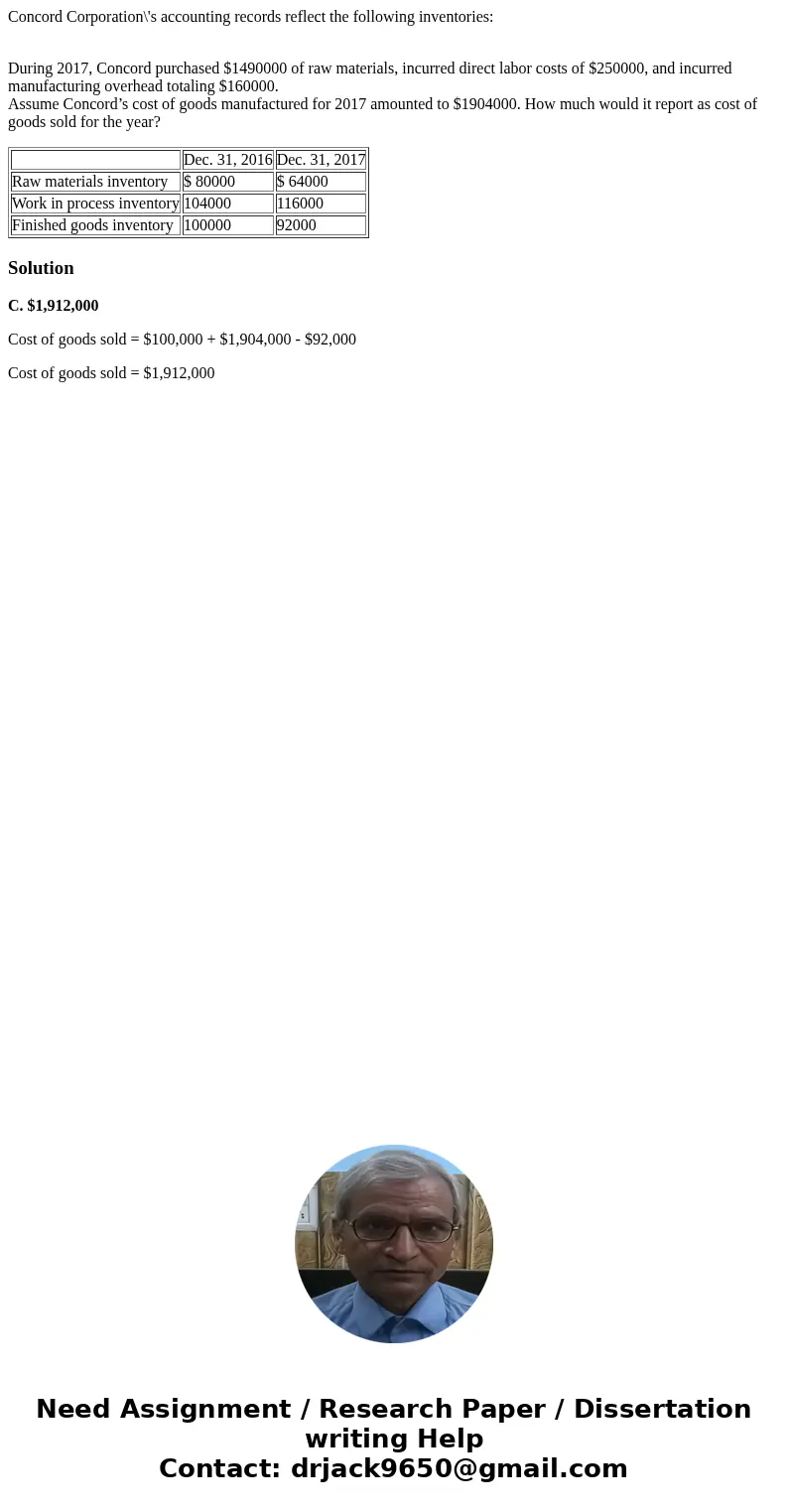

Concord Corporation\'s accounting records reflect the following inventories:

During 2017, Concord purchased $1490000 of raw materials, incurred direct labor costs of $250000, and incurred manufacturing overhead totaling $160000.

Assume Concord’s cost of goods manufactured for 2017 amounted to $1904000. How much would it report as cost of goods sold for the year?

| Dec. 31, 2016 | Dec. 31, 2017 | |

| Raw materials inventory | $ 80000 | $ 64000 |

| Work in process inventory | 104000 | 116000 |

| Finished goods inventory | 100000 | 92000 |

Solution

C. $1,912,000

Cost of goods sold = $100,000 + $1,904,000 - $92,000

Cost of goods sold = $1,912,000

Homework Sourse

Homework Sourse