Starbooks Corporation provides an online bookstore for elect

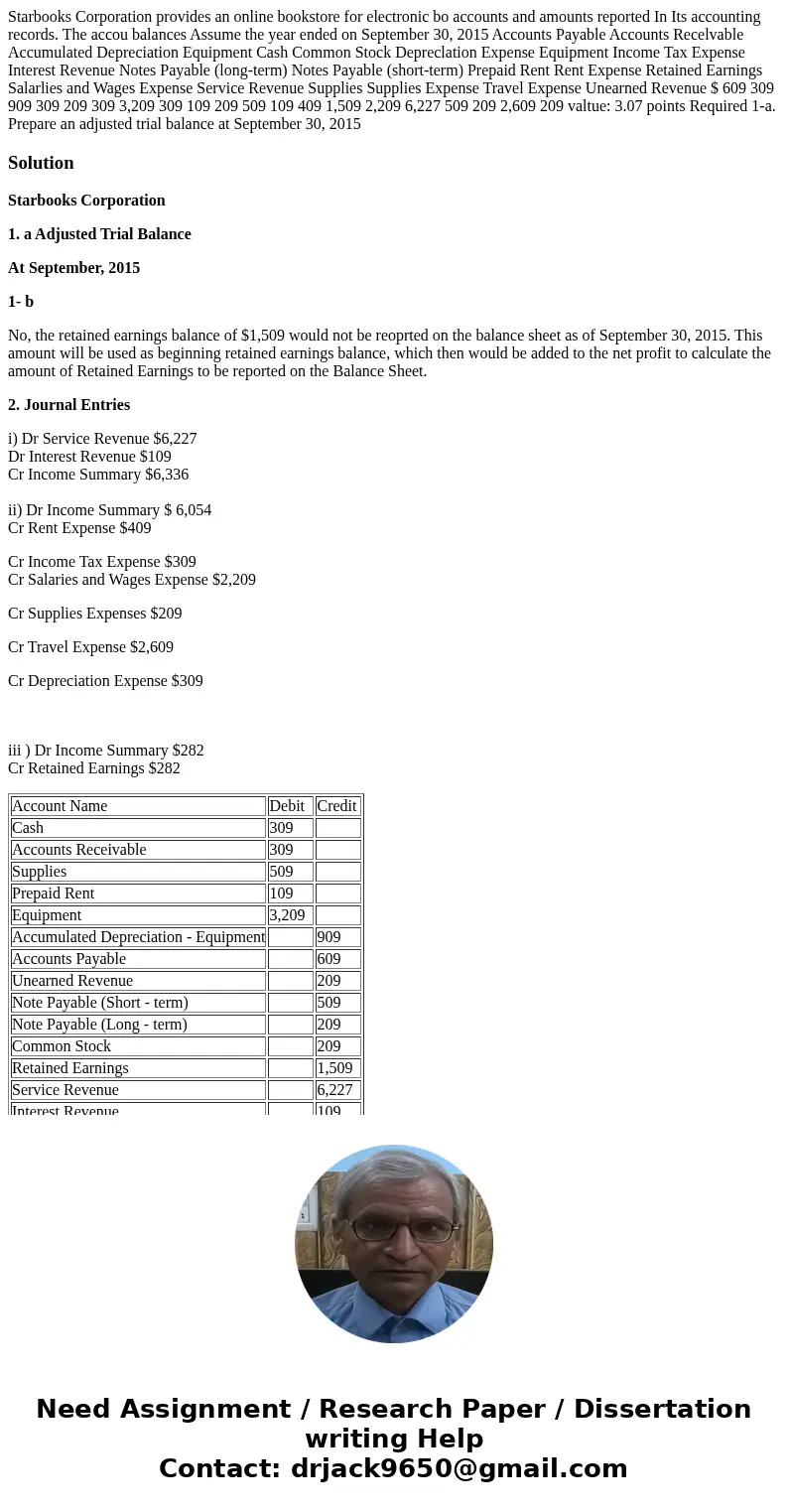

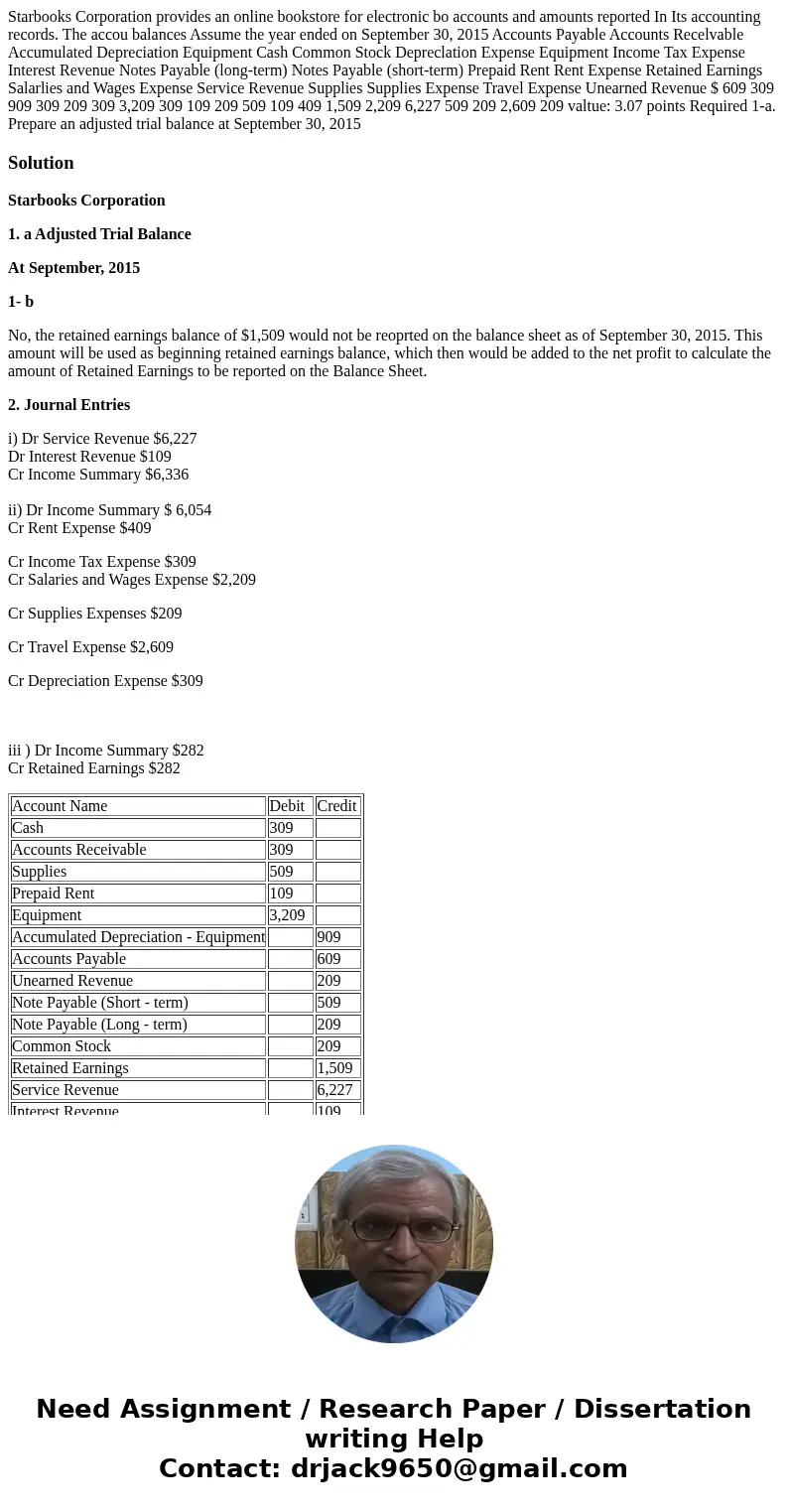

Starbooks Corporation provides an online bookstore for electronic bo accounts and amounts reported In Its accounting records. The accou balances Assume the year ended on September 30, 2015 Accounts Payable Accounts Recelvable Accumulated Depreciation Equipment Cash Common Stock Depreclation Expense Equipment Income Tax Expense Interest Revenue Notes Payable (long-term) Notes Payable (short-term) Prepaid Rent Rent Expense Retained Earnings Salarlies and Wages Expense Service Revenue Supplies Supplies Expense Travel Expense Unearned Revenue $ 609 309 909 309 209 309 3,209 309 109 209 509 109 409 1,509 2,209 6,227 509 209 2,609 209 valtue: 3.07 points Required 1-a. Prepare an adjusted trial balance at September 30, 2015

Solution

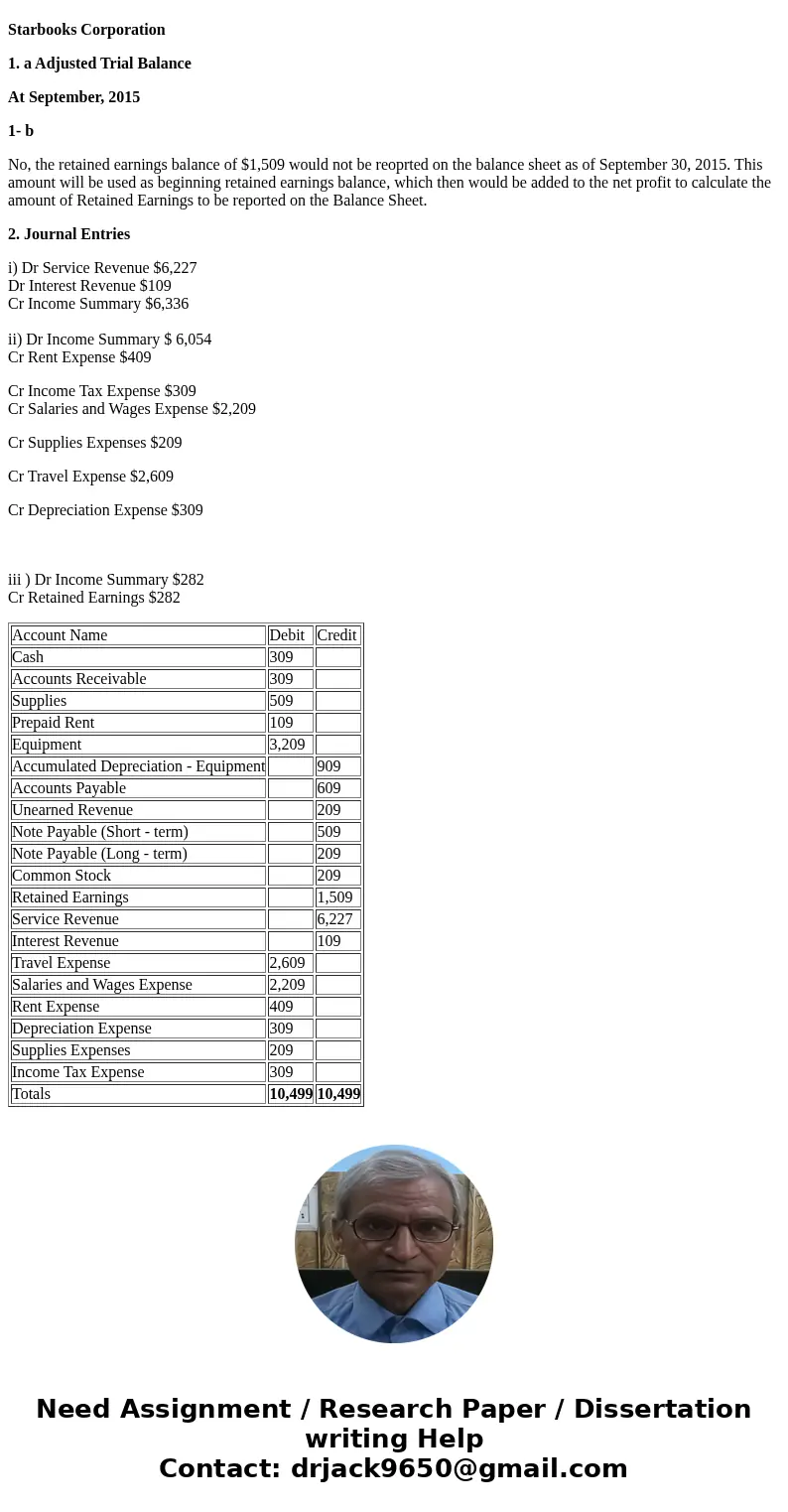

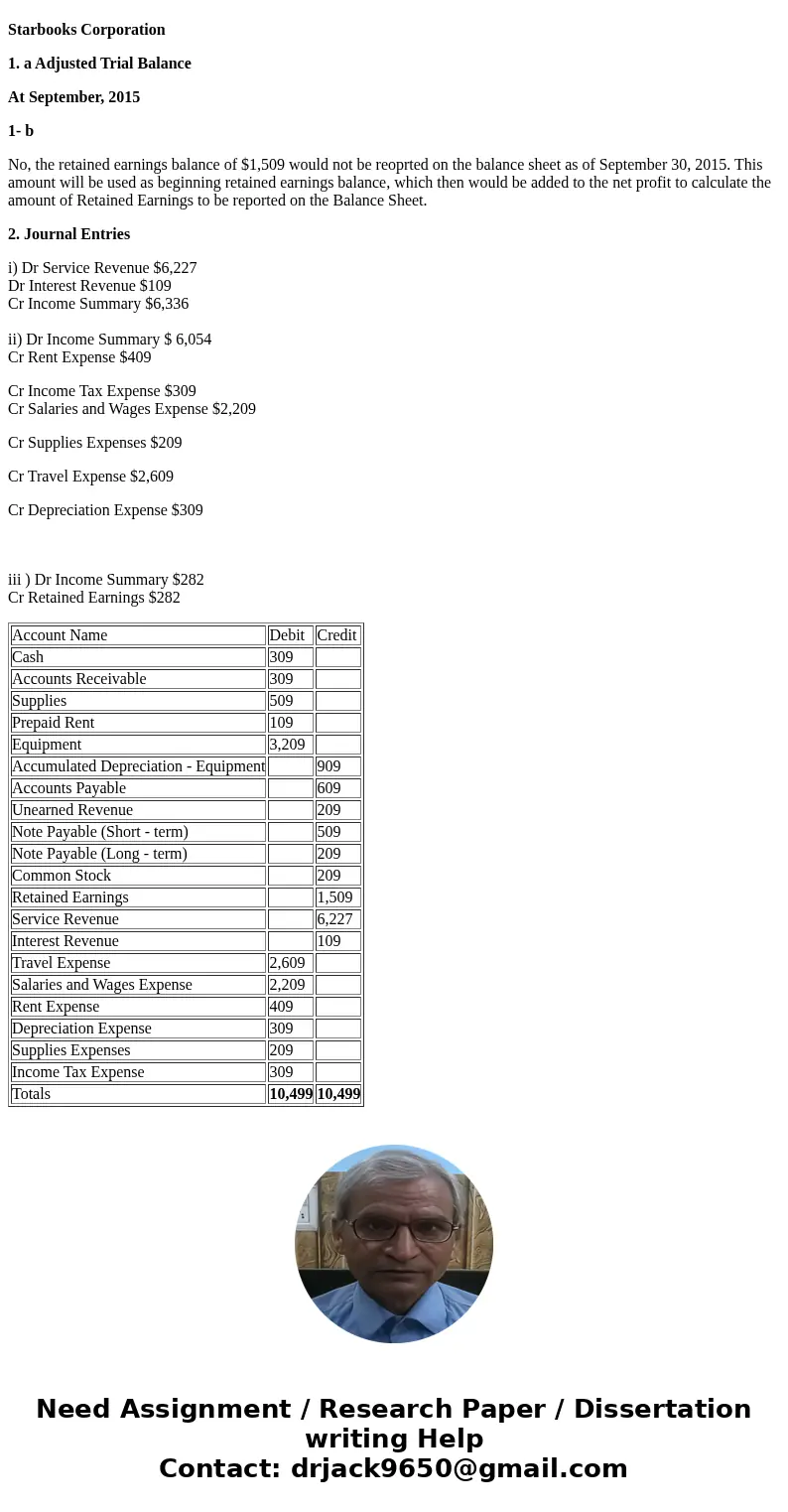

Starbooks Corporation

1. a Adjusted Trial Balance

At September, 2015

1- b

No, the retained earnings balance of $1,509 would not be reoprted on the balance sheet as of September 30, 2015. This amount will be used as beginning retained earnings balance, which then would be added to the net profit to calculate the amount of Retained Earnings to be reported on the Balance Sheet.

2. Journal Entries

i) Dr Service Revenue $6,227

Dr Interest Revenue $109

Cr Income Summary $6,336

ii) Dr Income Summary $ 6,054

Cr Rent Expense $409

Cr Income Tax Expense $309

Cr Salaries and Wages Expense $2,209

Cr Supplies Expenses $209

Cr Travel Expense $2,609

Cr Depreciation Expense $309

iii ) Dr Income Summary $282

Cr Retained Earnings $282

| Account Name | Debit | Credit |

| Cash | 309 | |

| Accounts Receivable | 309 | |

| Supplies | 509 | |

| Prepaid Rent | 109 | |

| Equipment | 3,209 | |

| Accumulated Depreciation - Equipment | 909 | |

| Accounts Payable | 609 | |

| Unearned Revenue | 209 | |

| Note Payable (Short - term) | 509 | |

| Note Payable (Long - term) | 209 | |

| Common Stock | 209 | |

| Retained Earnings | 1,509 | |

| Service Revenue | 6,227 | |

| Interest Revenue | 109 | |

| Travel Expense | 2,609 | |

| Salaries and Wages Expense | 2,209 | |

| Rent Expense | 409 | |

| Depreciation Expense | 309 | |

| Supplies Expenses | 209 | |

| Income Tax Expense | 309 | |

| Totals | 10,499 | 10,499 |

Homework Sourse

Homework Sourse