1a In carly 2015 Sosa Enterprises purchased a new machine fo

1a. In carly 2015, Sosa Enterprises purchased a new machine for $10,000 to make cork for wine bottles. The machine has a 3-year recovery period and is expected to stopper have a salvage value of $2,000. Develop a depreciation schedule for this asset using the MACRS depeeciation percentages in Table 4.2 on textbook page 120. (4 points) Ib. Corporations face the following corporatc tax schedule: Tax on Base of Bracket Percentage on Excess above Base Taxable Income $ 0-$ 50,000 S 50,000 $ 75,000 $ 75,000 -$100,000 $100,000- $335,000 7,500 13,750 22,250 15% 25% 34% 39% If a firm has $180,000 of taxable income, what is its tax liability? (4 points)

Solution

Answer

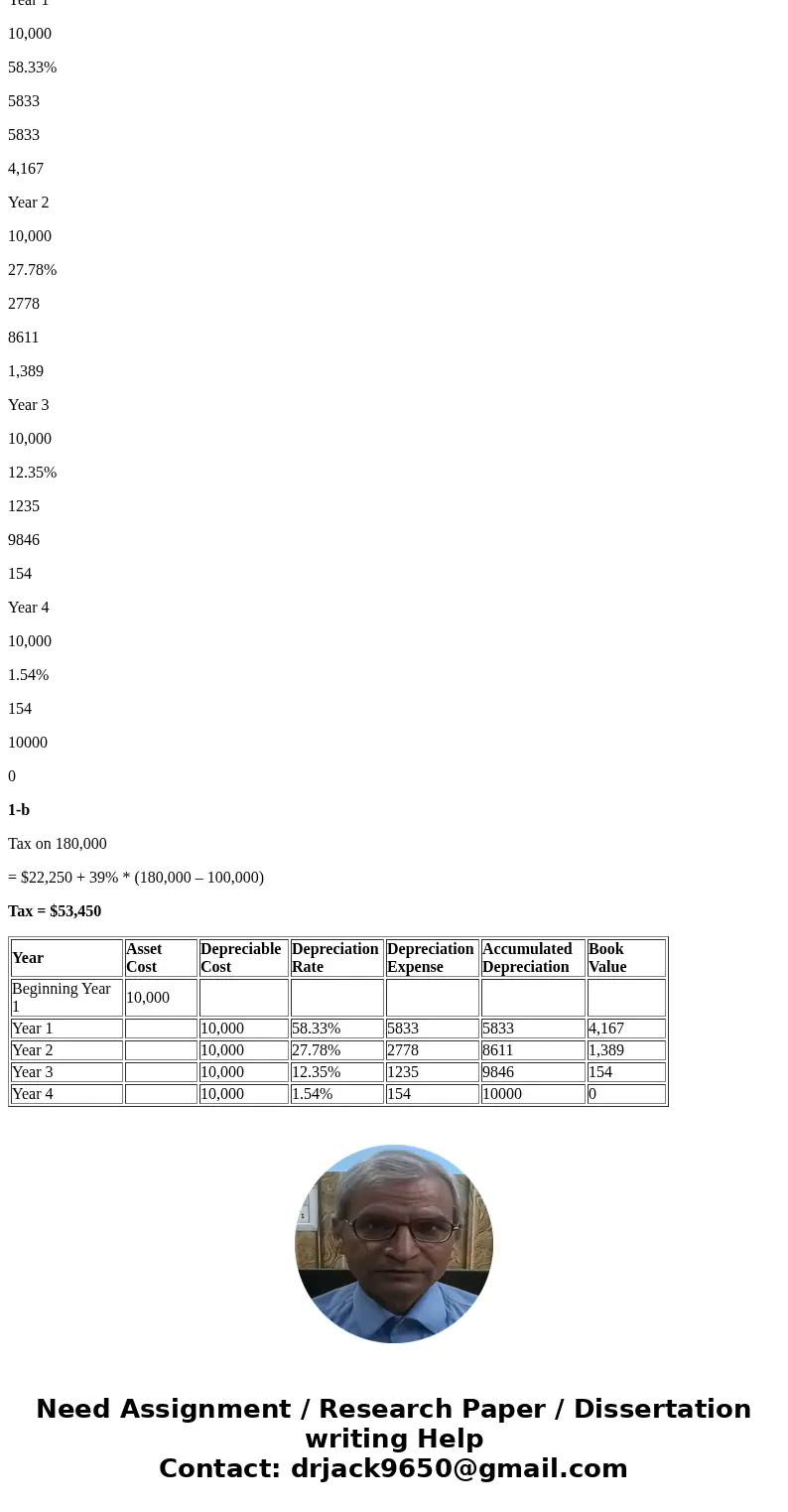

1-a

Cost = 10,000

Depreciation = Cost * Depreciation Rate

Year

Asset Cost

Depreciable Cost

Depreciation Rate

Depreciation Expense

Accumulated Depreciation

Book Value

Beginning Year 1

10,000

Year 1

10,000

58.33%

5833

5833

4,167

Year 2

10,000

27.78%

2778

8611

1,389

Year 3

10,000

12.35%

1235

9846

154

Year 4

10,000

1.54%

154

10000

0

1-b

Tax on 180,000

= $22,250 + 39% * (180,000 – 100,000)

Tax = $53,450

| Year | Asset Cost | Depreciable Cost | Depreciation Rate | Depreciation Expense | Accumulated Depreciation | Book Value |

| Beginning Year 1 | 10,000 | |||||

| Year 1 | 10,000 | 58.33% | 5833 | 5833 | 4,167 | |

| Year 2 | 10,000 | 27.78% | 2778 | 8611 | 1,389 | |

| Year 3 | 10,000 | 12.35% | 1235 | 9846 | 154 | |

| Year 4 | 10,000 | 1.54% | 154 | 10000 | 0 |

Homework Sourse

Homework Sourse