Classifying Costs Calculating Cost of Goods Manufactured and

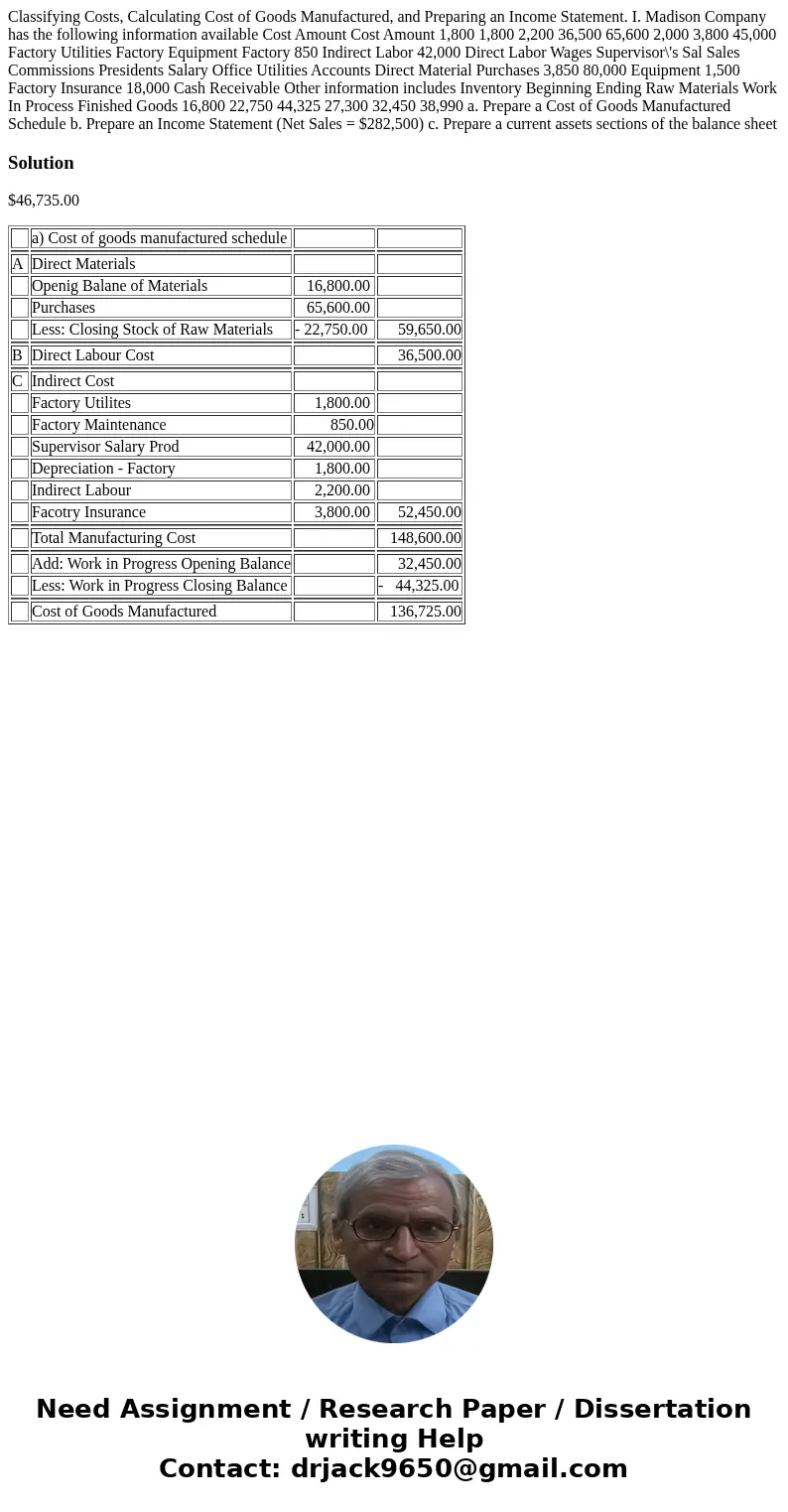

Classifying Costs, Calculating Cost of Goods Manufactured, and Preparing an Income Statement. I. Madison Company has the following information available Cost Amount Cost Amount 1,800 1,800 2,200 36,500 65,600 2,000 3,800 45,000 Factory Utilities Factory Equipment Factory 850 Indirect Labor 42,000 Direct Labor Wages Supervisor\'s Sal Sales Commissions Presidents Salary Office Utilities Accounts Direct Material Purchases 3,850 80,000 Equipment 1,500 Factory Insurance 18,000 Cash Receivable Other information includes Inventory Beginning Ending Raw Materials Work In Process Finished Goods 16,800 22,750 44,325 27,300 32,450 38,990 a. Prepare a Cost of Goods Manufactured Schedule b. Prepare an Income Statement (Net Sales = $282,500) c. Prepare a current assets sections of the balance sheet

Solution

$46,735.00

| a) Cost of goods manufactured schedule | |||

| A | Direct Materials | ||

| Openig Balane of Materials | 16,800.00 | ||

| Purchases | 65,600.00 | ||

| Less: Closing Stock of Raw Materials | - 22,750.00 | 59,650.00 | |

| B | Direct Labour Cost | 36,500.00 | |

| C | Indirect Cost | ||

| Factory Utilites | 1,800.00 | ||

| Factory Maintenance | 850.00 | ||

| Supervisor Salary Prod | 42,000.00 | ||

| Depreciation - Factory | 1,800.00 | ||

| Indirect Labour | 2,200.00 | ||

| Facotry Insurance | 3,800.00 | 52,450.00 | |

| Total Manufacturing Cost | 148,600.00 | ||

| Add: Work in Progress Opening Balance | 32,450.00 | ||

| Less: Work in Progress Closing Balance | - 44,325.00 | ||

| Cost of Goods Manufactured | 136,725.00 |

Homework Sourse

Homework Sourse