Given the following choices what is the optimal capital stru

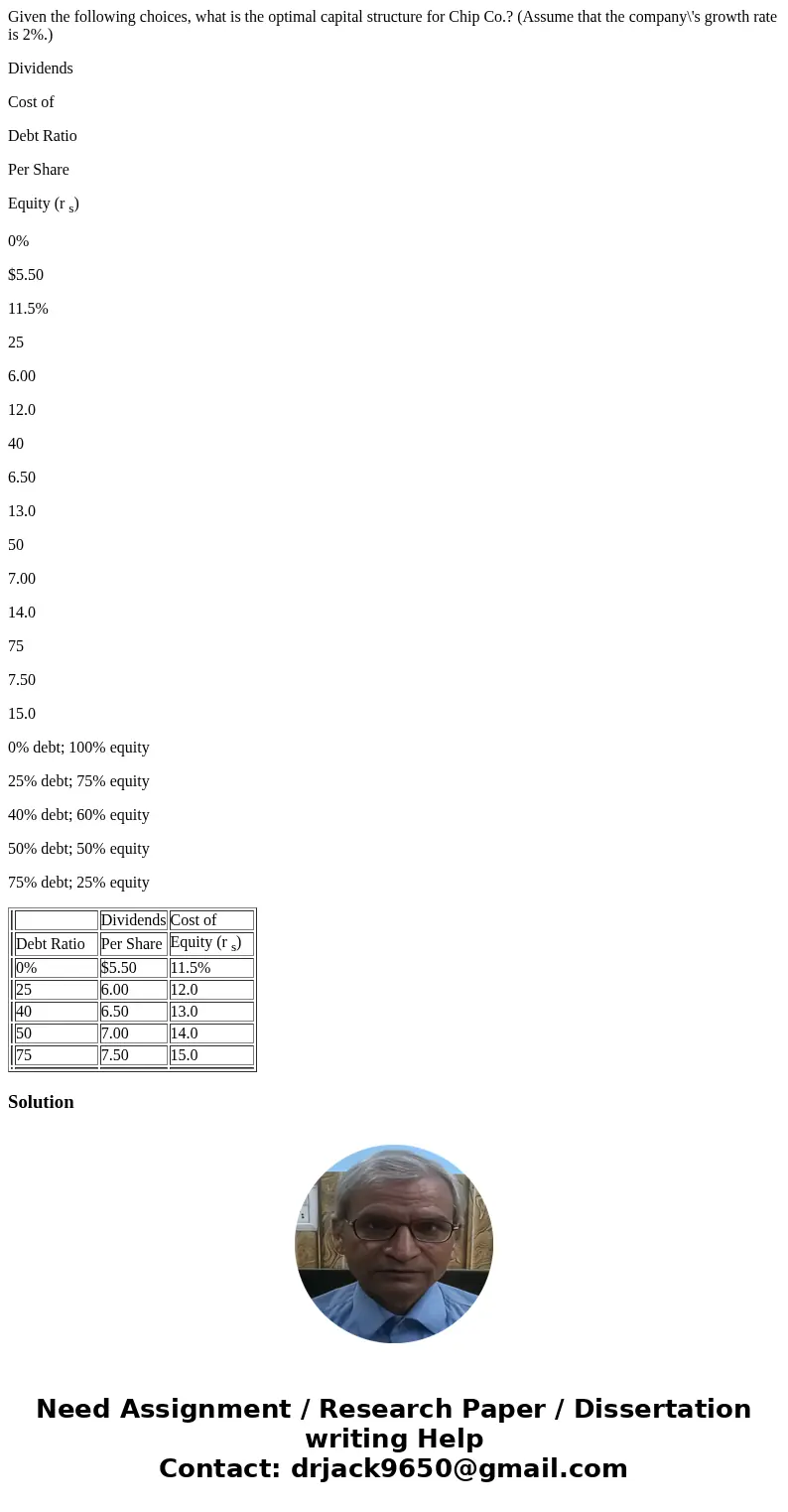

Given the following choices, what is the optimal capital structure for Chip Co.? (Assume that the company\'s growth rate is 2%.)

Dividends

Cost of

Debt Ratio

Per Share

Equity (r s)

0%

$5.50

11.5%

25

6.00

12.0

40

6.50

13.0

50

7.00

14.0

75

7.50

15.0

0% debt; 100% equity

25% debt; 75% equity

40% debt; 60% equity

50% debt; 50% equity

75% debt; 25% equity

| Dividends | Cost of | ||

| Debt Ratio | Per Share | Equity (r s) | |

| 0% | $5.50 | 11.5% | |

| 25 | 6.00 | 12.0 | |

| 40 | 6.50 | 13.0 | |

| 50 | 7.00 | 14.0 | |

| 75 | 7.50 | 15.0 | |

Solution

Optimal capital structure is where the share price is maximum.

Cost of Equity Dividend/( Cost of Equity - Growth)

1. For 0% debt Ratio Price of share = 5.5/(11.5% - 2%) = 57.89

2. For 25% debt Ratio Price of share = 6/(12% - 2%) =60.00

3. For 40% debt Ratio Price of share = 6.5/(13% - 2%) = 59.09

4. For 50% debt Ratio Price of share = 7.0/(14% - 2%) = 58.33

5. For 75% debt Ratio Price of share = 7.5/(15% - 2%) = 57.69

25% debt; 75% equity gives optimal capital structure as price = 60.00

Best of Luck. God Bless

Homework Sourse

Homework Sourse