Essay From your personal research articles and materials abo

Essay

From your personal research, articles and materials about the activities of Xfinity, the Comcast Corporation, develop a comprehensive and well documented Essay answering the following questions:

Xfinity Performance:

- Xfinity’s Competitors

- Functional Analysis

- 4P Analysis

- Financial Analysis

- Industry Ratios

- Competitor Ratios

Solution

Answer )

XFINITY services has been started by the global telecommunicationsconglomerate headquartered in Philadelphia, Pennsylvania, Comcast Corporation . The company runs the Xfinity cable communications , over-the-air national broadcast network channels (NBC and Telemundo), multiple cable-only channels.Recently a new mobile based application to connect and even control your XFINITY Home system. With Xfinity network system, the company ,Comcast ,provides the best in TV, voice,Internet,and home management services, all coming together to provide instant access to the things that matter most – anywhere, anytime to customers.

Major competitors for the Xfinity : Verizon FiOS , ADT Security Services ,Hulu ,Level 3 etc are major competitors for the business.

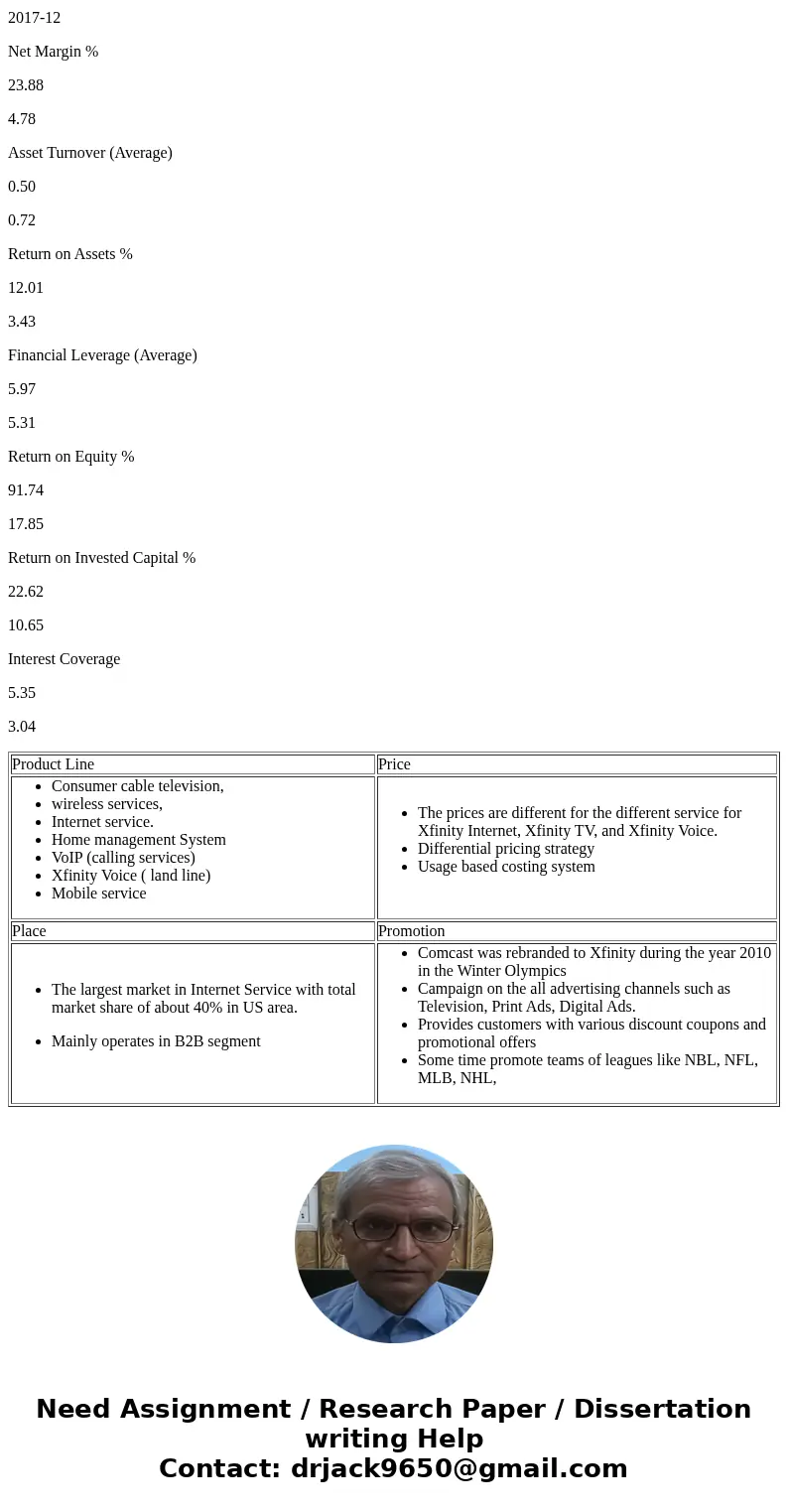

4p analysis i.e. Marketing Mix analysis ,which covers 4Ps (Product, Price, Place, Promotion) to explain the Xfinity marketing strategy.

Product Line

Price

Place

Promotion

Financial Analysis: ( source from Company website directly)

Consolidated 1st Quarter 2018 Highlights:

Ratios :

2017-12

Revenue USD Mil

84,526

Gross Margin %

70.0

Operating Income USD Mil

17,987

Operating Margin %

21.3

Net Income USD Mil

22,714

Earnings Per Share USD

4.75

Dividends USD

0.63

Payout Ratio % *

29.3

Shares Mil

4,786

Book Value Per Share * USD

11.93

Operating Cash Flow USD Mil

21,403

Cap Spending USD Mil

-11,297

Free Cash Flow USD Mil

10,106

Profitability

2017-12

Net Margin %

26.87

Asset Turnover (Average)

0.46

Return on Assets %

12.36

Financial Leverage (Average)

2.73

Return on Equity %

37.07

Return on Invested Capital %

19.80

Interest Coverage

5.96

Some Competitors Ratio

Verizon FIOS

HULU

Profitability

2017-12

2017-12

Net Margin %

23.88

4.78

Asset Turnover (Average)

0.50

0.72

Return on Assets %

12.01

3.43

Financial Leverage (Average)

5.97

5.31

Return on Equity %

91.74

17.85

Return on Invested Capital %

22.62

10.65

Interest Coverage

5.35

3.04

| Product Line | Price |

|

|

| Place | Promotion |

|

|

Homework Sourse

Homework Sourse