Record each transaction in the journal Be sure to record the

Record each transaction in the journal. Be sure to record the date in each entry. Explanations are not required.

2.

Post the transactions to the T-accounts, using transaction dates as posting references. Label the ending balance of each account Bal.

3.

Wortham ServicesWortham Services,

OctoberOctober

4.

MarkMark

WorthamWortham,

OctoberOctober

OctOct 2

Wortham ServicesWortham Services

$ 64 comma 000$64,000

3

$ 600$600,

$ 11 comma 900$11,900,

4

$ 5 comma 700$5,700.

7

$ 34 comma 000$34,000.

11

$ 3 comma 500$3,500.

WorthamWortham

16

OctoberOctober

17

$ 560$560.

18

$ 1 comma 400$1,400.

22

$ 390$390.

29

$ 2 comma 300$2,300

31

$ 2 comma 800$2,800.

31

$ 2 comma 700$2,700.

Journal Entry

Date

Accounts

Debit

Credit

Oct

| Record each transaction in the journal. Be sure to record the date in each entry. Explanations are not required. | |

| 2. | Post the transactions to the T-accounts, using transaction dates as posting references. Label the ending balance of each account Bal. |

| 3. | Prepare the trial balance of Wortham ServicesWortham Services, Inc., atOctoberOctober 31 of the current year. |

| 4. | MarkMark WorthamWortham, the manager, asks you how much in total resources the business has to work with, how much it owes, and whetherOctoberOctober was profitable (and by how much) |

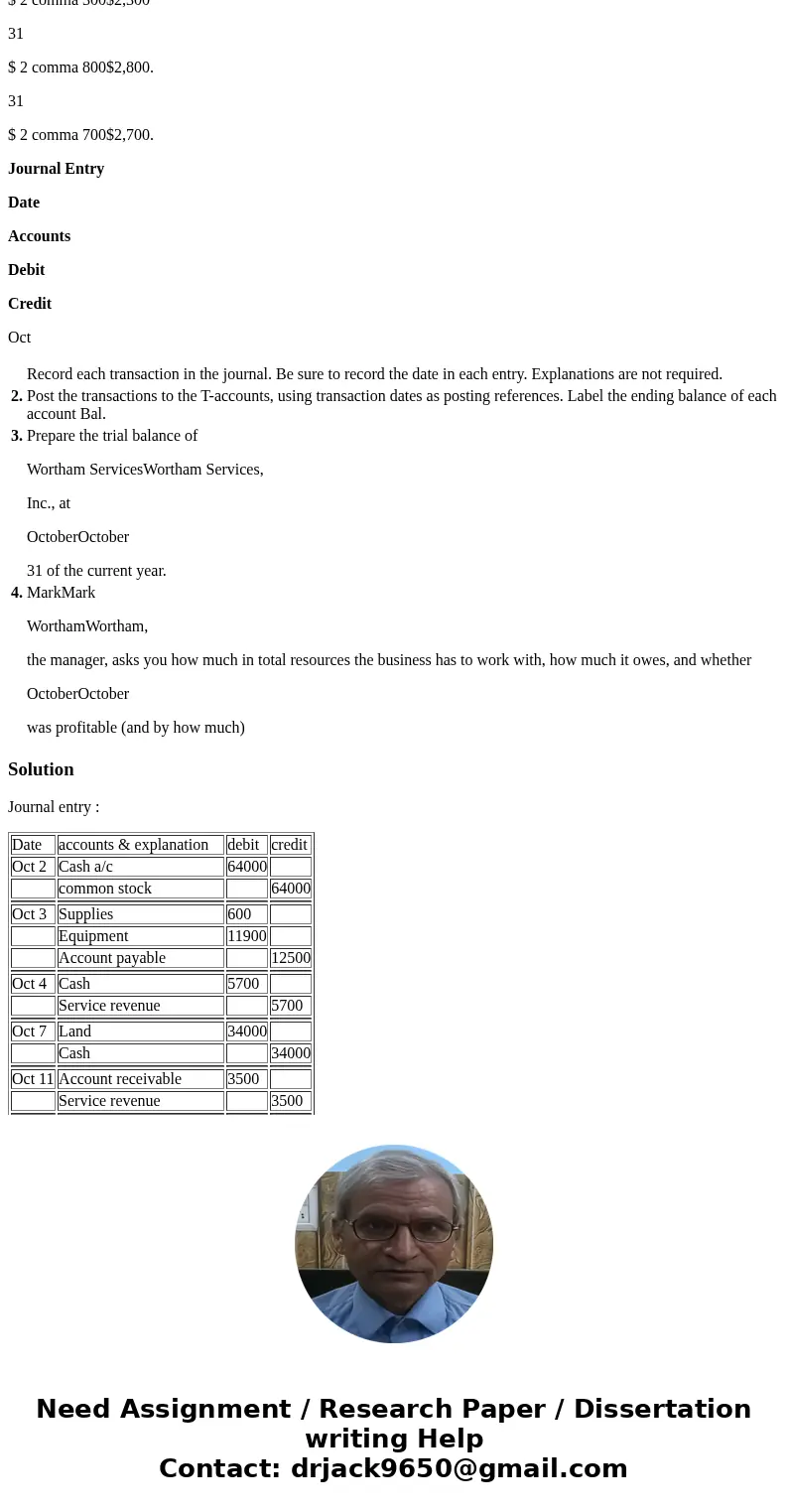

Solution

Journal entry :

| Date | accounts & explanation | debit | credit |

| Oct 2 | Cash a/c | 64000 | |

| common stock | 64000 | ||

| Oct 3 | Supplies | 600 | |

| Equipment | 11900 | ||

| Account payable | 12500 | ||

| Oct 4 | Cash | 5700 | |

| Service revenue | 5700 | ||

| Oct 7 | Land | 34000 | |

| Cash | 34000 | ||

| Oct 11 | Account receivable | 3500 | |

| Service revenue | 3500 | ||

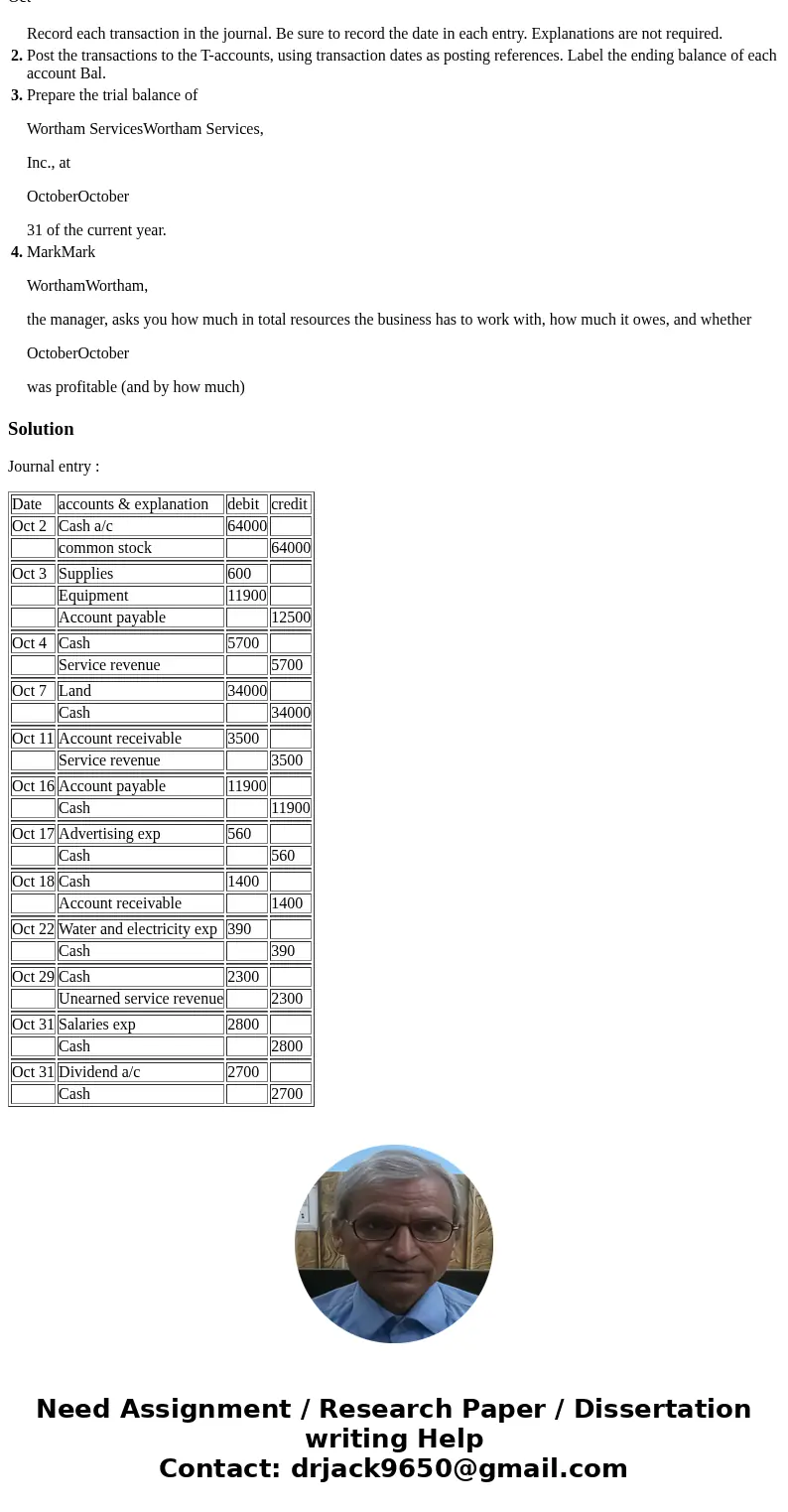

| Oct 16 | Account payable | 11900 | |

| Cash | 11900 | ||

| Oct 17 | Advertising exp | 560 | |

| Cash | 560 | ||

| Oct 18 | Cash | 1400 | |

| Account receivable | 1400 | ||

| Oct 22 | Water and electricity exp | 390 | |

| Cash | 390 | ||

| Oct 29 | Cash | 2300 | |

| Unearned service revenue | 2300 | ||

| Oct 31 | Salaries exp | 2800 | |

| Cash | 2800 | ||

| Oct 31 | Dividend a/c | 2700 | |

| Cash | 2700 |

Homework Sourse

Homework Sourse