e Edit View History Bookmarks Develop Window Help newconnect

Solution

Answer

a.

Detail $

Net $

Sales (3,000 Units @ $400 per unit)

1,200,000

Less: Cost of Goods Sold

(245,000)

Gross Margin

955,000

Selling and Administrative Expenses

Selling Expenses

294,000

Administrative Expenses

173,000

Total Selling and Administrative Expenses

(467,000)

Net Operating Income

488,000

Cost of Goods Sold = Beginning Inventory + Purchases - Closing Inventory

= 65,000 + 290,000 – 110,000

Cost of Goods Sold = 245,000

Selling Expenses = Fixed Selling Expenses + Variable Selling Expenses

= 150,000 + ($48 * 3,000 Pairs)

Selling Expenses = 294,000

Administrative Expenses = Fixed Administrative Expenses + Variable Administrative Expenses

= 125,000 + ($16 * 3,000 Pairs)

Administrative Expenses = $173,000

b.

Detail $

Net $

Sales (3,000 Units @ $400 per unit)

1,200,000

Less: Variable Expenses

Cost of Goods Sold

245,000

Selling Expenses ($48 * 3,000 Pairs)

144,000

Administrative Expenses

($16 * 3,000 Pairs)

48,000

Total Variable Selling and Administrative Expenses

(437,000)

Contribution Margin

763,000

Fixed Expenses

Selling Expenses

150,000

Administrative Expenses

125,000

Total Fixed Selling and Administrative Expenses

(275,000)

Net Operating Income

488,000

c.

Contribution Margin Per Unit = Contribution Margin / No. of Units Sold

= 763,000 / 3,000 Units

= 254.33 per unit

Contribution Margin Per Unit = $254 per unit

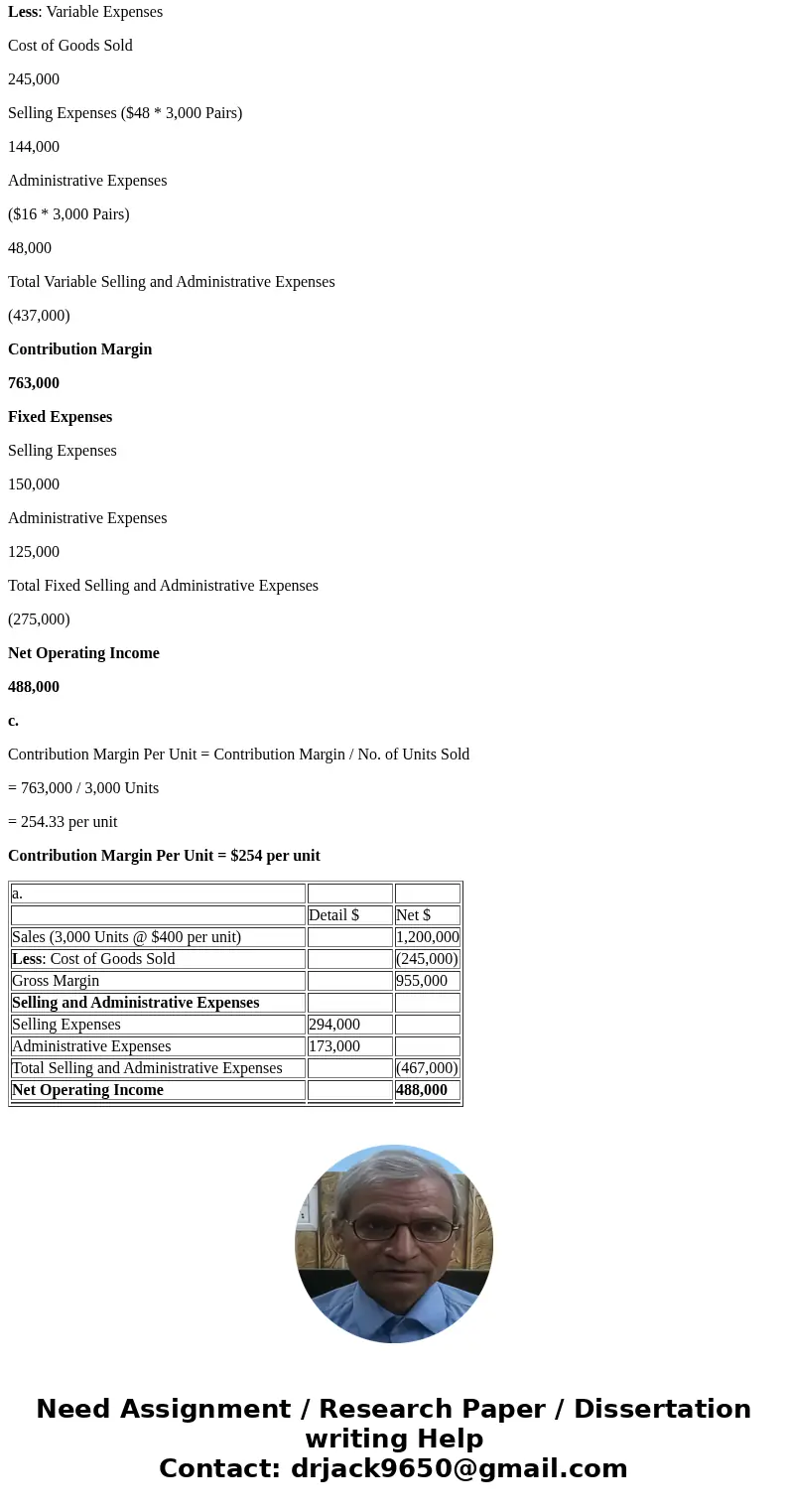

| a. | ||

| Detail $ | Net $ | |

| Sales (3,000 Units @ $400 per unit) | 1,200,000 | |

| Less: Cost of Goods Sold | (245,000) | |

| Gross Margin | 955,000 | |

| Selling and Administrative Expenses | ||

| Selling Expenses | 294,000 | |

| Administrative Expenses | 173,000 | |

| Total Selling and Administrative Expenses | (467,000) | |

| Net Operating Income | 488,000 | |

Homework Sourse

Homework Sourse