Grouper Corporation made credit sales of 30600 which are sub

Grouper Corporation made credit sales of $30,600 which are subject to 7% sales tax. The corporation also made cash sales which totaled $10,593 including the 7% sales tax.

Prepare the entry to record Grouper’s credit sales.

Prepare the entry to record Grouper’s cash sales.

|

Solution

Answer:

1

Entry to record Grouper’s credit sales.

Description

Debit $

Credit $

Account receivable

(30600+7%*30600)

32742

Sales revenue

30600

Sales tax payable

(30600*7%)

2142

(to record on account sales)

2

Entry to record Grouper’s cash sales.

Description

Debit $

Credit $

Cash

10593

Sales revenue

(10593*100%/107%)

9900

Sales tax payable

(10593-9900)

693

(to reord cash sales)

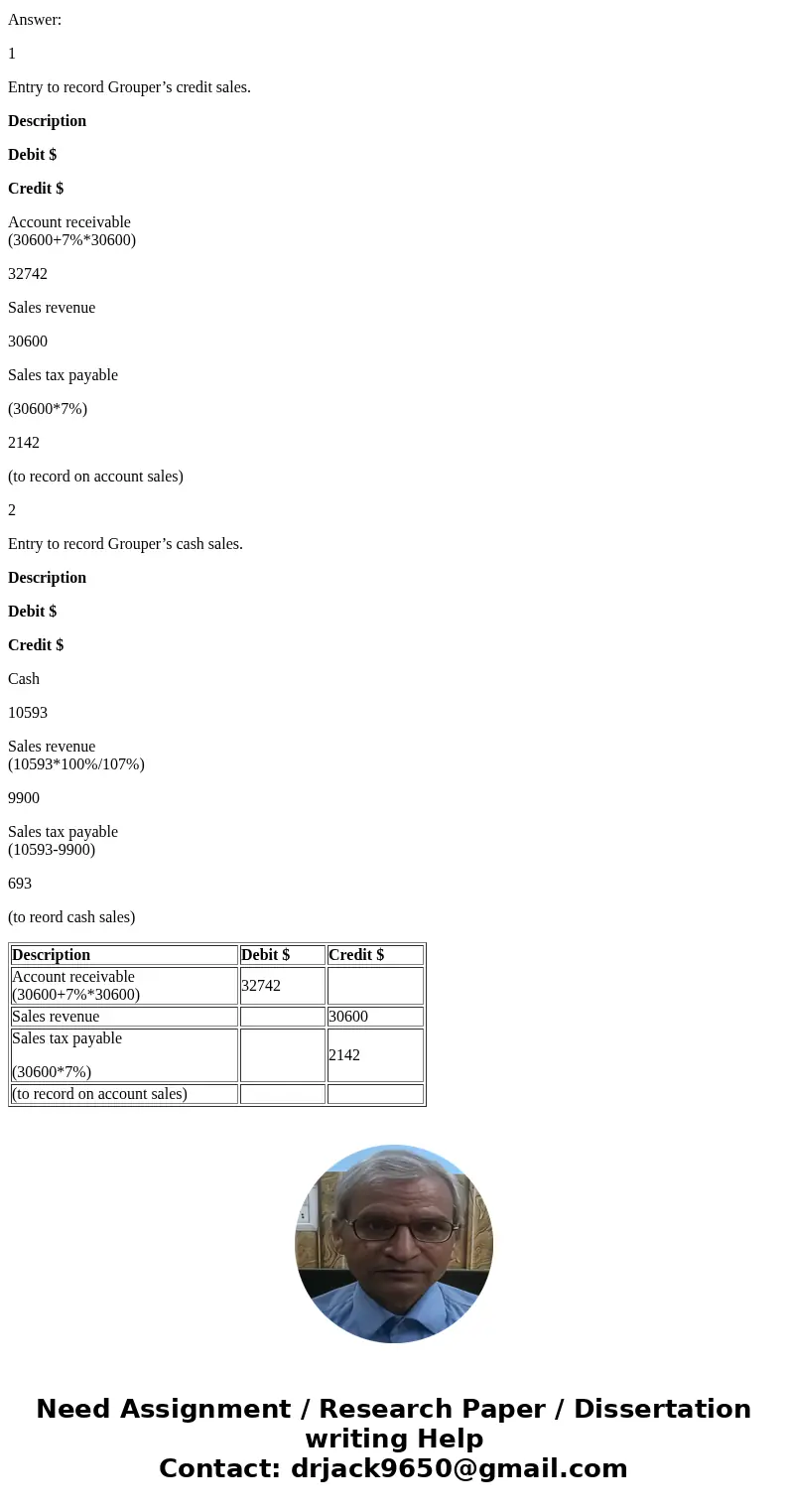

| Description | Debit $ | Credit $ |

| Account receivable | 32742 | |

| Sales revenue | 30600 | |

| Sales tax payable (30600*7%) | 2142 | |

| (to record on account sales) |

Homework Sourse

Homework Sourse