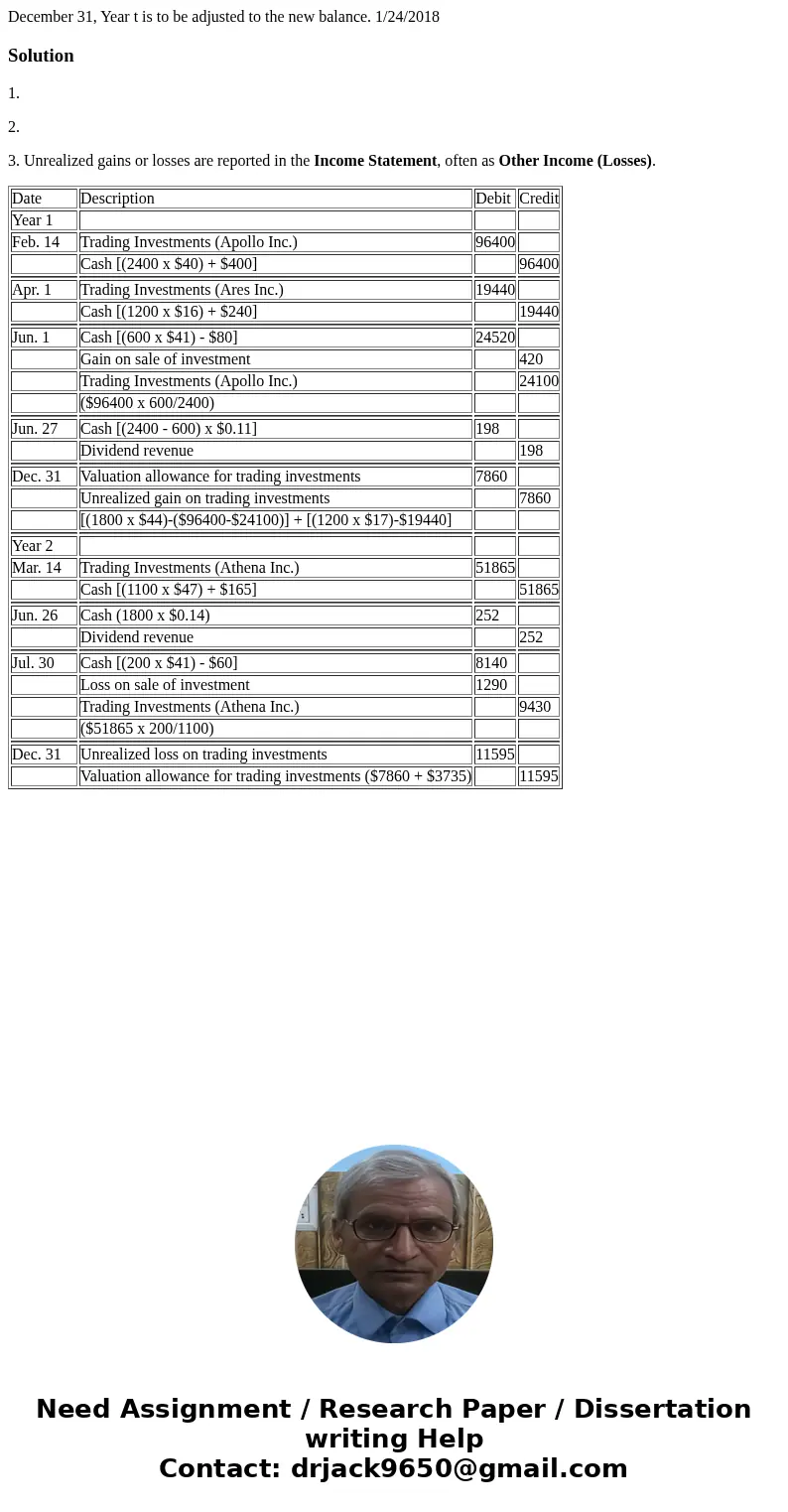

December 31 Year t is to be adjusted to the new balance 1242

December 31, Year t is to be adjusted to the new balance. 1/24/2018

Solution

1.

2.

3. Unrealized gains or losses are reported in the Income Statement, often as Other Income (Losses).

| Date | Description | Debit | Credit |

| Year 1 | |||

| Feb. 14 | Trading Investments (Apollo Inc.) | 96400 | |

| Cash [(2400 x $40) + $400] | 96400 | ||

| Apr. 1 | Trading Investments (Ares Inc.) | 19440 | |

| Cash [(1200 x $16) + $240] | 19440 | ||

| Jun. 1 | Cash [(600 x $41) - $80] | 24520 | |

| Gain on sale of investment | 420 | ||

| Trading Investments (Apollo Inc.) | 24100 | ||

| ($96400 x 600/2400) | |||

| Jun. 27 | Cash [(2400 - 600) x $0.11] | 198 | |

| Dividend revenue | 198 | ||

| Dec. 31 | Valuation allowance for trading investments | 7860 | |

| Unrealized gain on trading investments | 7860 | ||

| [(1800 x $44)-($96400-$24100)] + [(1200 x $17)-$19440] | |||

| Year 2 | |||

| Mar. 14 | Trading Investments (Athena Inc.) | 51865 | |

| Cash [(1100 x $47) + $165] | 51865 | ||

| Jun. 26 | Cash (1800 x $0.14) | 252 | |

| Dividend revenue | 252 | ||

| Jul. 30 | Cash [(200 x $41) - $60] | 8140 | |

| Loss on sale of investment | 1290 | ||

| Trading Investments (Athena Inc.) | 9430 | ||

| ($51865 x 200/1100) | |||

| Dec. 31 | Unrealized loss on trading investments | 11595 | |

| Valuation allowance for trading investments ($7860 + $3735) | 11595 |

Homework Sourse

Homework Sourse